What are they?

Medigap policies are sold by insurance companies to help fill in the gaps in coverage of Original Medicare Parts A and B. These gaps are your potential out-of-pocket liabilities like deductibles and co-insurances. To review your cost sharing responsibilities under Original Medicare, check out the Part A and Part B sections of this tutorial.

What Do They Cover?

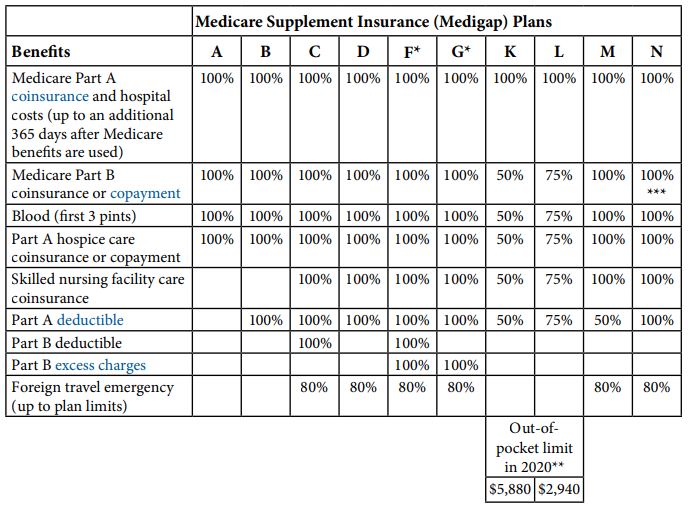

There currently are 11 different Medigap plans that a Medicare Beneficiary could enroll in today. All of them are slightly different, each covering a certain list of benefits. You can see these plans in the chart below. The nice thing is that all of these plans are “standardized”. Well, what does that mean? Notice the 11 plans are all designated by a different letter like F, G, and N. This means that each insurance company offering a certain plan letter has to provide benefits according to this chart. So, this also means that every insurance company offering the same letter plan is offering the exact same plan. Let me say this again a different way because it’s a very important point. The same letter plan sold by different insurance companies has exactly the same coverage. However, each company will offer that specific plan for a different price. But more on that later.

The way to read the chart above is that the first column on the far left titled “Benefits” is basically a list of your potential out-of-pocket liabilities under Original Medicare. Now if a particular letter plan has a percentage number in the box for a certain “benefit” it means that Medigap plan pays for that percentage of your cost sharing responsibility.

So look at the vertical column for Plan F, for example. You can see that there is a percentage number in every box. This means that as long as you go to a healthcare provider than accepts assignment and everything you have done is “medically necessary”, Plan F will pay 100% of your cost share since there is a “100%” in every box. The only exception is if you get treated outside of the U.S.; then the plan will cover only 80% of your expenses (after you meet a deductible and with some other benefit limits that really are beyond the scope of this article). Each column can be read the same way for each different letter plan.

How Much Does it Cost?

Monthly premium

The premium of a Medigap plan is based on several factors: age, zip code or county, health status, whether you smoke or not, plan letter, type of pricing, etc. Sometimes insurance companies will provide household discounts if both spouses enroll in plans from the same company, and sometimes if only one person enrolls and they’re simply married or living with someone 60 years or older. Because of these and other factors, prices for the same letter plan (e.g. Plan G) can be very different between two different insurance companies. That’s why it’s always best to talk to an independent agent who can represent many different companies to shop among several options. You can request a free quote from me today, or contact me to set up a time for a personal consultation.

Open Enrollment (OE)

The best time to buy a Medigap policy is during your Medigap Open Enrollment Period because you can’t be turned down, charged more, or made to wait for your plan to start because of any health conditions you may have. This OE period starts when you’re both: 65 or older, and enrolled in Part B. So this period does not apply to those who are on Medicare and younger than 65, or to those who are 65 or older but don’t have Part B yet because they may still be working. Keep in mind, some states do offer OE periods for other reasons, so it’s all the more reason to work with a professional.

Guaranteed Issue (GI)

Guaranteed Issue is similar to Open Enrollment where you can’t be turned down, charged more, or made to wait for a Medigap policy because of health conditions. However, unlike Open Enrollment, GI only allows you to this right for certain Medigap plans, not all of them. Currently only Plans A, B, C, F, K, and L are Plans that qualify for GI. Some of the more common situations that would result in a GI situation are:

- You have a Medicare Advantage plan and either the plan stops giving care in your area, or you move out of this area

- You have Original Medicare along with an employer group plan (including retiree coverage) that pays secondary and that plan is ending

- You joined a Medicare Advantage plan when you were first eligible for Part A at 65 and within the first 12 months on the plan you want to disenroll and switch back to Original Medicare

- Your current Medigap insurance company goes bankrupt and you lose your coverage at no fault of your own

This isn’t a complete list, but it gives you an idea of some options you have to get automatically qualify for a Medigap plan even if you’re in bad health.

Deductible, Coinsurance, and Copays

As you can see from the chart above that shows the 11 Medigap plans available, all of them leave some type of cost sharing left to you. The following is a list of the more common cost sharing amounts:

- Part A coinsurance - $371 per day for days 61-90 of a benefit period; $742 per day for days 91 – 150 of a benefit period.

- Part B coinsurance – An uncapped 20% of all Part B services

- Skilled nursing facility coinsurance - $185.50 per day for days 21-100 or a Medicare-covered stay

- Part A deductible - $1,484 for a 60-day benefit period

- Part B deductible - $203 annually

There is a high-deductible Plan F which is a separate plan from Plan F. High-deductible Plan F requires you to meet a deductible of $2,370 before the plan pays anything. Also, note that Plan N is the only Medigap plan that has copays due at the time of the visit. The *** underneath the chart explains how there is a maximum of a $20 copay for some office visits, and a $50 copay for an emergency room visit that doesn’t result in an inpatient admission.

How Do I Pay For It?

Most of my clients pay for their Medigap premiums directly out of their checking or savings account. You can provide your routing and account number for the bank account you want to use and it will be automatically deducted monthly. This method is the easiest, most convenient, and often gives you a lower premium amount. For most companies, if you want to pay a direct bill, they won’t let you pay monthly; your choices would be quarterly, semiannually, or annually. Some companies will actually have slightly higher rates if you want to pay a direct bill too. Medigap plans do not offer you the ability to pay out of your Social Security check.

For deductible and coinsurance amounts, you’ll typically get billed for those by the health care provider’s office. The claim initially goes to Medicare as your primary insurance. They either approve or deny the claim, pay their part, and then send it to your Medigap insurance company. The insurance company will pay their part, if any, and you’ll be billed for the remainder. Copays are the only out-of-pocket expenses that you owe at the time of the visit.

How Do I Sign Up?

You can usually sign up several ways: thru the insurance company’s website, calling them directly, through an independent insurance agent, etc. This is not a comprehensive list, but the important thing to remember is that the plan, its premium, and all of its cost shares and coverage is exactly the same no matter how you sign up. There are a couple reasons that you would want to enroll through an independent agent: first, they can explain how the different letter plans work, show you premiums across several companies, and find one that meets your health needs and budget the best. Second, they can answer questions for you in the months and years following the initial enrollment and assist you directly with customer service issues rather than you having to deal with the insurance company. Lastly, Medigap rates are changing all the time, and an independent agent can help you shop around again sometime down the road when you can get the same plan for a lower premium with a different company or if you want to change your coverage as your needs change.

Medicare doesn’t allow insurance agents to charge for these services. Instead, we’re compensated directly by the insurance company as we’ll make a small commission for each plan we enroll someone in. It’s really a win-win for you as the client. You can contact me at 866-240-8639 any time to schedule a consultation to discuss your unique situation.

When Will it Start?

Your plan can start as soon as both Part A and Part B are effective, and no sooner. The effective date of your plan will depend on the day you apply for it and whether or not you’re in OE or you are GI. You’ll most likely have other coverage before your new Medigap policy starts, so you should coordinate your preferred effective date with your current coverage to ensure you don’t have any gaps and days where you are not covered. Also, keep in mind that if you are not in OE or are GI, you will have to go through underwriting. This means that the insurance company will consider your health and often check your medical records before deciding whether or not to approve your application or possibly charge a higher premium. If you have to go through underwriting, make sure you’re accepted at your preferred rate before you notify your current coverage that you’re cancelling.

Do I Have to Sign Up?

Since Medigap insurance is supplemental insurance, there are no penalties if you don’t get it. Also, if you choose to get a Medicare Advantage plan, you cannot get a Medigap plan. If you or your spouse are covered through an employer’s group plan, whether as an employee or retiree, this plan may be more cost-efficient than getting a Medigap policy. This is just one more reason to seek the advice of a professional that has your best interest in mind.