What to Expect Moving Forward

Whew, you made it!

Hopefully by now you understand Medicare much better. You understand how the plans work and made an educated decision about which plan to sign up with that you can feel comfortable with.

I hope you’ve contacted me by either by email at chris@paramountretirementsolutions.com , by phone (866-240-8639), or filling out one of the quote or appointment request forms that have been available in each chapter. If so, hopefully I helped you enroll in a plan you’ll be happy with and that’ll meet your healthcare needs and budget.

Once you’ve enrolled, the next thing to expect is…

Receiving Your Welcome Materials in the Mail

I’d say with one or two weeks of enrolling in your plan, you should expect to receive a “welcome kit” from your new insurance company. Sometimes, they send you a quick letter before this just to confirm your enrollment.

Depending on your plan, your welcome kit will include things like:

- Your insurance cards

- Your health insurance policy

- A copy of your application

- Coupons or discount programs to other health-related things (Weight Watchers, for example)

- Your plan’s list of covered drugs, also called a formulary

- A directory of healthcare providers in your network

Sometimes you won’t receive these materials by the time your plan starts and you need to use your insurance. Just give your agent or your insurance company a call, and they can at least give you a contract number to give the doctor or pharmacist so they can properly submit the claim.

One quick note if you're...

Staying with an Employer Group Health Plan

Here's a step-by-step guide of what you need to do when you're ready to leave that plan.

Otherwise, here's how to make sure each year you're...

Staying in the Best Coverage

The one thing you can count on is that things are going to change down the road. Medicare will change, your plans will change, and even your health needs will change.

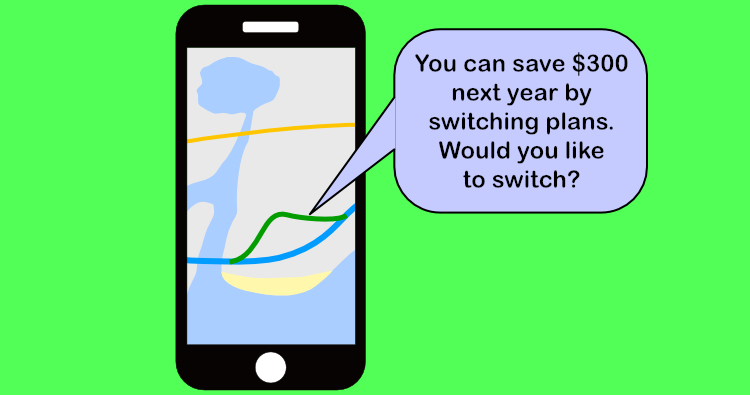

It’s best to start off Medicare on the right foot and establish a good relationship with an insurance agent, someone who has your best interest at-heart. Like I mentioned in the last chapter, an insurance company isn’t going to call you and let you know you should switch your plan to an identical plan of their competitor because you can save $30 a month.

Let’s look at a couple important times for you each year, and how best to handle them…

The Annual Enrollment Period (AEP)

Sometimes this period is called the annual Medicare open enrollment period. It runs every year from October 15th – December 7th.

This period will impact you differently depending on what plan you start out with:

Medigap plan with a Prescription Drug Plan (PDP)

This time is most important for you because it’s the time each year you can reevaluate your PDP.

PDPs can change drastically from one year to the next. Sometimes you could spend several hundred dollars more in drug-related expenses year over year by staying in the same plan, even if your drug list doesn’t change.

Sometimes your pharmacy goes from preferred to standard pricing. Sometimes one or more of your drugs goes increases in tiers, which means increases in cost. Maybe your plan stops covering one of your drugs altogether, and you don’t realize it until you fill your prescription for the first time next year and it’s too late to change plans.

The safe bet is to either contact your insurance agent or call 1-800-MEDICARE to do a drug plan review every year at this time. It may not be worth making a change in plans. But at least you’ll have a heads up on what changes could really affect you, and you can find out whether or not you’re still in the most cost-efficient plan for the next year.

Medicare Advantage Plan (MAPD)

This is the time of year you can switch to a different MAPD if you’re not happy with yours. Maybe your doctor left your network mid-year. Or, you might want to drop your MAPD and switch back to Original Medicare and get a Medigap plan with a PDP instead.

Your Annual Review

This is best done at your policy’s yearly anniversary of your start date. There’s not much you can do at this time if you have an MAPD, so it’s more for Medigap plans.

Medigap plans usually only have changes in premiums on your anniversary date. This is a good time to reconnect with your agent to see if your rate increase is normal or not.

Eventually, it will probably make sense to switch Medigap companies at some point down the road. It might be just one year later, maybe ten years later. Remember, Medicare standardizes Medigap plans. This means the same letter plan (Plan G, for example) is exactly the same coverage from one company to another. The only difference is price.

Whenever that price difference between your plan and the lowest one out there is big enough to make it worthwhile to change, you should try to change. It’s a great way to keep your premiums low year after year.

Just remember, when you do make a change you’ll have to answer health questions. If you apply and get turned down you’re not any worse off because you can still keep your current policy. That’s why you don’t cancel your old one until you know you’re accepted with the new one.

Medigap plan premiums and out-of-pocket costs are definitely a lot more stable than those costs for a PDP, so it may not be necessary to do a review every single year. But, it’s easy enough to have a ten minute conversation with your agent to catch up and for them to let you know it’s best to stay put for the next year.

Conclusion

I think that about does it.

I hope this guide has been a valuable resource for you. Maybe you read it all the way through, or you just checked out the chapters where you needed the most help on.

Give me a call at 866-240-8639 or shoot me an email if you have any questions at all, and I’d be more than happy to answer them. Or, if you're ready to enroll in your plans, I can help guide you through this and make it very easy for you!

Best of luck with your Medicare decision!