Understanding the Medicare Basics

So what exactly is Medicare?

Why am I suddenly eligible for it when I turn 65?

Why do I need it if I already have a health insurance plan?

Whether you realize it or not, you’ve probably been paying into the Medicare program most of your life. You’ve contributed quite a bit of money into the Medicare program, and at some point you’ll get to start reaping the benefits of what you’ve put in.

Wait, didn’t you realize you’ve already put lots of money into the program? Well, let’s start there…

Medicare Funding

Did you ever notice the word “FICA” on your pay stub from work and not know what it was for? FICA stands for Federal Insurance Contributions Act. Basically, that’s the amount for your Social Security income and for Medicare that’s been taken out of each and every check all of your working life.

The amount that is taken out of your paycheck for Medicare is 1.45%. If you work for an employer, they have to match this amount to put into Medicare. If you’re self-employed, you have to match this amount as if you’re the employer, so you have to pay a total of 2.9% of your check towards Medicare.

So likely you’ve paid tens of thousands of dollars already into the system.

But, what exactly is Medicare? I’m glad you asked…

Medicare Defined

Medicare is the national health insurance program in the United States for folks that are 65 and older, or for those younger than 65 who qualify because of certain disabilities. It has four main parts:

- Part A

- Part B

- Part C

- Part D

You don’t need all these parts of Medicare to be covered. Also, depending on your situation, you may sign up for one or more of these parts now, and wait to sign up for others later. But, we’ll get into that in much more detail in the next chapter.

These four parts in a bit more detail are…

Part A – Hospital Insurance

Part A of Medicare is known as Hospital Insurance. The only way to use Part A of Medicare is either to be admitted to the hospital as an inpatient, or be eligible for hospice. So since the average person is not hospitalized or eligible for hospice all that often, Part A covers a pretty limited scope of your Medicare coverage.

Here are the things that fall under Part A:

- Inpatient coverage

- Skilled nursing facilities

- Hospice

- Home health care (also covered under Part B)

Part B – Medicare Insurance

Part B of Medicare is known as Medical Insurance. Part A and Part B together are known as “Original Medicare”. So, if you’ve ever heard that term, just know it’s referring to Part A and B together. Parts A & B are also the only two parts of Medicare provided directly by the federal government. The other parts are provided through private insurance companies.

Another thing to keep in mind is that when you do sign up for Medicare, your Medicare card will show only Parts A & B and what your start dates are for both. It won’t show any other details about other parts of Medicare. You’ll get separate cards for those after you sign up for them.

You’ll use Part B quite often. It covers anything physician, or doctor, related. This could be:

- Tests

- Treatments

- Outpatient procedures

- Medical equipment

- Urgent or emergency services

- Drugs administered in a doctor’s office or outpatient setting

- Doctors’ visits

Part B includes some other things not listed here as well.

One other thing to point out is that when you’re admitted to the hospital, that is covered by Part A as mentioned above. However, a lot of the doctor-related treatments, procedures, and so-forth you have while hospitalized will fall under Part B coverage.

Part C – Medicare Advantage Plans

Part C of Medicare is also known as Medicare Advantage Plans. I’ll dive much deeper into these plans in Chapter 6. Just know for now that Part C is referring to this type of secondary insurance coverage.

Part D – Prescription Drug Coverage

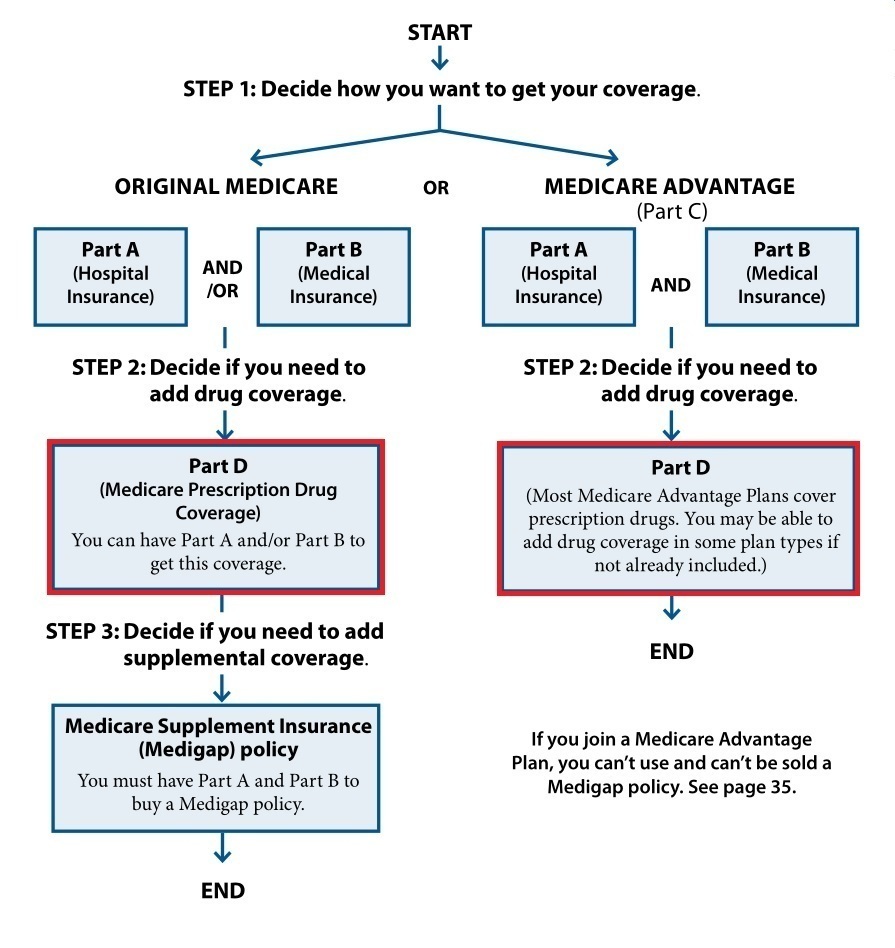

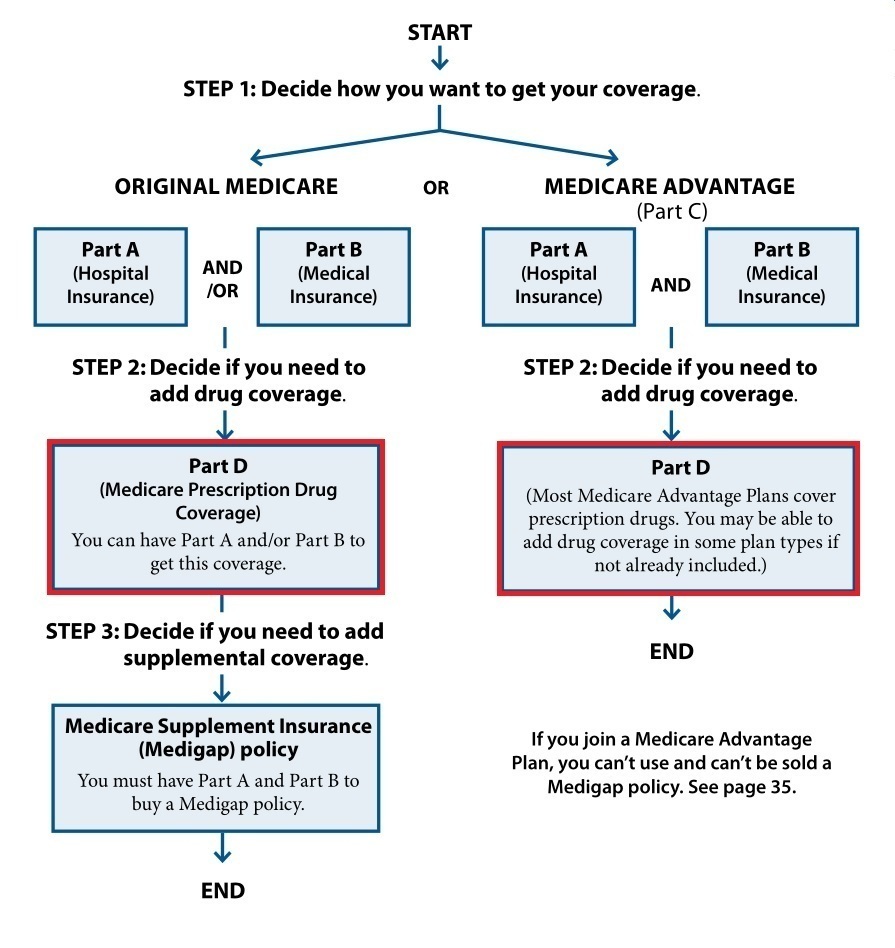

Part D of Medicare refers to prescription drug coverage. It can be a little tricky to understand Part D since you can get it one of two different ways. Take a look at the chart below to see what I mean:

You can get a Part D insurance plan as a standalone prescription drug plan (PDP). That means if you sign up for a PDP, it will provide insurance coverage for prescriptions only. PDPs are usually paired with Medigap plans, which will help cover hospital and medical coverage along with Original Medicare. We’ll tackle these topics in Chapter 5 and Chapter 4, respectively.

The second way you can get Part D coverage is in, or with, Medicare Advantage Plans. Part D is part of the plan, probably similar to the type of health plan you have now.

These four parts of Medicare don’t cover everything. Let’s start by taking a look at what your out-of-pocket expenses are, and then we’ll talk about the areas of healthcare that Medicare doesn’t cover at all…

Medicare Costs

I know you’re probably thinking, “hey if I’ve already paid in tens of thousands of dollars into Medicare, why do I have to pay anything more?!”

I don’t really have a good answer for you. My job is just to show you how things work and bring you the facts. Don’t kill the messenger, ok?

Let’s break down what you’ll spend by looking both at monthly premiums and out-of-pocket costs:

Monthly premiums

We’re going to restrict our discussion here to Original Medicare, just Parts A & B, since we’ll cover the other parts in later chapters.

Part A premium

The good news is that almost nobody pays a monthly premium to have Part A. As long as you’ve worked 40 quarters (10 total years) where they’ve taken out that 1.45% FICA amount out of your paycheck, you’re entitled to “premium-free” Part A.

If you’ve only worked 30 – 39 quarters, your premium will be $259. If you’ve worked less than 30 quarters, you’d have to pay $471 per month just to have Part A.

Work History | Part A Monthly Premium |

|---|---|

0 - 29 quarters | $471 |

30 - 39 quarters | $259 |

40+ quarters | $0 |

But, you can also qualify for premium-free Part A based on your spouse’s, or even ex-spouse’s work history. Here are the requirements to get premium-free Part A based on your spouse’s record:

- They must be at least 62 by the time you turn 65, or are eligible for Medicare because of a disability, and

- They must have 40+ quarters

The same is true for your ex-spouse as long as you were married to them for at least 10 years.

One other thing is that if you and your spouse have less than 40 quarters, and either of you continue to work, your Part A premium will be reduced when either of you hit those magic 30-quarter or 40-quarter marks.

Part B premium

Most folks new to Medicare in 2020 and 2021 have to pay $148.50 per month for Part B. But, if your income is over certain amounts, you’ll have to pay more for Part B. This is called the Income Related Monthly Adjustment Amount (IRMAA). This is more likely to come into play if either you and/or your spouse are still working when you start Part B.

Take a look at the chart below to see how much you could pay:

Individual Tax Return MAGI | Joint Tax Return MAGI | Married Filing Separately MAGI | Part B Monthly Premium |

|---|---|---|---|

$88,000 or less | $176,000 or less | $88,000 or less | $148.50 |

$88,001 - $111,000 | $176,001 - $222,000 | n/a | $207.90 |

$111,001 - $138,000 | $222,000 - $276,000 | n/a | $297.00 |

$138,001 - $165,000 | $276,000 - $330,000 | n/a | $386.10 |

$165,001 - 499,999 | $330,001 - $749,999 | $88,001 - $411,999 | $475.20 |

$500,000 or above | $750,000 and above | $412,000 and above | $504.90 |

Keep in mind these income amounts are Modified Adjusted Gross Income, or MAGI. You can figure out what your, or your household’s, MAGI is by finding the Adjusted Gross Income on your tax return and adding in any tax-exempt bond interest you received that year.

The MAGI amounts are based on those from your tax return from two calendar years ago. For example, if you're starting Part B in 2018, then your 2016 MAGI is the one that's considered.

If your income is high enough to have to pay an IRMAA and you're starting Part B, but one or both you and your spouse are retiring, you can appeal to have this IRMAA lowered or waived. You'll likely be successful in your appeal too. Just select "Work Stoppage" in Step 1 when you fill out this form.

If you’re drawing Social Security income when Medicare starts, your Medicare premium will just be taken right out of your check starting the month you turn 65. Otherwise, you’ll receive a bill in the mail about four times per year to pay 3 months’ worth of premium at a time.

If you'd rather pay monthly instead of quarterly before your Social Security starts, just fill out the Medicare Easy Pay form to have it taken electronically right out of your preferred bank account.

Out-of-Pocket amounts

Alright so we’ve just figured out how much Medicare will cost us each month whether we use it or not. This is what “premiums” are.

But, when we do use Medicare as our primary health insurance, we will have out-of-pocket (OOP) costs too. Now keep in mind, the secondary insurance like Medigap and Medicare Advantage plans, even work insurance, we’ll talk about in later chapters will help cover these OOP costs.

But for now, let’s look at what these OOP amounts are under Original Medicare by itself…

Part A OOP amounts

We mentioned before that Part A kicks in when you’re hospitalized. Let’s just ignore the hospice copays for this discussion and take a look at what OOP expenses are for the bulk of what you’ll use Part A for.

In-patient hospitalization – if you’re hospitalized and have Part A, you’re responsible for coming up with the first $1,340 as soon as you’re admitted. If you know anything about how expensive hospital stays can be, you know this will be charged right away. This first $1,484 is what’s known as the Part A deductible. A deductible is just something you are responsible for paying before Medicare starts to pay its part.

Once you pay your Part A deductible, this covers you for a 60-day benefit period. This period starts when you’re admitted, and ends after you haven’t received inpatient care for 60 days in a row. During this time Medicare will pick up the tab for all Part A costs after you pay your deductible.

This could get a little tricky if you’re released from the hospital but then get re-admitted later. If it’s been more than 60 days where you haven’t received care as a hospital inpatient or even in a skilled nursing facility, then you’d have to pay the deductible again. If it’s been less than 60 days, let’s look at a few examples to see what happens:

Example #1: Two hospital stays a few months apart - Steve got pneumonia in January and had a 5-day hospital stay. He fell on the ice in early April and broke his leg. It was pretty bad and he had another hospital stay for 3 days this time. Because it was more than 60 days in between his stays, he'd owe the Part A deductible twice.

Example #2: Two hospital stays in consecutive months - Steve got pneumonia in January and had a 5-day hospital stay. He fell on the ice in early February this time and broke his leg. It was pretty bad and he had another hospital stay for 3 days this time. Because he was re-admitted to the hospital less than 60 days after he was released in January, he's still under the same Part A deductible and will not owe it again. It doesn't matter that it was for a different health reason.

Example #3: Stroke involving rehab - Sally had a stroke on August 18th. She was hospitalized for four days and then went to a skilled nursing facility for rehab. She stayed in this facility til September 3rd and then went home. Then due to complications, she went back into the hospital on October 31st. She does not owe the Part A deductible again because it has been less than 60 days since she received inpatient care, even though it was last given at a skilled nursing facility rather than a hospital.

Once you’ve used 60 days’ worth of care and you’re still an inpatient, you’ll have to pay coinsurance for each additional day. During days 61-90, you would have to pay $352 for each additional day.

If you still need inpatient care at this point, you have the option to use what are called lifetime reserved days. You’ve got 60 of them. For each one you use, you pay $704 per day. Once they’re gone, Medicare Part A will no longer cover your hospital stay.

As an aside, I know a lot of this makes it seem something like a long hospital stay could wipe you out financially. Take heart! When we talk about supplemental insurances, we’ll see how they can protect you from these devastating costs.

Skilled Nursing Facility (SNF) – SNFs go by a few different names like nursing homes, rehab, and post-hospital stays. That last name probably describes them the best since Medicare will only pay their portion of your SNF stay if you’re a hospital inpatient for at least 3 days first. If not, you’ll have to pay the whole bill.

If you were hospitalized for 3 days first, Medicare covers the first 20 days you’re in a SNF. After this point, you’re responsible for $185.50 per day for days 21-100. If you’re in a SNF longer than 100 days, Medicare will no longer pay anything.

Also, you have to be in a SNF for a “medically necessary” reason. If not, Medicare won’t pay anything. This is why Medicare doesn’t pay if you need to be in a nursing home for something like Alzheimer’s disease or dementia. They consider this custodial care, and not qualifying as medically necessary. It’s unfortunate, but it is what it is.

A good way to remember all of these daily coinsurance amounts is that they’re all certain fractions of the Part A deductible. Take a look at the chart below to see what I mean:

Part A Cost Share | Out-Of-Pocket Amount |

|---|---|

Part A deductible | $1,484 |

Daily coinsurance for days 61 - 90 | $371 (1/4 of Part A deductible) |

Lifetime reserve days | $742 (1/2 of Part A deductible) |

SNF daily coinsurance for days 21-100 | $185.50 (1/8 of Part A deductible) |

Alright now on to…

Part B OOP amounts

These amounts are a lot more straightforward and will take a lot less time to discuss.

You’re responsible for coming up with the first $203 each year for anything Part B related. Unlike the Part A deductible that worked with complicated “benefit period” rules, the Part B deductible is much simpler. It’s based on a given calendar year, and it starts over every January 1st. The amount can change a little bit from year to year, as well.

Also, it’s not $203 for each type of test or procedure, or even for each health condition you may be treating. It’s a running total for everything Part B related throughout the year. So, you might have a doctor’s visit in February and have some bloodwork done in April, and the two things together could total together to meet your deductible.

Once you pay the first $203, Medicare then pays 80% of Part B related costs. So, it’s up to you to cover the other 20%. When I talk to folks about the basics of Medicare, the main thing they know is they need supplement insurance to cover the other 20%. As you can see, there’s a bit more to it than that, but they’re on the right track.

The biggest problem with this 20% gap (this 20% is known as your Part B coinsurance) is that there is no limit to how much money it could be! If you have lots of medical expenses like surgery, chemo, or physical therapy you could easily have a Part B bill of $100,000 or more! Paying 20% of this would not be fun!

Whew, we just learned a lot about what’s involved with Original Medicare (Parts A & B). We’ve learned what types of things it covers and what we’d be responsible for paying. But, Medicare doesn’t cover some things that may surprise you. Let’s take a look at those things now…

Things Medicare Does NOT Cover

Medicare uses the term “medically necessary” a LOT. There are certain things it does and does not consider to be “medically necessary”. We’ll break down these into some different categories here:

Dental, Vision, and Hearing

This is the one I get a lot of complaints on.

Medicare doesn’t consider routine dental, vision, or hearing coverage to be “medically necessary”. So, they don’t cover it. This list includes (but isn’t limited to):

- Cavity fillings

- Tooth extractions

- Root canals and crowns

- Teeth cleanings

- Routine eye exams

- New glasses, including lenses or frames

- Hearing aids

Some of the Medicare Advantage plans provide some basic coverage for some of these expenses. We’ll touch on those in Chapter 6.

Now, there are some things in these areas are medically necessary and therefore will be covered. Again, some examples of these are:

- Cataract surgery

- New glasses or contacts after cataract surgery (in some cases)

- Costs incurred to treat and monitor diseases of the eyes (glaucoma, for example)

- Costs incurred to monitor the health of the eyes (for diabetics, for example)

Custodial Care

We touched on this one earlier when talking about nursing homes. If you don’t need to be in a nursing home for a medical reason, then you likely qualify for custodial care instead.

Usually, custodial care is defined when someone can’t perform 2 or more of the following activities of daily living (ADLs) such as:

- Dressing

- Bathing

- Toileting

- Transferring

- Continence

- Eating

This type of care can be given by non-licensed caregivers, so this is why Medicare considers it as not medically necessary and won’t cover it.

Misc.

A couple other things worth mentioning here that Medicare doesn’t cover are acupuncture and cosmetic surgery. Medicare also doesn’t cover certain types of prescriptions, but we’ll talk about that in a later chapter.

Limits on Treatment

For some things Medicare does cover, it will set a limit on how much it will cover for certain time periods. For example, we saw earlier that Medicare sets a limit on how many hospital and SNF days it will cover in a certain benefit period. Here are a few other:

Physical (PT), occupational (OT), or speech therapy (SLP) - in general, Medicare will only cover up to $2,110 worth of PT and OT combined for the year, and $2,110 for SLP. In some cases, you can get an exception to get more covered but you have to go through an approval process.

Psychiatric hospital stays – Medicare limits you to 190 days of lifetime coverage in this type of facility.

Foreign Travel

As a rule, Original Medicare doesn’t provide coverage outside of the U.S. In some very limited exceptions and emergencies, they will provide some basic coverage. But, if you’re going to spend any extended time away from the States, you’re strongly encouraged to get some type of travel insurance.

Some supplemental insurance coverage like Medigap and Medicare Advantage plans will cover foreign travel, but not very well. Your out-of-pocket expenses could be quite large if you end up with an emergency while travelling abroad even with one of these plans. Again, we’ll address this more in later chapters.

Conclusion

Wow, I think we’ve covered the basics of Medicare pretty thoroughly. I hope you have a much better understanding of exactly when Medicare covers, and what it doesn’t.

In the next chapter, we’re going to really dive into the many different situations you may be in at 65 when it comes to your current health insurance coverage. We'll then find out the different ways to make Medicare fit in best with your unique situation.