Frequently Asked Questions (FAQs)

Even after reading this guide, or even just one or two of the chapters, I’m sure you have questions.

The following is a list of some of the more common questions I get asked.

If you don’t see your question listed below and you’d like to ask me personally, just send me an email at chris@paramountretirementsolutions.com

Medicare Questions

Q: How do I pay for my Medicare Part B premium?

A: If you’re drawing any type of Social Security income, they’ll take it right out of your Social Security check. If not, Social Security will send you a bill every quarter to pay three months at a time.

Q: What if I can’t afford to pay my Part B premium 3 months at a time?

A: No problem! Medicare has something called Medicare Easy Pay where they can draft your Part B premium once a month directly out of your checking account. Just fill out this simple form with your bank account info.

Q: Does Medicare cover chiropractors?

A: Yep, but they only cover manipulating your spine when your bones are out of alignment. They’ll cover what they consider medically necessary. They won’t cover x-rays or any heat or massage treatments you’re billed for. Ask your chiropractor before you’re treated to make sure what is and isn’t covered.

Q: Can I laminate my Medicare card?

A: No, although it seems like a good idea, right? Those things are so flimsy. But, I’ve heard multiple times from Social Security and other sources they don’t want you doing this. It has something to do with possibly damaging some of the features of the card.

Either get a wallet or card holder with a protective sleeve for your Medicare card. Or, anytime you need a new card, just call 1-800-Medicare and they’ll send you a new one.

Q: Does Medicare cover the flu shot?

A: Yes, Medicare covers one flu shot per year at no cost to you.

Q: If I stay on my employer plan past 65, how and when can I sign up for Medicare later?

A: You can actually sign up for Medicare whenever you want while you’re still working. Once you retire, you have up to eight months to sign up after either:

- your plan ends, or

- your employment through this employer ends, whichever is first

Plan ahead and make sure Medicare is effective right when your employer plan ends.

You’ll need to fill out 2 forms to sign up: an application for Part B, and a Request for Employer Information form. It’s best to get these forms filled out and submitted 4-8 weeks before your planned Medicare start date.

Medicare Plan Questions

Q: How do I pay for my plan?

A: Well it depends on what plan you’re talking about:

For Medigap plans you can pay either by direct bill, electronic funds transfer (EFT) from a checking or savings account, or some companies allow using a credit card.

For Prescription Drug Plans (PDP) and Medicare Advantage Plans (MAPD), the same options as those for Medigap plans are available. However, you can also pay the monthly premiums for these plans by just having the premium deducted from your Social Security check.

Q: Does my Medigap company matter?

A: Not really. Medicare standardizes the Medigap plans by letter. So for example, a Plan G with Company ABC is exactly the same as a Plan G with Company XYZ. It’s exactly the same coverage.

In general though, I tend to put clients into the plans of companies that have one or more of the following characteristics:

- A high AM Best rating

- A low loss ratio (usually indicating stronger financial strength)

- Longevity in the Medigap business

- A large number of people insured by them

Being stronger in one or more of these areas will tend to make their rates more stable over time, having sharp premium increases less likely.

Q: What happens if I get sick? Will my Medigap rates go up?

A: Maybe a little, but you won’t be singled out. Medigap rates are not like car insurance rates where if you total your car and have a large claim, your rates will skyrocket.

You’re lumped together with a bunch of other people that are insured by the same company you have, usually in your state with the same plan. They raise and lower their rates based on the amount of claims they have to pay out as a group. So if your rates increase, everybody with your plan will have the same increase.

Q: Will my plan cover pre-existing conditions?

A: Original Medicare always will. MAPDs will too, but they won’t usually let you enroll if you have end stage renal disease. Medigap plans will cover them at 65 provided that you haven’t gone more than 63 days without “creditable coverage” in the previous six months. If you have, Medigap companies have the right to not pay claims for pre-existing conditions the first six months of your coverage. But, very few companies will actually deny these claims in these situations.

Q: If I don’t like my plan, when can I change?

A: This is one most people get wrong, so pay close attention. With a few exceptions, you can only change your drug plan each year during the Annual Enrollment Period (AEP). This period lasts from October 15 through December 7. Any changes you make during this time go in effect the following January 1st.

If you’re looking to change your health plan, here’s when you can do it based on the plan you have and the plan you want to change to:

- One Medigap to another Medigap – whether you’re looking to switch companies, switch plans or both, you can change any time throughout the year you want. However, after your 6-month Medigap Open Enrollment (OE) period is over, you’ll have to answer health questions to qualify for your new plan.

- MAPD to Medigap – You can either change during AEP. Or, you can switch during the Medicare Advantage Disenrollment Period which goes from January 1st to February 14th. Again, you’ll have to answer health questions outside of OE.

- Medigap to MAPD – In general, you can only do this during AEP, although there are a few, much less common situations that would allow you to do it mid-year.

- MAPD to MAPD – Same answer as #3.

There are some situations that entitle you to a Special Enrollment Period (SEP) that would let you make these changes outside of the timeframes mentioned above. But that discussion is a bit more involved than I want to have here. If you want to see if you can qualify for one of these SEPs, just send me an email, or contact Medicare.

Q: What do I do if I get a bill that I feel I shouldn’t have to pay?

A: Don’t pay it, at least right away. Sometimes it can take a few months for the bill to get processed either by Medicare or your Medicare plan. You can always call the provider who billed you and make sure they submitted the claim to your insurance plan. And remember, if you haven’t satisfied your yearly deductible yet, that may be the very reason you may owe.

Q: Can I ever lose my coverage?

A: The only times you can really lose coverage when it’s your fault is if you don’t pay your premiums in a timely way or you lie on your application. Other than that, your plan can never kick you out because of your health, for example.

If your plan stops serving in your area, goes bankrupt, or you lose coverage because of no fault of your own, you’ll have a guaranteed issue right to choose from certain Medigap policies with no health questions.

Q: What happens if I start taking a new drug once my drug plan starts? Will they cover it, or increase the cost?

A: When you, I, or Medicare uses the Medicare Plan Finder to find the most cost-efficient Part D plan for you, we’re doing so based on your best guess of what drugs you’ll need filled the rest of the calendar year. It’s not limiting the plan you pick to only covering those drugs.

If you add a new drug or two to the mix, it will never increase your plan premium. That’s fixed.

Any Part D plan has a rule that it has to cover at least two drugs in every therapeutic category (unless it’s a drug class not covered under Part D). If your plan doesn’t specifically cover your new drug, you have the following options:

- Ask them to make an exception

- Take another drug in that therapeutic class that is covered by your plan

- See if your doctor can provide you with enough free samples to tide you over to the next enrollment period where you can switch plans

Q: How can MAPD companies afford to give me a plan for free ($0 premium)?

A: Because that insurance company is getting a portion of your Medicare dollars each year. From the numbers I’ve heard, the company receives somewhere around $10,000 per member per year enrolled in their plan.

Q: My older brother has a Plan J but he pays almost $300 per month for it. I noticed that Plan isn’t on the chart. Why? And can he switch to something cheaper?

A: Every so often, Medicare updates the Medigap plans available for various reasons. In 2010, Medicare made Plan J no longer available because it covered things like preventative services that Original Medicare expanded and started to cover on their own.

Whenever a plan is no longer available to new subscribers, the amount of people enrolled in the plan will shrink over time. People that are healthy enough to switch to a different plan do so and can save money. People that aren’t are stuck in the plan. That plan’s premiums rise faster than others over time because of the increasing number of claims they have to pay because of the deteriorating health of the average member.

Q: Why should I sign up with you when I can just sign up directly with the insurance company?

A: For several reasons:

- I can help educate you on Medicare when you first are eligible, answer all of your questions, give you options, and shop for the best price for you based on the plan you want.

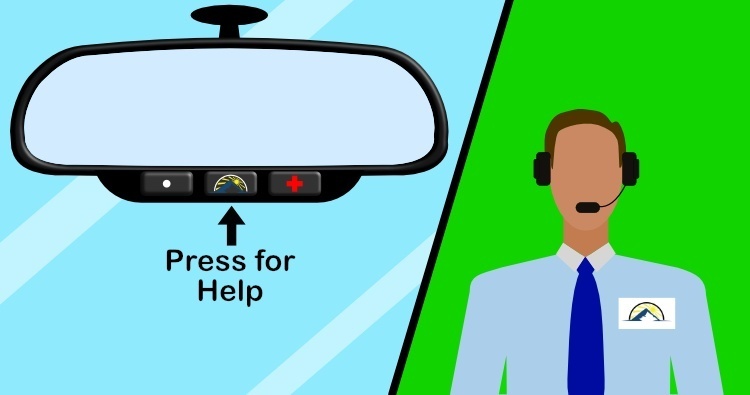

- If you have any type of question or problem with your plan later on, you can call me as your agent and I get take care of it on your behalf. Dealing with the insurance company directly on these matters might not be that bad…or it might be a maddening experience involving you having a 90 minute phone call getting transferred back and forth from department-to-department still not resolving your issue when all is said and done.

- If your rate goes up over the next few years and you can get the exact same plan with a different company for $300 less per year in premiums, your insurance company won’t call you recommending you switch to another company. I will.

- You get all this from me with no additional cost. I get paid by any insurance company I’m able to help you get set up in their plan.

Q: Another insurance agent told me that if I signed up with Plan F, it would be cancelled and I would lose coverage in a couple years. Is that true?

A: No, that’s a classic scare tactic to get you to buy what they’re selling.

Plan F will no longer be available to folks who’s Part B effective date is 1/1/2020 or later. So, if your Part B date is before this, you can keep your Plan F if you have it. Or, you can switch to Plan F from another Medigap plan even after 2020.

Q: Can I get a Medigap plan to cover the OOP costs of a MAPD?

A: Nope, you can either get one or the other. They can never work together.

Alright, one more chapter. Let’s look at what to expect moving forward.