Figuring Out if You Need Medicare at 65

So do you understand a little bit better what Medicare is after reading Chapter 1?

I would think maybe a little. For some of you, you knew most of the stuff I covered already. For others, you really had to focus to understand some of those concepts.

I get it. It can get pretty complicated. The biggest things I want you to take away from Chapter 1 though are:

- Having only Original Medicare leaves you exposed to unlimited medical costs

- Supplemental insurance is necessary to protect you from these costs

In this chapter we’re going to look at lots of different situations depending on what type of insurance you currently have in order to figure out how each one will work together with Medicare. Each situation is very much unique, but they can be grouped together depending on what type of insurance you have. Let’s get started…

Employer Group Health Plan (EGHP) Coverage From Current Employer

People are working a lot longer today for lots of different reasons.

Maybe you just need something to keep you busy. Maybe you want to let your Social Security income amount to keep growing. Or, you just like your job. It could be your spouse is the one still working and you’re covered on their plan.

Whatever the reason, you still have health insurance through work. But how does it compare to Medicare? Do you even have to sign up for Medicare?

Things to Consider

There will be lots of things to consider when comparing your options and figuring out what to do. Don’t worry, these will make much more sense as we review these concepts with lots of examples to follow. These main things to consider are:

- How many people work at the company. This is very important because if there are less than 20 employees working there, you have to get Part B at 65 or likely have to pay a late enrollment penalty later. So if you’re getting Part B anyway it might make more sense to get your own secondary insurance and leave the EGHP.

- The costs of your plan like monthly premiums, deductibles, coinsurance, and copays. If your plan has expensive premiums or high deductibles, you may want to leave your EGHP and sign up for Parts A & B and your own secondary insurance.

- Whether you’re the only one that’s covered, or if your spouse or other dependents have coverage thru your plan, and they’d lose it if you dropped it. If you have family members on your EGHP with you, it’s almost certainly best you don’t leave this coverage because they would likely lose coverage too and you’d be left paying for an expensive plan for them through your state health insurance Marketplace. However, some exceptions to this would be whether or not your spouse can get insurance through their work or if they’re already eligible for Medicare.

- Whether you are the employee or your spouse is. If your spouse is the one still working, they often will pay much less to stay alone on their EGHP if you drop off, get Medicare and your own supplemental insurance.

- How much your current plan limits your choice of doctors you want to see. If you’re not able to see the healthcare providers you want or need to, especially if you’re managing a chronic condition and want to see a specialist outside your network, you may want to leave your plan and get your own Medicare coverage.

- Whether any other benefits like 401k matching or pension contributions are tied in with keeping your health plan. This one doesn’t happen that often, but still something to think about.

- Whether you can rejoin your plan later once you leave, including retiree coverage after you retire. Leaving your EGHP now may seem like a good idea. But, if your retiree health coverage from your employer is pretty good, and you leave while you’re still working, you may not be able to get back on their coverage later.

- What your current health is like and how much you use your plan. If you’re in bad health, you probably shouldn’t get Part B now unless you get your own supplemental insurance (more on this in Chapter 4). Also, if you’re in bad health it might also make more sense to get your own Medicare coverage in order to keep out-of-pocket expenses down.

- What types of prescriptions you’re on. If you’re on one or more expensive brand name drugs, it may make more sense for you to stay on your EGHP. Brand name prescriptions can get very expensive on Medicare Part D, and are often more reasonable on EGHPs.

- How much you (and your spouse) earn. If your Modified Adjusted Gross Income is over $88,000 per year (or over $176,000 in household income if you file a joint tax return), you may not want to get Part B now because it will cost you more than $148.50/mo. (link to Chapter 1) Your income is more likely to be higher than these amounts while you’re still working, compared to after you retire.

- Whether you want to keep contributing to a health savings account (HSA) – An HSA allows you to contribute a certain amount of money each year and put it away in an account as a tax-deductible contribution. This account can grow tax-free and you can withdraw and use the funds in this account for certain medical expenses also tax-free. There’s one catch though: you can no longer contribute to an HSA if you’re on any Part of Medicare.

- Whether your EGHP’s drug coverage is considered “creditable” or not. If it’s not, you’ll need to at least sign up for your own Part D drug coverage. Otherwise, you’ll likely have a Part D late enrollment penalty if/when you sign up for a Part D plan later.

Your 3 Main Options

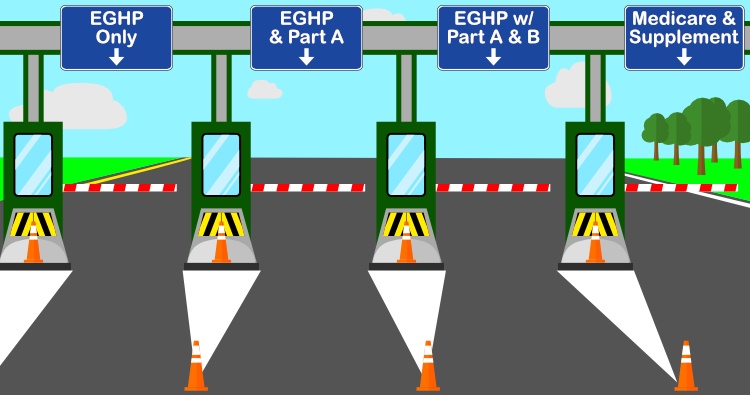

If you consider all the things above, it can get pretty overwhelming to try and make a decision. But, basically any decision you make about your work insurance falls into one of three choices:

- Stay on your EGHP and don’t sign up for any part of Medicare

- Stay on your EGHP and sign up for one or more parts of Medicare

- Leave your EGHP, sign up for Medicare and get your own supplemental insurance

Let’s take a look at several examples of each of these 3 options and reasons why you’d want to take it:

Stay on your EGHP and don’t sign up for any part of Medicare

Example #1: Spouse is also on plan – Joe is turning 65 and has been working for the same small tool & die company for the last 20 years. There are about 30 people who work for this employer, so Joe doesn’t have to sign up for Part B at 65 and won’t be penalized later. His wife is on his plan too and his employer takes out about $200 per month from his check for his EGHP. She is 63, is not eligible for Medicare, and would have to buy her own policy if he dropped his insurance to go on Medicare. Their plan has an annual $3,000 deductible, but Joe is pretty healthy and only takes one blood pressure medication.

Conclusion: Joe should stay on his EGHP. He could sign up for Part A alone which would have a $0 monthly premium, since he has more than 10 years of work history paying into Medicare. But he won’t be penalized if he doesn’t sign up at 65. If he leaves his work insurance, he would probably spend anywhere from $150 -$300 per month to get Medicare and his secondary insurance, depending on the plan he chooses and where he lives. The big thing to consider though is his wife. At her age, she could easily spend $500-$1,000 per month to get her own plan that could have an even larger deductible than they have now combined.

Example #2: Higher income – Karen is a widow and works as a nurse at a local hospital. She makes good money and doesn’t plan on retiring any time soon. She contributes to her HSA for the tax write-off. She pays about $125 every two weeks in premium for her EGHP, but it only has a $1,000 deductible and a large network of doctors and hospitals that take her plan.

Conclusion: Karen should definitely stay on her EGHP. She shouldn’t sign up for Part A since she still wants to contribute to her HSA. She shouldn’t sign up for Part B since she doesn’t pay that much for a fairly low deductible plan. The biggest issue with Karen is that she would likely pay more than $134/mo. for Part B because of her income. Once you add this extra expense, it doesn’t really seem worth it to leave her insurance at this point.

Stay on your EGHP and sign up for one or more parts of Medicare

Example #3: Very small employer – Victor works in a small accountant’s office with about 8 employees. The accountant who owns the practice pays for all but $100/mo. of their EGHP monthly premium, which is actually pretty good coverage. The drug coverage in the plan is considered “creditable”, but this doesn’t matter much to Victor at this point since he’s not on any prescriptions. If he dropped the plan, he’d also lose dental and vision coverage. When he retires, he’ll no longer have coverage.

Conclusion: Since there are less than 20 employees at his employer, Victor needs to sign up for Part B or face a lifetime late enrollment penalty. Since he pays so little for his plan with pretty good coverage including dental and vision and since he’s in good health, he should be alright staying with his current EGHP. He can then switch over to his own Medicare supplemental insurance at retirement.

One important thing I want to point out here is that when you get Part B at 65, you now have a one-time Medigap Open Enrollment Period that lasts for 6 months. During this period, you can get any Medigap policy you want with no health questions. If Victor retires more than 6 months after turning 65, he could be declined by certain companies if he’s got certain health issues. Also, some Medigap companies will allow you to get their Medigap plans with no health questions when you retire because that’s considered a loss of coverage. This is called Guaranteed Issue. But these rules are different in different states and with different Medigap companies. We’ll talk about this more in Chapter 4.

Example #4: Expensive drugs – Jacqueline’s husband works as a trucker for a decent sized trucking company. She’s retired and on his health plan. Their EGHP has a monthly premium of $150/mo. with a $3,000 family deductible and $5,000 max out-of-pocket (OOP) amount. If she dropped off the plan, her husband’s premium would drop to $50/mo. with the same deductible and OOP amounts. She is a type 2, insulin-dependent diabetic, and he is anticipating a couple knee replacements this year and next.

Conclusion: Jacqueline will likely be better off staying on her husband’s plan. Since it’s a large employer, she can sign up for Part A alone and defer Part B until later without a penalty. Also, since she’s on insulin, she could easily spend $3,000 or more each year just for her Part D prescription insurance and copays if she got her own drug coverage. On top of this, she would have to spend even more for Part B and for a supplemental policy.

Since her husband’s plan would drop from $150 per month to $50/mo., they’re basically paying $100/mo. for her to be covered. The plan does have a pretty large deductible and OOP. But, if her husband is going to have knee surgery, including a hospital stay and physical therapy likely too, they will probably hit their family cost-sharing limits because of him alone. This would leave very little left to pay out-of-pocket for her medical costs. Also, her insulin would likely be much less expensive on the EGHP compared to leaving the plan and getting her own Part D coverage.

Example #5: Non-creditable drug coverage – Phyllis works as a paralegal at a law firm with 22 employees. Her husband is still working as an engineer but covered on her EGHP too since his work insurance isn’t very good and would cost over $500/mo to just cover him. Phyllis’ EGHP has a monthly premium of $400/mo, a family deductible of $1,500 and a max OOP of $3,000. She and her husband are in decent health. She currently contributes to an HSA too. However, she just got a letter from her health plan administrator saying that the drug coverage of her EGHP is not “creditable coverage”.

Conclusion: Let’s look at each Part of Medicare one at a time. She doesn’t need to sign up for Part B since there are more than 20 employees at her job. Also, since she and her husband both work at pretty good jobs, they make good money and she would likely have to pay more for Part B because of this higher income level. She probably shouldn’t leave her plan because her husband would likely be dropped and forced to go on his own, expensive EGHP.

Now, if she wants to keep contributing to an HSA, she shouldn’t sign up for Part A either. But for her the catch is that her drug coverage is not “creditable”. This means that if she doesn’t go out and sign up for a standalone Part D plan, she would have a Part D late enrollment penalty if she signs up for Part D after she retires. The rule is that you have to have either Part A or Part B in order to sign up for Part D, so Phyllis has a choice to make: either she can keep contributing to her HSA, not sign up for Part D, and risk paying a penalty later; or she can sign up for Part A and Part D, but lose out on the tax benefits of the HSA.

Leave your EGHP, sign up for Medicare and get your own supplemental insurance

Example #6: Small employer & expensive plan – Curtis is retired but covered on his wife’s EGHP. She works for a temp agency with only 12 employees. Her premium for her plan is $450/mo., but would only be $150 if he dropped off her coverage.

Conclusion: Curtis will be better off dropping off her EGHP. He needs to sign up for Part B anyway because her employer is so small. Besides, she’s basically paying $300/mo. to keep her on her plan. Now that he’s eligible for Medicare at 65, he should be able to find coverage that’s as good or better than her plan for less than $300/mo.

Example #7: Bad health, small network – Maria is still working as a middle manager of a medium-sized manufacturing company. She’s single and has recently been diagnosed with a rare form of cancer. She only pays about $150 per month for her EGHP, which is an HMO with a fairly small network. In doing research about her illness, she found a group of specialists in another state that have experience successfully treating her specific type of cancer. However, they’re out of her HMO network and wouldn’t accept this insurance. She could opt for a PPO at work, but the monthly premiums would almost be $500 per month with an annual max OOP of $5,000.

Conclusion: Maria should probably leave her EGHP to get Parts A & B and her own Medicare supplement. Since she’s new to Part B at 65, she can get any supplement plan she wants now with no health questions. Also, premiums for this type of coverage combined with Medicare and Part D premiums usually run about $250/mo, with very little out-of-pocket hospital and medical expenses.

Getting the treatment she needs is most important. The HMO won’t work since she can’t get that treatment. With a PPO, she’ll probably hit the max OOP and combined with the monthly premium, she’ll be spending more than $10,000 for that year, and possibly years to follow. The one catch is that if she has to take a very expensive prescription for her condition, she could end up spending several thousand dollars for it under Part D. But any medication (like chemo) that’s administered in a medical setting is covered under Part B and her supplemental insurance would cover most or all of that expense.

Example #8: Expensive plan – Jack works for a credit union with 35 employees. He’s married and his wife is 67, retired, on Medicare Part A only, and covered under his EGHP. Their premium is $450 per month and they have a high deductible health plan of $4,000 with a max OOP of $6,000. They’re both in pretty good health, with no expected upcoming medical expenses.

Conclusion: This one’s pretty close, but Jack and his wife might be a bit better off leaving his work plan and getting Medicare with their own secondary insurance. One hospital stay or unexpected surgery could easily cause them to hit that $6,000 max out-of-pocket. They might spend a bit more each month for Medicare coverage, but they can greatly lower the risk of a large medical bill. Besides, getting Medicare with a Medigap plan will give them the option to see any healthcare provider that takes Medicare and free them from their current plan’s network restrictions.

Alright, I think these examples give you a pretty good idea of what you need to do in many of these cases. While I haven’t given examples for every possible situation, they should show you the types of things to think about when deciding what to do.

Now let’s talk about having coverage as a retiree, which makes things a bit different:

Employer Group Health Plan (EGHP) Coverage as a Retiree

These days there’s not a lot of good retiree coverage out there.

Your company may offer you a decent health plan if you’re lucky, but this will probably go away or at least change for the worse when you hit 65. Your benefits department knows at this point you’re eligible to go on Medicare, so most retiree coverage just serves to bridge the gap til you reach 65.

There still are a few groups of retirees who have decent coverage even after Medicare starts for them. Some of these are retired:

- Teachers

- Union members

- Government employees, at the federal, state, and/or local level

However, the benefits of these groups tend to be quite different from region to region.

Things to Consider

Almost all of the things to consider with retiree EGHPs are the same as with EGHPs from active employment. However, where things are different are:

- Almost all retiree plans will require you to get Part A & B at 65. Before if you were working you had the option of what Parts to get based on the size of the employer. Now, you will have to sign up for Original Medicare. The only exception that I know of is if you were a federal employee and have certain Federal Employee Health Benefits (FEHB).

- Retiree EGHPs can change quite a bit at 65. If you’re still working, it’s illegal for them to change your or your spouse’s benefits (except in the case of some smaller employers). But that’s not the case if you’re retired. They can drop you, or just your spouse, or your benefits can get a lot worse that it makes sense for you to get your own Medicare secondary insurance.

Let’s give a few more examples:

Example #9: Makes more sense to leave EGHP – Linda retired from a large food & beverage maker at 62. She’s currently drawing Social Security income. They offered her a retiree EGHP where they take $425 per month from her sizeable pension check. The coverage is pretty good though. She has a PPO with a $500 deductible and a $1,000 max OOP. She takes a couple generic prescriptions, one for her thyroid, and the other for cholesterol. The plan doesn’t change at all when she hits 65.

Conclusion: This has been pretty decent retiree coverage. She would have been hard pressed to find a plan for this price with of benefits this rich in her state Marketplace. Besides, she still makes a pretty decent income between Social Security and her pension and would likely not have qualified for any Marketplace subsidies.

But now that she’s eligible for Medicare and required to sign up for Part B, this would add another $134 per month to her premium. She will almost certainly be able to get much better coverage on her own with a Medicare supplement and a Part D drug for much less than $425/mo.

Example #10: Spouse dropped – Brian is on his wife’s retiree EGHP because his company didn’t offer him coverage when he retired. The coverage has been decent, but her former employer has notified her that they will no longer offer him coverage at 65.

Conclusion: Brian has no choice and can now sign up for Medicare and pick the secondary insurance that works best for him.

Example #11: Expensive prescriptions – Ruben has been on his retiree plan for just over a year. They take $125 per month out of his pension for it. His deductible and max OOP amount are the same at $1,000. These amounts apply for hospital, medical, and prescription expenses combined. Ruben has a heart condition and has a lung condition called COPD. Because of these conditions, he takes two expensive brand name medications. At 65, his coverage will remain the same but his premium will increase to $200/mo.

Conclusion: Ruben is probably better off staying on his retiree EGHP. If he didn’t have expensive prescriptions, he could likely find Medicare secondary insurance with slightly lower premiums and medical OOPs. But, if he got his own Part D plan, he could easily spend $3,000 or $4,000 in copays for his meds every year. With his retiree plan, they cap his OOP at $1,000 every year for his medical and drug expenses combined. It’s not worth the risk to save a few hundred dollars in premiums for the year to have to possibly pay a few thousand extra in expenses.

Well, I think that pretty well covers employer group plans. Now let’s move on to individual coverage…

Individual Coverage Through the Marketplace

There’s no doubt, individual plans are ridiculously expensive today, especially in your early 60’s. The only way they’re somewhat affordable is if you qualify for a premium subsidy based on your income level.

Still, even then you likely have a plan with deductible and max OOP of several thousand dollars. Your coverage basically amounts to catastrophic coverage because you have to spend so much money before the insurance company starts to pay anything.

For most of you, you realize that your coverage will improve drastically when you get on Medicare and get your own supplemental insurance.

However, for some of you who pay little to nothing in premium for your plan because of subsidies, you may be wondering why you have to go on Medicare and pay $134/mo. just for Part B and then even more for a supplement?

Just realize once you become eligible for Medicare, you lose any subsidies you’ve been receiving. Going on Original Medicare at this point is the only thing that makes sense.

Veterans Benefits

There are a few different types of benefits you may be entitled to if you or your spouse served in our military. Some of these require you sign up for different parts of Medicare, and some don’t. Let’s take a look at two of them…

Tricare

Tricare is the healthcare program for uniformed service members of the military and their families.

You don’t necessarily have to sign up for Part B if you or your family member is still on active duty. Also, certain Tricare plans don’t require that you sign up for Part B.

Tricare For Life is a plan that works as a secondary insurance to Medicare, so you do need Parts A and B.

If you qualify for Tricare, you shouldn’t need to get any type of Medicare secondary insurance like a Medigap or Medicare Advantage plan.

The best thing to do is talk to the department who handles your military benefits, see what your options are, and pick out the one that works best for you and your family.

Veterans Affairs (VA) Benefits

If you have healthcare coverage as part of your VA benefits, just know that they don’t work together with Medicare.

This means if you go see a VA doctor or have a procedure or treatment done at a VA facility, you’ll be covered by the VA, but Medicare will not be your secondary insurance to help pick up some of the costs. The opposite is also true: the VA will not pick up any costs if you get treated by a provider who takes Medicare.

So if you have VA health benefits, you basically have 3 options when it comes to Medicare:

- Don’t sign up for Part B – Like we talked about in the last Chapter, Part A is usually free. However, Part B will cost you money every month. If you’re happy getting all your treatment at VA facilities, then you think you may not need Medicare.

However, I would strongly advise against this option. If you don’t sign up for Part B if you’re new to Medicare at 65, they will charge you a late enrollment penalty if you sign up later. And the longer you wait, the more it would be.

At some point in the future, you may want to see a specialist or get treated at a facility that doesn’t participate in the VA system. Or, your VA benefits may be cut in the future. - Sign up for Parts A & B only – This is the option that a lot of vets take. You could always get a Medigap or Medicare Advantage plan later on. Keep in mind though, at 65 you can get any of these plans with no questions. If you wanted to enroll in them later, you may not be accepted if you have certain health conditions. Or, in the case of Medicare Advantage plans, you would have to wait for the next annual enrollment period to come around.

I haven’t talked about Part D yet. You usually have pretty good prescription coverage thru the VA, so you usually don’t need to get Part D coverage on your own. And, if you do decide to get a Part D plan later, you won’t have a penalty because drug coverage thru the VA is considered “creditable”. - Sign up for Parts A & B and a supplement – If you want to have the freedom to get treated by Medicare providers just the same as VA providers, it’d be smart to get a supplement plan too. This way you don’t have to worry about being turned down or waiting later if you need it. As far as which supplement to get, we’ll talk about those options in Chapters 4 and 6.

Medicaid

You might be a little confused on how Medicaid is different than Medicare.

Well, we’ve seen what Medicare is and that is a program run by the federal government. It’s administered at a national level.

Medicaid is run at the state level, so it’s usually mostly run and funded state-by-state.

When you become eligible for Medicare, you need to sign up for Parts A & B. Medicare then becomes your primary insurance, and Medicaid acts like a supplement and is secondary. But you have to remember, in order for Medicaid to pay their part, you must see a provider that takes your particular Medicaid plan.

When you turn 65 and start Medicare for the first time, you could qualify for one of several different levels of Medicaid. It’s not just that either you have it or you don’t.

The lower your income level is, the more help you can qualify for:

- You can start by qualifying for Extra Help, which can lower your Part D drug plan premium and your prescription copays.

- If your income is then below certain amounts, you’re eligible for one of the Medicare Savings Programs. These programs will pay things for you like your Part B premium, and even your Part A & B deductible and coinsurance amounts that we covered in the last chapter.

One important thing to note is that before you’re eligible for Medicare, your Medicaid eligibility is usually based only on your income amount. However, after you qualify for Medicare, your assets are considered too.

So, for example, you may have a small Social Security income check but have $100,000 in a 401k account from work that you haven’t touched. Before you turn 65, you might qualify for full Medicaid, but lose it after 65 because the amount you have in your 401k account would disqualify you.

Conclusion

Alright! I hope that you fit into one of the many possible situations we reviewed in this chapter. Hopefully now you have a game plan for what you want to do about Medicare and secondary coverage.

Based on this, in the next chapter we’ll go over how you can sign up for Original Medicare, or defer Part B if you decide you don’t need it right now.