Standalone Prescription Drug Plans (PDP)

So are you taking a lot of prescription drugs, or none at all?

For some of you that are, this chapter will be incredibly important. Choosing the best standalone drug plan for your specific situation could save you several hundred dollars for the year compared to just picking a plan at random.

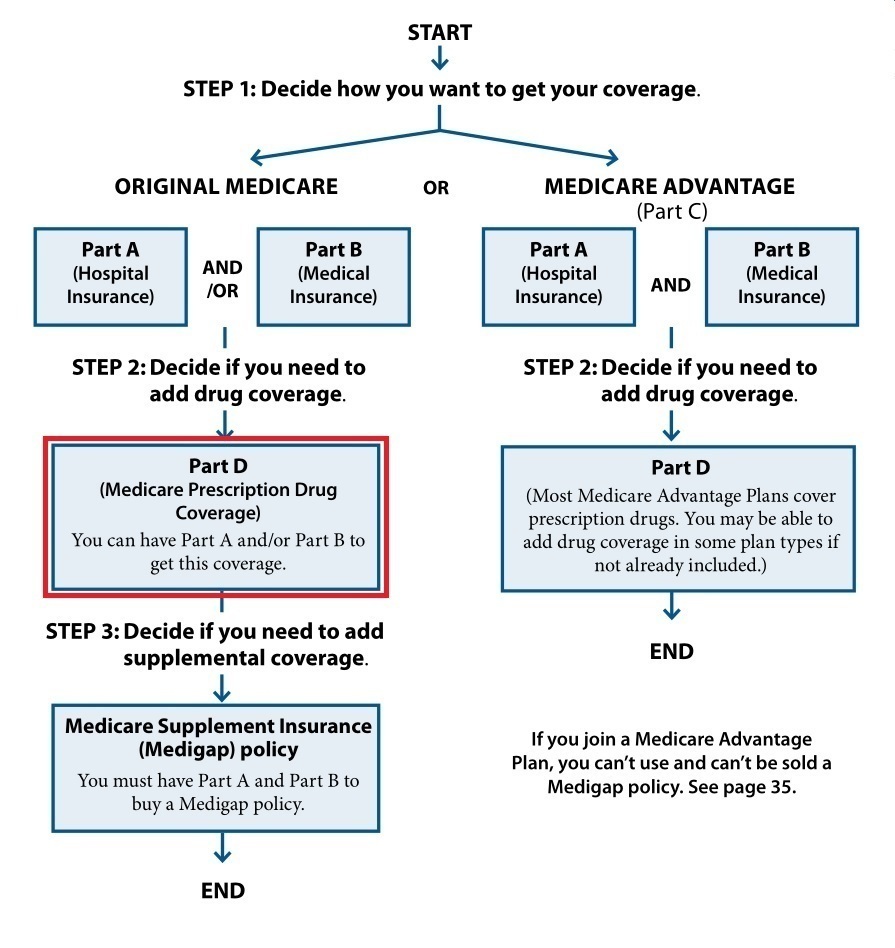

Just to tie in this chapter with the bigger Medicare picture, let’s look how it fits in again:

As you can see above, you can actually get your Part D (drug) coverage two different ways. In this chapter we’ll talk about standalone plans. Then, in Chapter 6 we’ll show how you can get Part D coverage in a Medicare Advantage plan.

For those of you who aren’t taking any meds, or maybe just one or two common, generic drugs, we’ll learn why should still sign up for a plan when you turn 65.

Let’s just start there…

The Part D Late Enrollment Penalty (LEP)

If your drug costs are little-to-nothing right now, it may be tempting to not get a drug plan.

If you did, you’d probably end up spending more for the insurance then it would save you on drug costs, right? But that’s how it is with all insurance…until you need it.

There are 2 main reasons to get a drug plan when you’re first eligible:

Reason 1: Limited enrollment periods

If you pass on your chance to get a drug plan at 65, the only time you can enroll is during the Annual Enrollment Period (AEP) each year. This AEP runs from October 15th to December 7th. If you sign up for (or change) your drug plan during this time, it starts January 1st. This is because drug plans are calendar year (e.g. 2017) plans, and they can change quite a bit from year to year.

This means if you ever get put on an expensive prescription at any time during the year, you have to wait until the first of the next year to get insurance to cover it. And, if it’s a maintenance medication where you’ll be taking it regularly from then on, there could be a lot of months you’re stuck with paying full price the rest of the year.

Reason 2: Late Enrollment Penalty

If you don’t sign up for Part D coverage when you’re first eligible, and do sign up sometime later, Medicare will count the number of months you went without “creditable coverage” and charge you a penalty. The longer you go without creditable coverage, the larger the penalty will be.

For each month without coverage, they count 1%. Then they multiply your total percent by whatever the average drug plan cost is for that year. The average drug plan cost is called the “national beneficiary base premium”.

Example: Not taking any meds - Kathleen doesn't take any meds. However, she develops a heart rhythm disorder when she's 72 and needs to start taking an expensive, brand name drug that would cost $425 per month without insurance. Let's say she went exactly seven years without coverage, or 84 months.

The national beneficiary base premium is $33.06 in 2021. So, she'd have a Part D Late Enrollment Penalty of $27.80 each month (84% x $33.06 = $27.77) since the penalty amount is rounded to the nearest $0.10.

Now, I know this amount doesn’t sound like a lot. But keep in mind that it lasts for the entire time you’re ever on a Part D plan. In this example, if you get on a plan at age 72 and live to 92, that’s 20 years’ worth of penalties which are really going to add up.

Still, it’s your choice whether or not to get a plan. My job is to give you the knowledge you need to make the best decision for you, and make sure you’re aware of all the angles. If you decide to get a plan, we’re now going to look at the only tool you need to find the best one for you…

The Medicare Plan Finder

This is by far the best and easiest to use tool to find the most cost-efficient drug plan for your individual situation.

Now some of the individual insurance companies that offer drug plans will have a similar tool on their websites. But, it will only evaluate the plans for that one company. The Plan Finder will look at all the plans available when it does its anaylsis.

You see every insurance company is responsible for submitting every detail about its drug plan, or plans, to Medicare. They have to let them know the entire list of drugs they cover, what tier each drug is in (more on this later), and which pharmacies give preferred pricing for their plan and which ones give standard pricing.

Based on this info, the Plan Finder looks at all the plans available in your area (usually about 20-25 plans), and finds the one that will result in the least total annual cost for your meds based on your:

- Zip code

- List of medications

- Preferred pharmacies

So, let’s really dive in here and learn how to use this extremely valuable tool:

Inputs

(Before we get started, it's worth noting that Medicare changes their website quite often. Sometimes the changes are minor, like a slightly different wording on a link. Sometimes the changes are major, where the look and feel is very different with a new update.

The best way to use this guide is to apply the concepts you see below to however the Plan Finder looks today.)

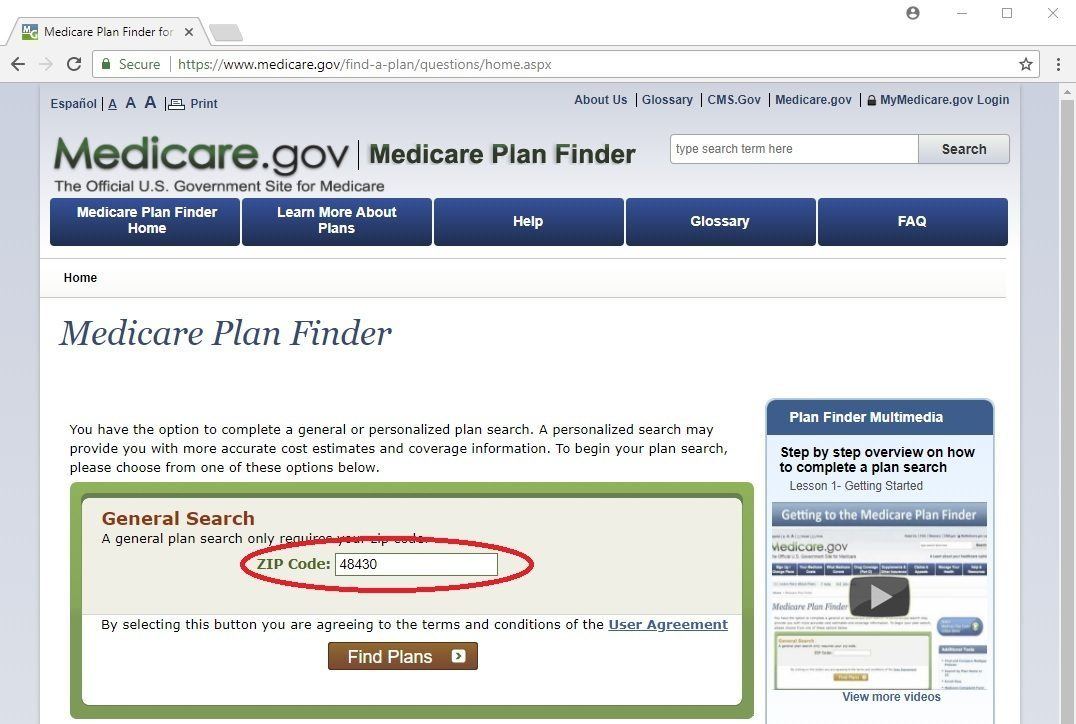

Let’s start off by going straight to the Medicare home page at www.medicare.gov. From there, you want to click one of the 3 big green buttons on the top-left side of the page that says “Find health & drug plans”.

On the next page, put in your zip code in the General Search area and click the brown "Find Plans" button. If you like, you can fill out fill out all your information in the Personalized Search section. But, if you haven’t signed up for Medicare yet or just recently signed up, you may not be in the system and it won’t find your info.

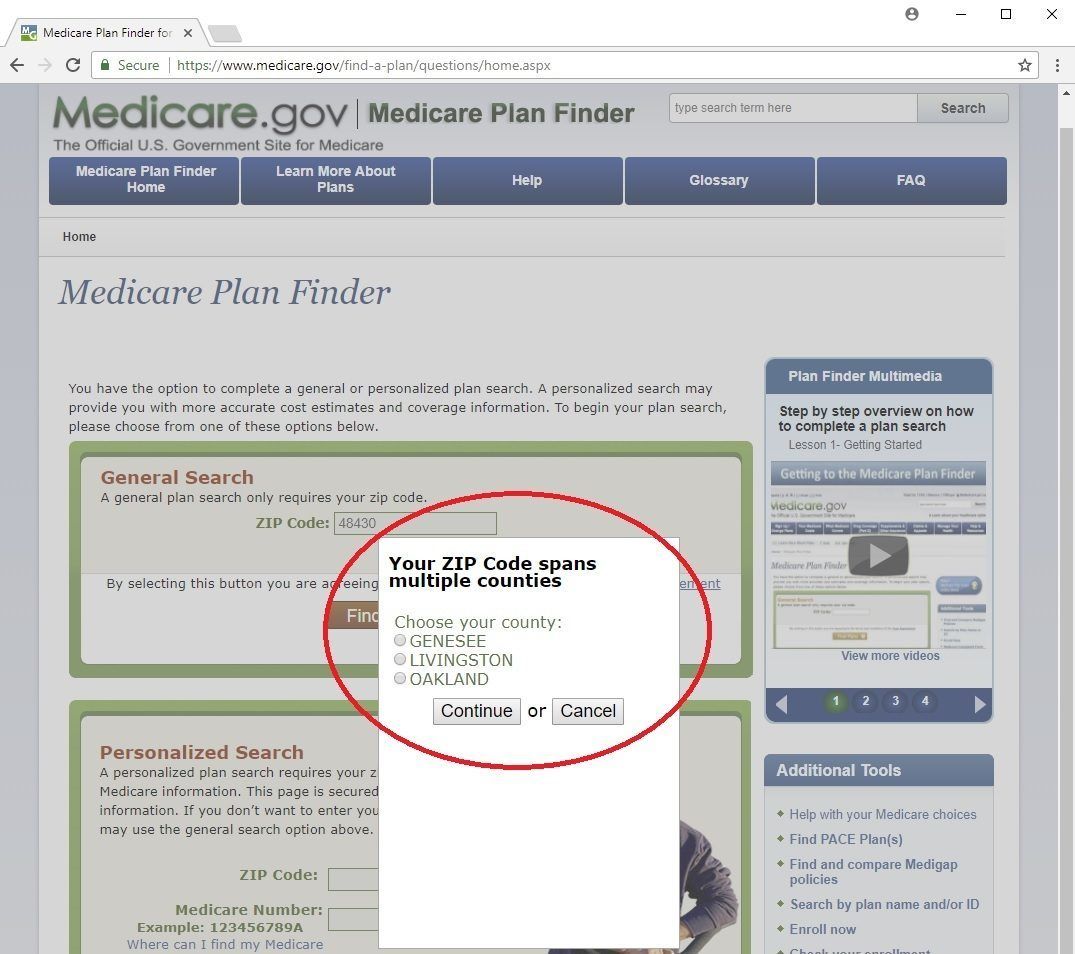

If you zip code is in more than one county, just select your county of residence here:

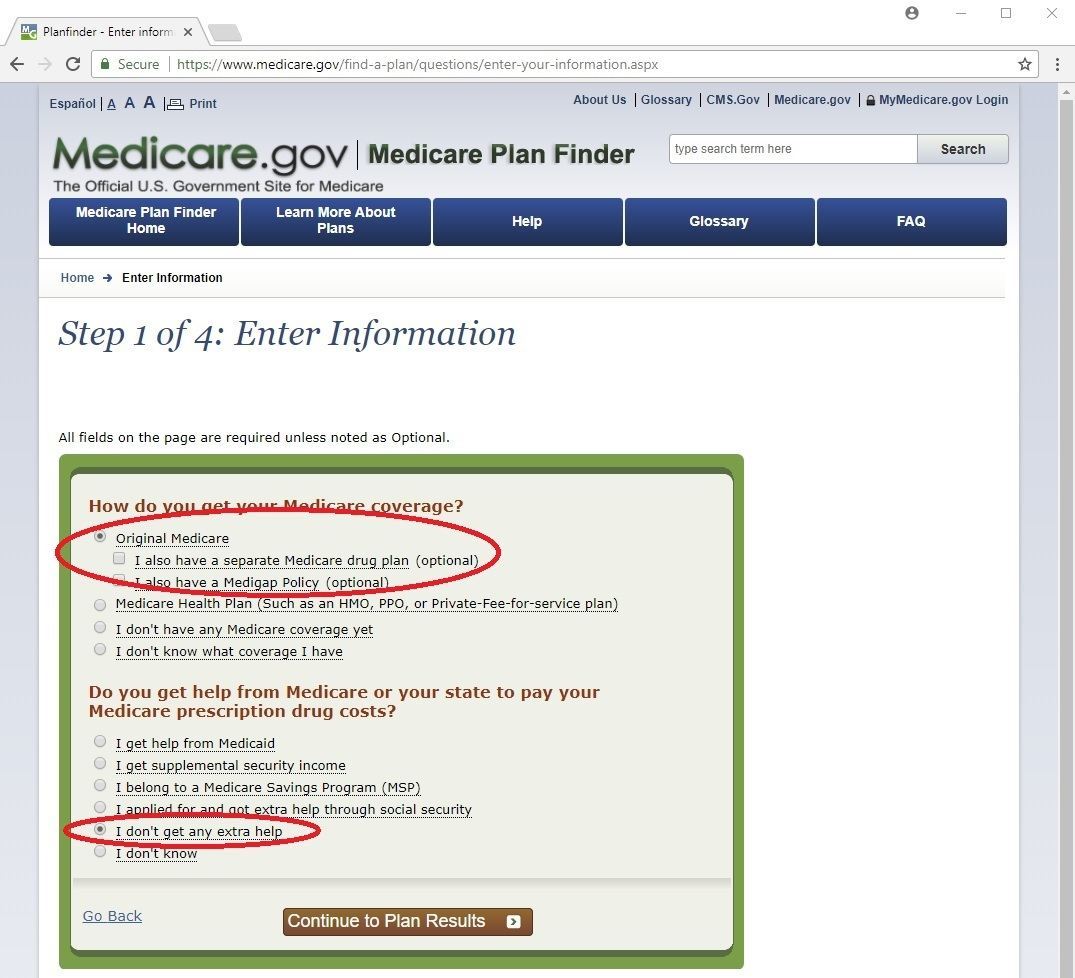

Step 1 of 4: Enter Information

On this page you have to answer 2 questions:

- How do you get your Medicare coverage? For this answer, I always select the first choice “Original Medicare”. The other parts to this question are optional.

- Do you get help from Medicare or your state to pay your Medicare prescription drug costs? I touched on this a bit in Chapter 2. The lower your income is, the more types of assistance programs you can qualify for like Extra Help and Medicare Savings Programs. I usually select the option “I don’t get any extra help”. This will let you see the full cost of the plans and drug copays with none of these discounts. You can always come back later and change this information later.

Now, click the brown "Continue to Plan Results" button.

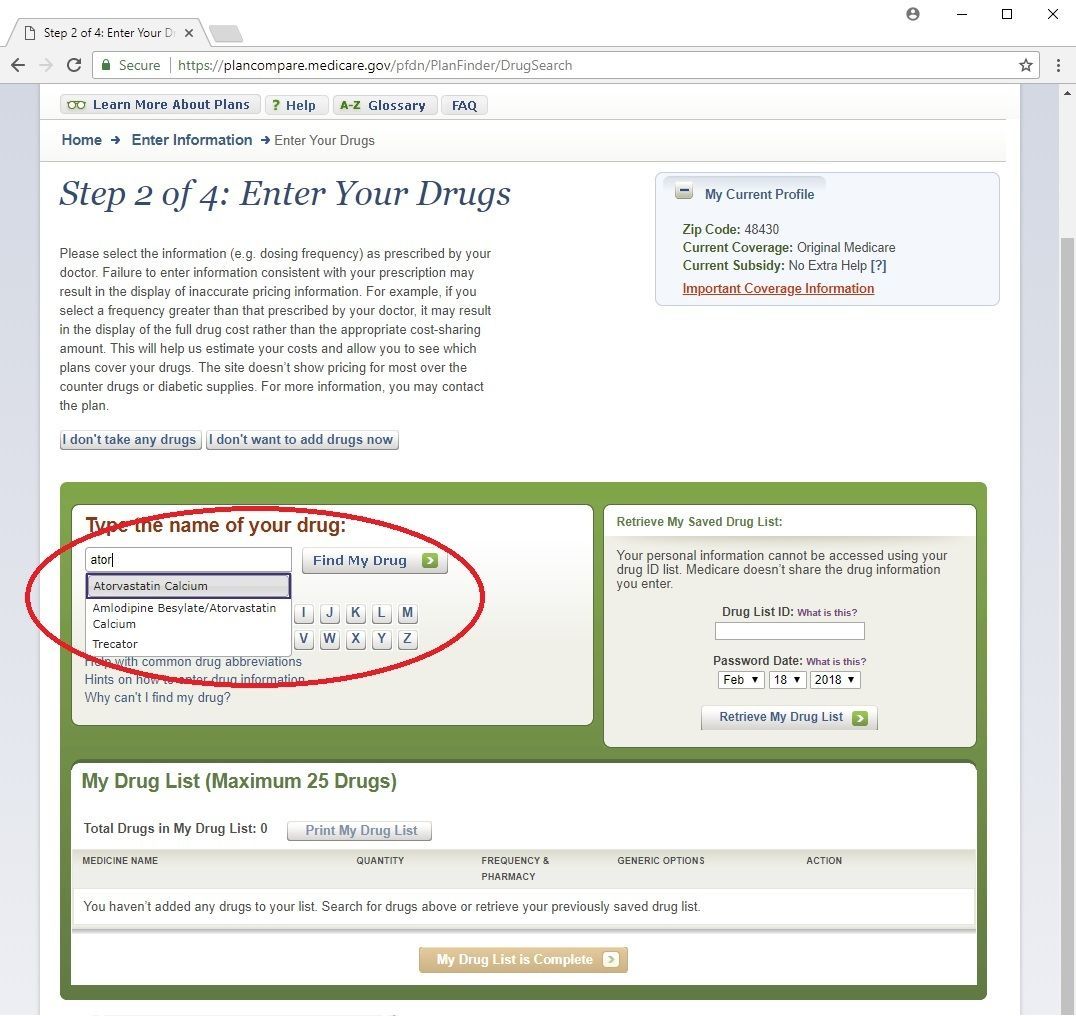

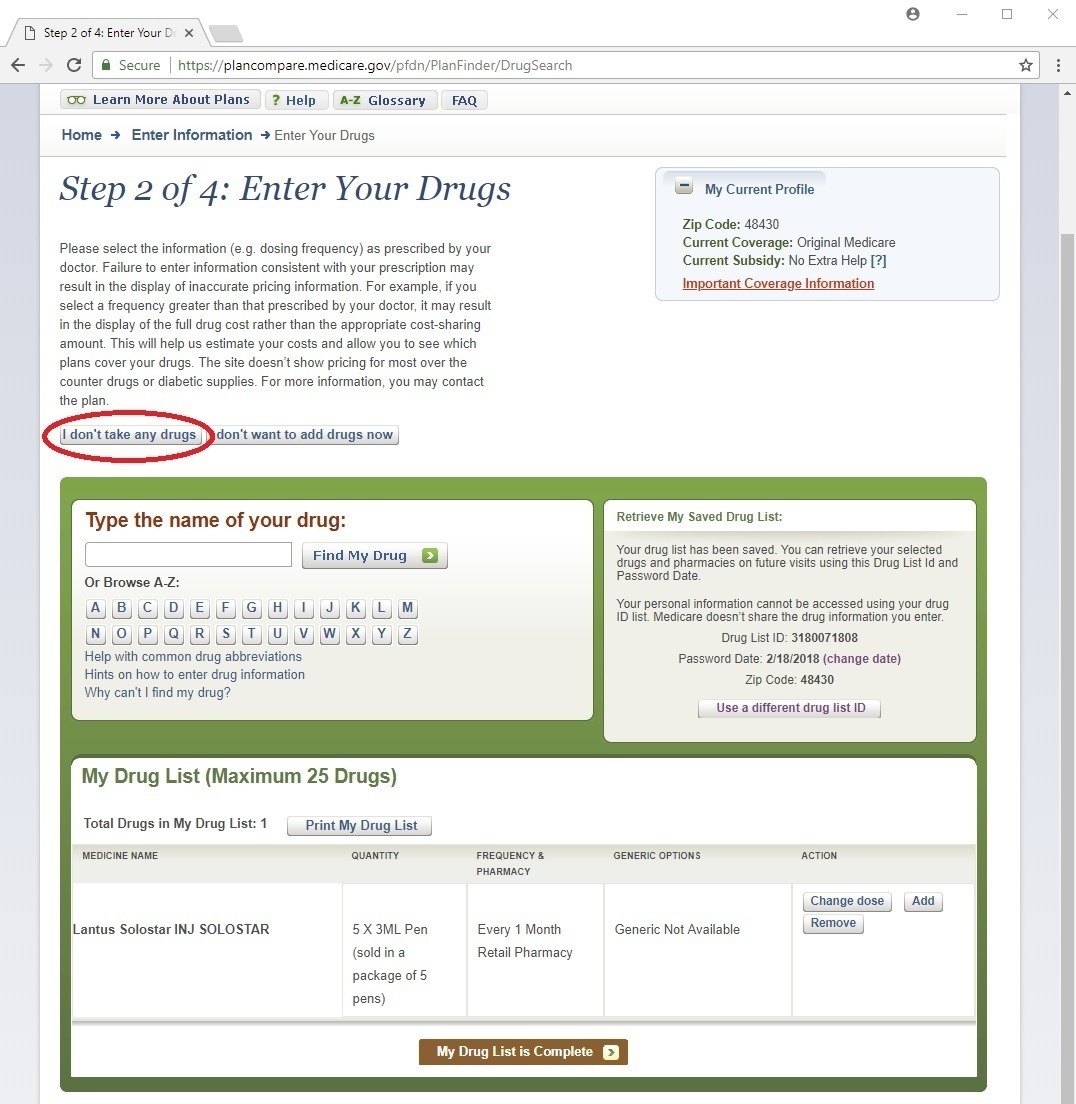

Step 2 of 4: Enter Your Drugs

This page can get pretty tricky and overwhelming when you’re trying to enter your drugs in correctly, so I’ll spend a lot of time on this page helping you with lots of different kinds of meds.

Also, you want to input each drug, including dosages and quantities, based on your best guess of what your usage will be for the rest of this calendar year. If you take a drug “as needed” (sometimes called “PRN”), just put in your best guess of how many you will take in a given month, or every 3 months.

The best way to enter your drugs is to actually have your bottles or containers in front of you so you know how to spell them and exactly what your dosage and frequencies are.

Also, you can enter either the generic or brand name of your drug. If you enter the brand name and there is a generic available, it’ll let you know.

Pills (tablets and capsules) – If you start typing the drug name in the box under the text “Type the name of your drug:”, it’ll probably find it once you type in the first 4 or 5 letters.

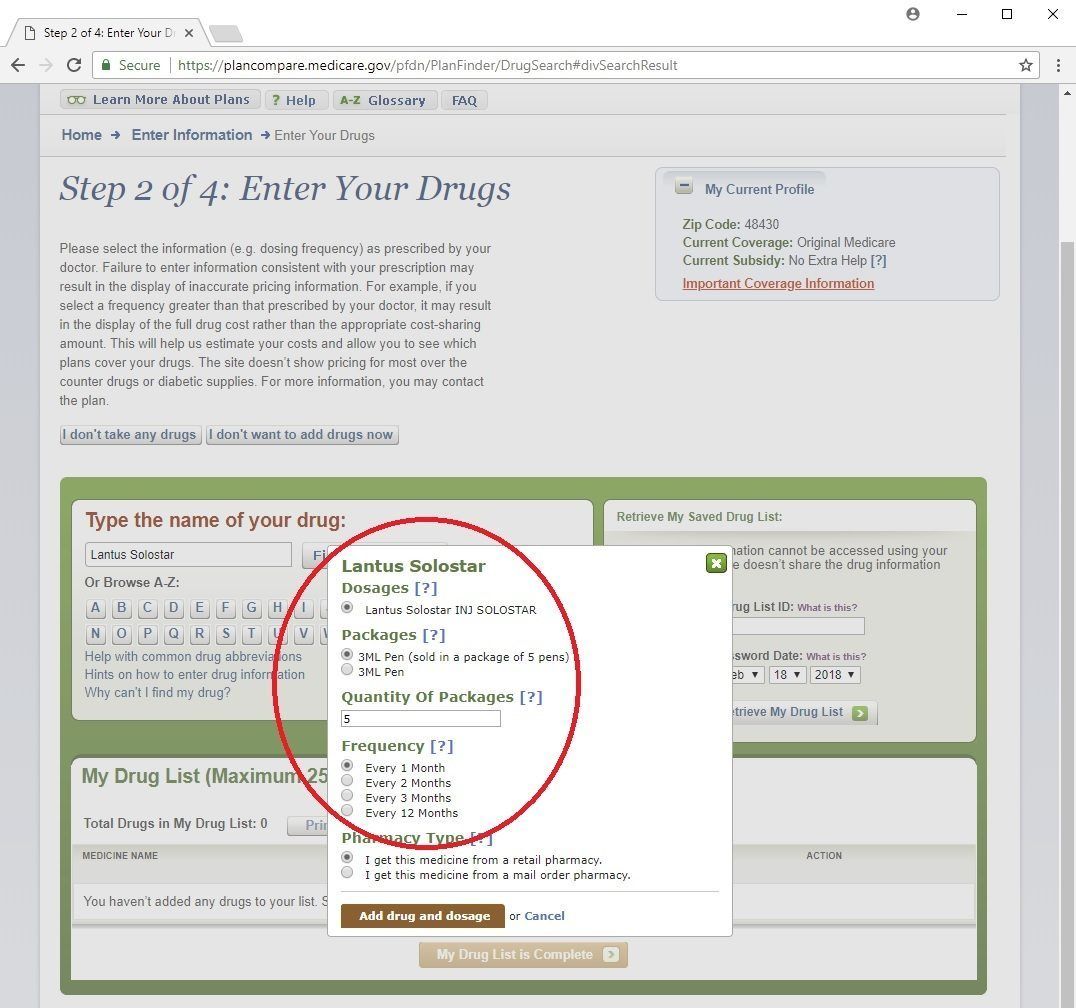

Once you select the drug you want, it’ll bring up a box where you can select your dosage, quantity, and frequency.

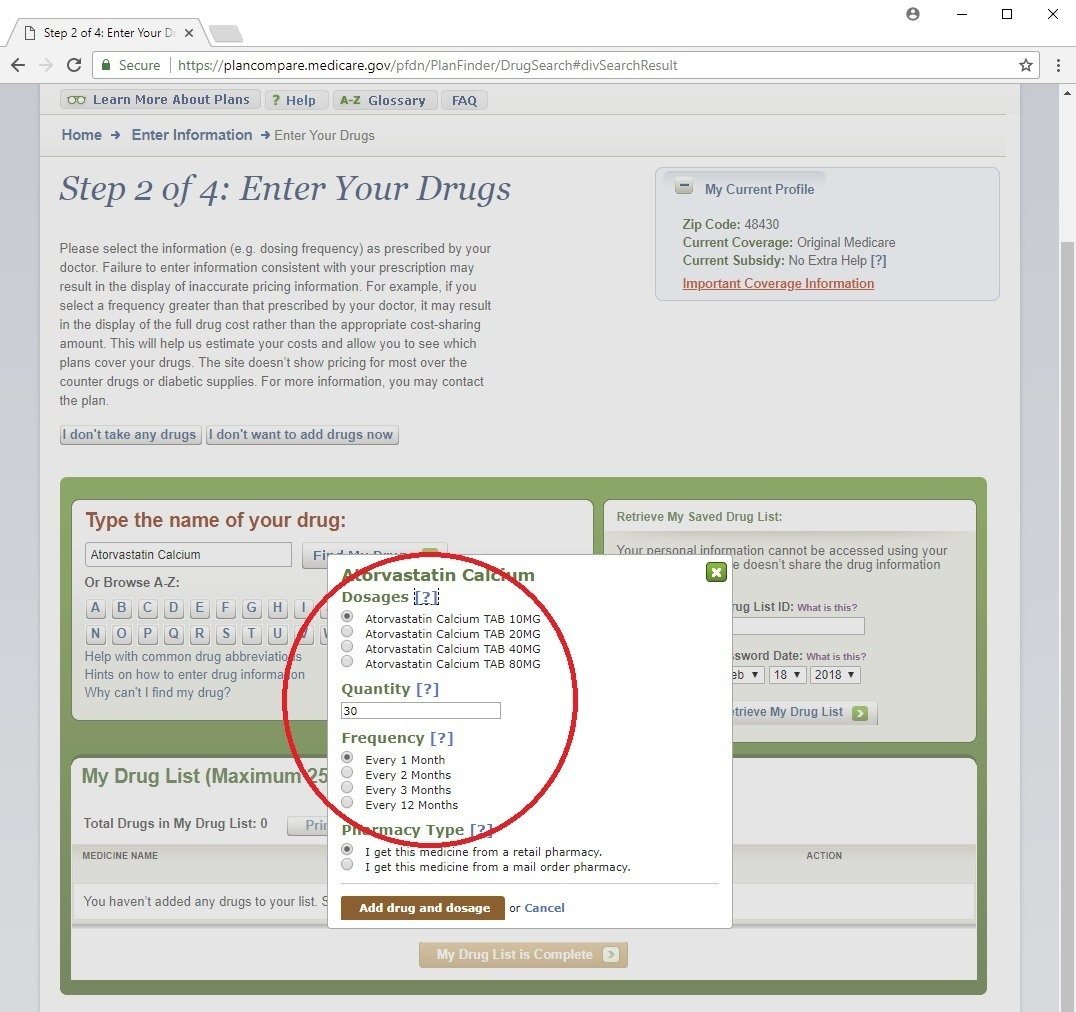

First, select your exact Dosage. There may be some abbreviations in there that you might not know what they are. Some of them are:

- TAB – tablet

- CAP – capsule

- CD – controlled delivery

- CR – controlled release

- DR – delayed release

- ER, XL, or XR – extended release

- SR – sustained release

Try to pick the drug option that is exactly the one you take. There is a difference between a drug is listed as XL and one listed as SR, for example, and they may cost different amounts too. The more accurately you can select the drugs you take, the more accurate results this tool can give you.

Second, select your Quantity and Frequency together. For example, if you take one pill per day, choose either a Quantity of 30 and Frequency of “Every 1 Month”, or a Quantity of 90 “Every 3 Months” depending on how often you fill your prescription.

For the Pharmacy Type, I never change this. We can look at the cost difference between retail and mail order pharmacies later

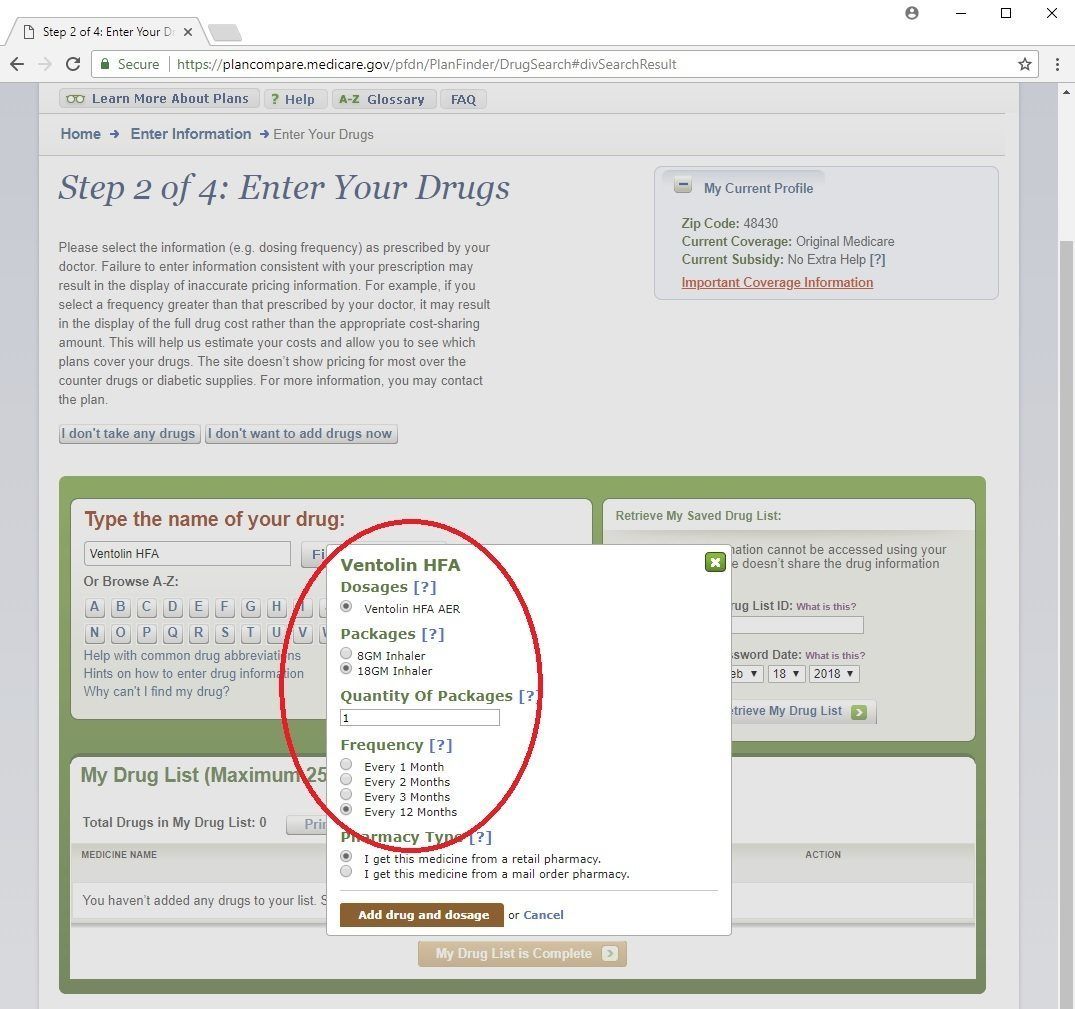

Inhalers – Some inhalers are meant to be daily maintenance medications, others are meant to be rescue inhalers and used every once in a while.

After you select the inhaler you take, there may be just one choice for Dosages or more than one. Sometimes these inhalers come in more than one size or strength, so to find out which one you take, just look very closely on the box or your prescription.

Next it’ll ask you about Packages. Your inhaler may have a certain number of aerosols, or may be a certain weight. If you see the abbreviation “GM” in this section, it is the weight measure of gram. Pick the one that you use.

For Quantity of Packages and Frequency, enter in your best guess on how long it takes before you would need to fill your prescription. For example, if you have a rescue inhaler, but only need to get a new one about once a year, then just select 1 Every 12 Months.

Insulins – Unfortunately, with insulin we’re going to have to do a little math to figure out your quantity and frequency. It can be a little tough to estimate how much you use.

First off, make sure you know if you’re using a vial or a pen. A pen will say something like flexpen, kwikpen, or (in the case of Lantus) Solostar.

Next, in order to figure out how much insulin you need, you need to know how many units you take per day. Now I know this amount can vary from day-to-day for a lot of you, so try to figure out much you use per day on average.

Once you know that, we need to know how many units per milliliter (mL) your insulin type has. Now, how many mL is in your pen or vial? For example, if your pen has 100 units per mL and it’s a 3 mL pen, there are 300 units in your pen. If your vial has 100 units per mL and it’s a 10 mL vial, there are 1,000 units in your vial.

So based on how many units you take per day and how many units are in a pen or vial, you know how long it will take you to use one. For example, if you take 50 units per day, and there are 300 units in your pen, you will use up a pen every 6 days. If you take 25 units per day and there are 1,000 units in your vial, you will go thru a vial in 40 days.

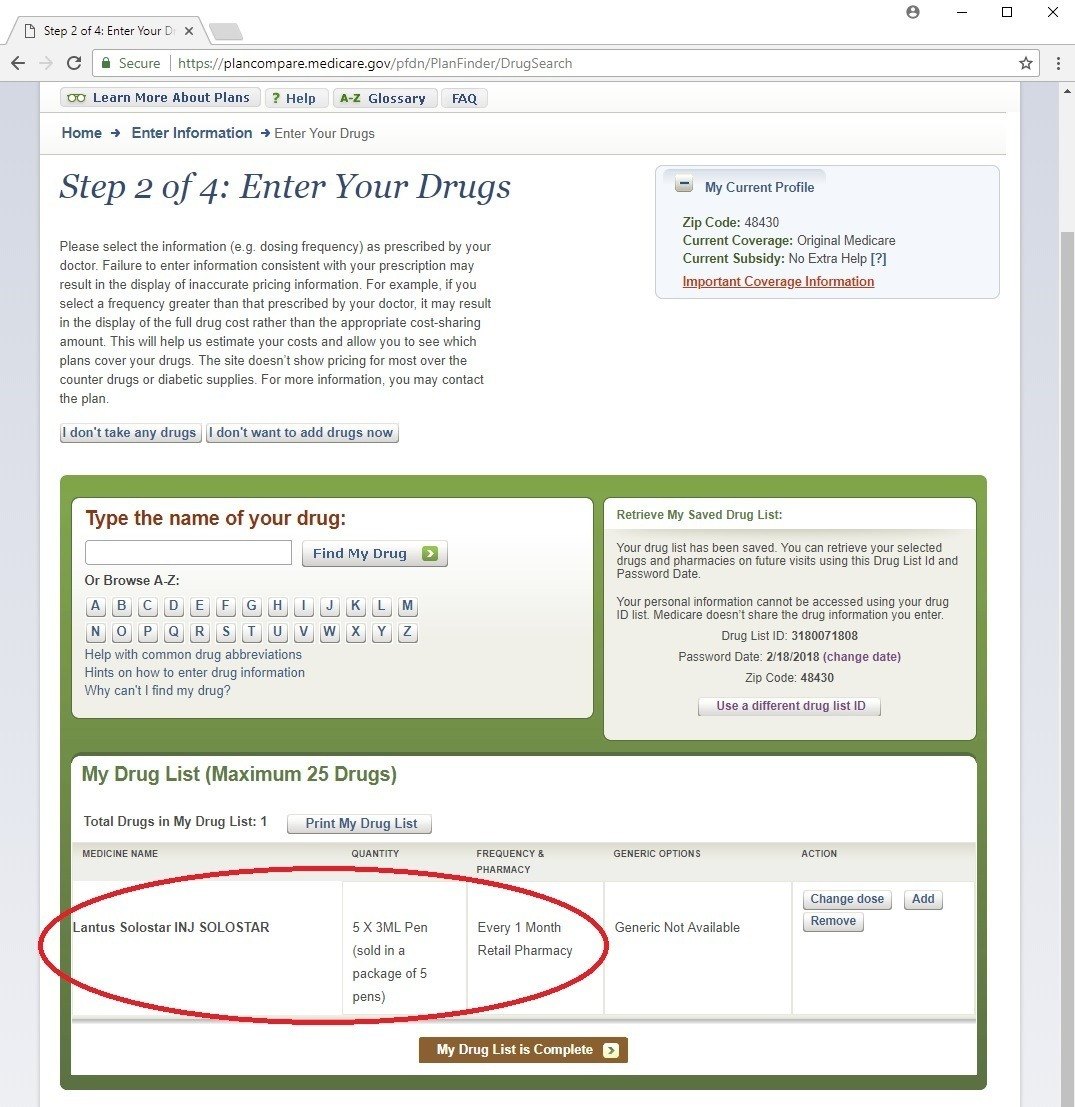

Now, that you know how often you’ll go thru a pen or vial, you can estimate your Packages, Quantity of Packages, and Frequency. If you use a pen every 6 days, then you’ll use 5 pens Every 1 Month, or 15 pens Every 3 Months. If you get your pens in a package of 5, you can select this option under Packages. You can always double-check that you put it in right at the bottom. Notice how it says “5 X 3ML Pen”.

I would strongly advise using the Every 1 Month or Every 3 Months options, not the Every 2 Months option. It tends to give less accurate results. If the amount of your insulin doesn’t fit that neatly using one of these Frequencies, you can always use decimals. For example, if you use one vial every 40 days, you could put in 2.25 vials every 3 months.

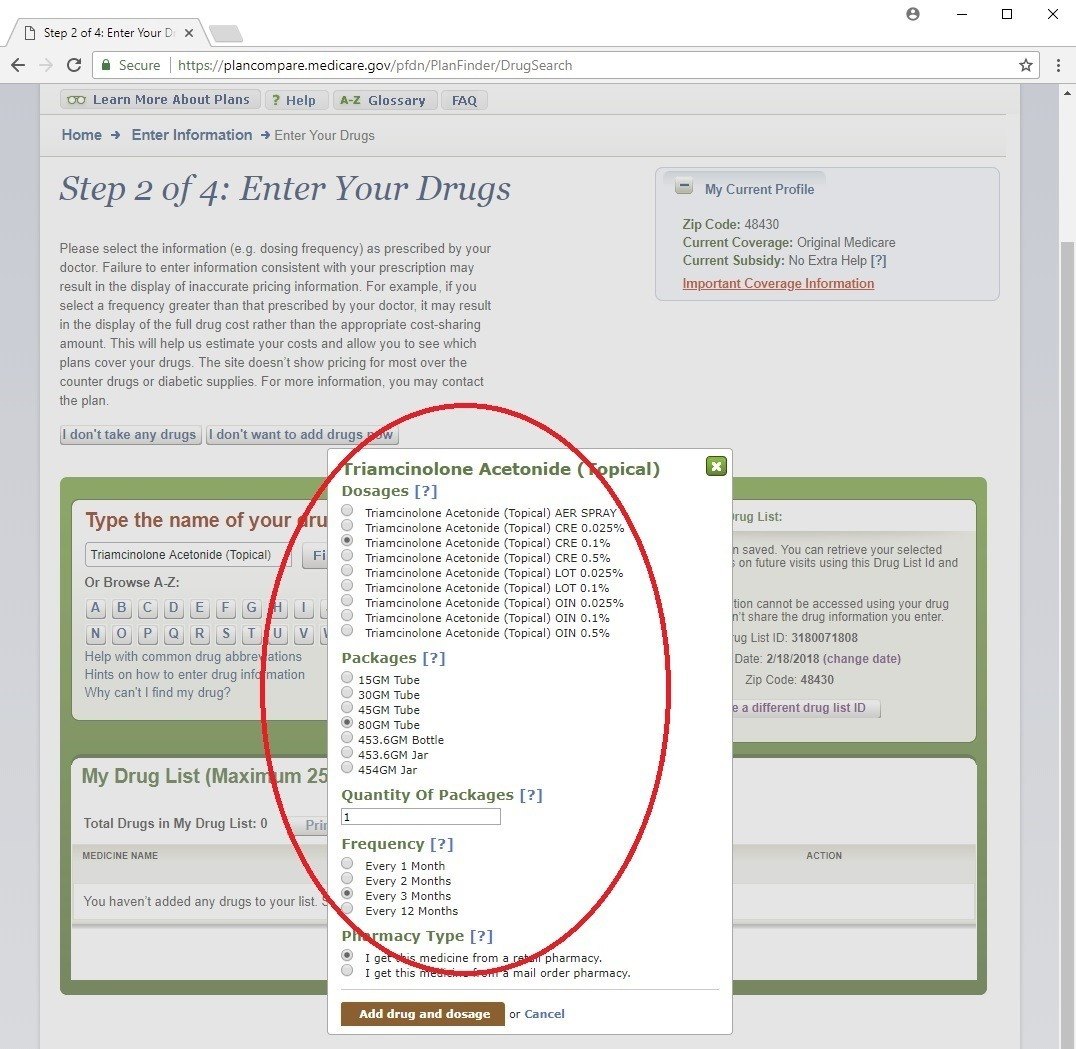

Creams, ointments, eye drops, and other non-solid medications – Just like we did with inhalers, you want to try and figure out how long it will take before you need to refill your container.

After you find your drug name, choose the right type:

- CRE – cream

- OIN – ointment

- SOL – solution

Also, you want to know the right strength, or concentration, 0.5% for example.

Next, you want to know the size of your bottle or tube.

Then just like we did in the examples of the other types of drugs, put in your best guess on how long it will take you to go thru that bottle or tube and need another one. Use that info in choosing the Quantity of Packages and Frequency.

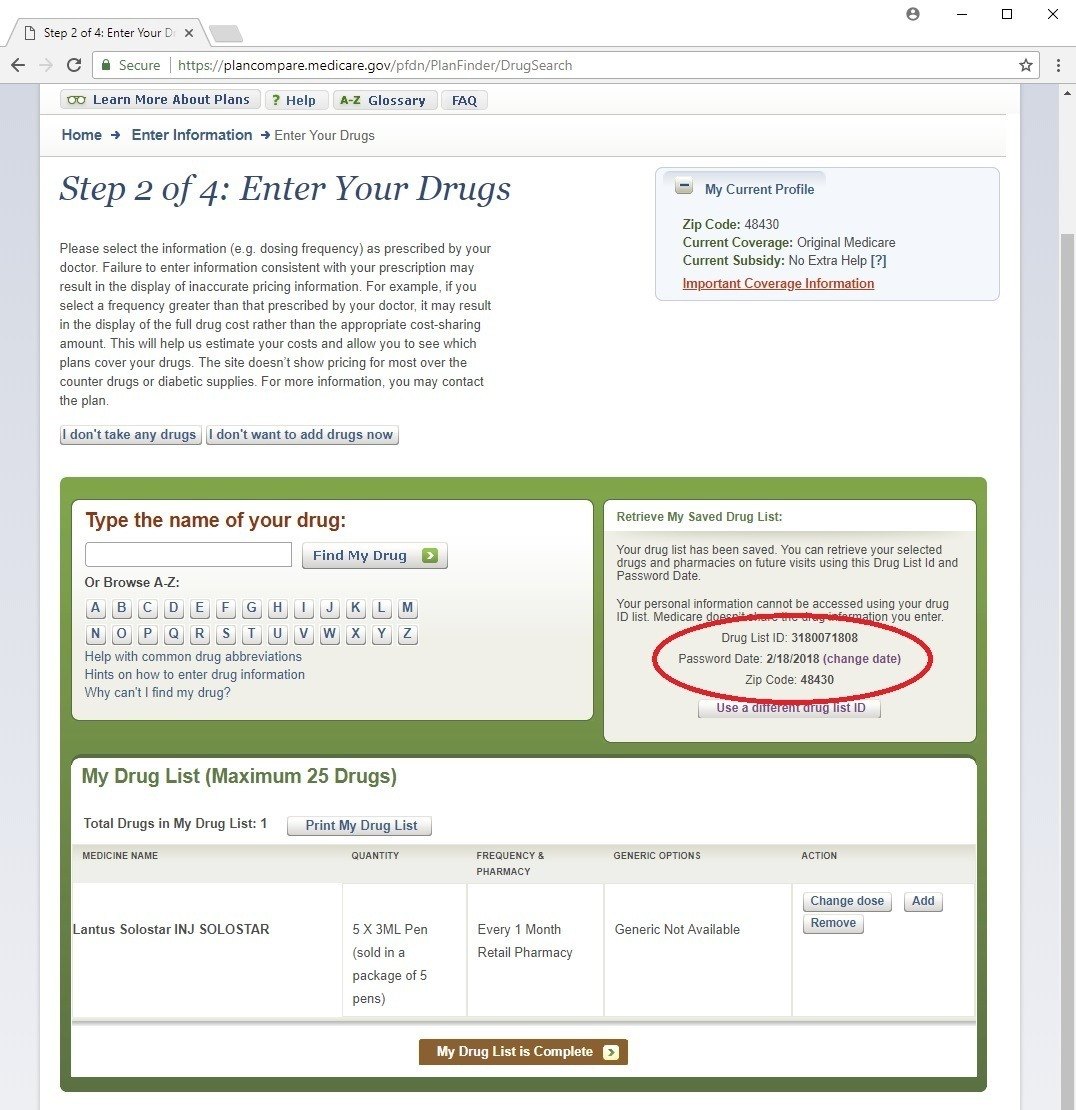

Once you’ve entered all your meds in, write down your Drug List ID and your Password Date. This tool has saved your list of meds with your zip code and you can enter these two numbers later to bring back up your list without having to re-enter it.

If you’re not taking drugs, just click the “I don’t take any drugs” button, then click Skip Drug Entry.

When you're done, click the brown “My Drug List is Complete” button at the bottom to move to the next step.

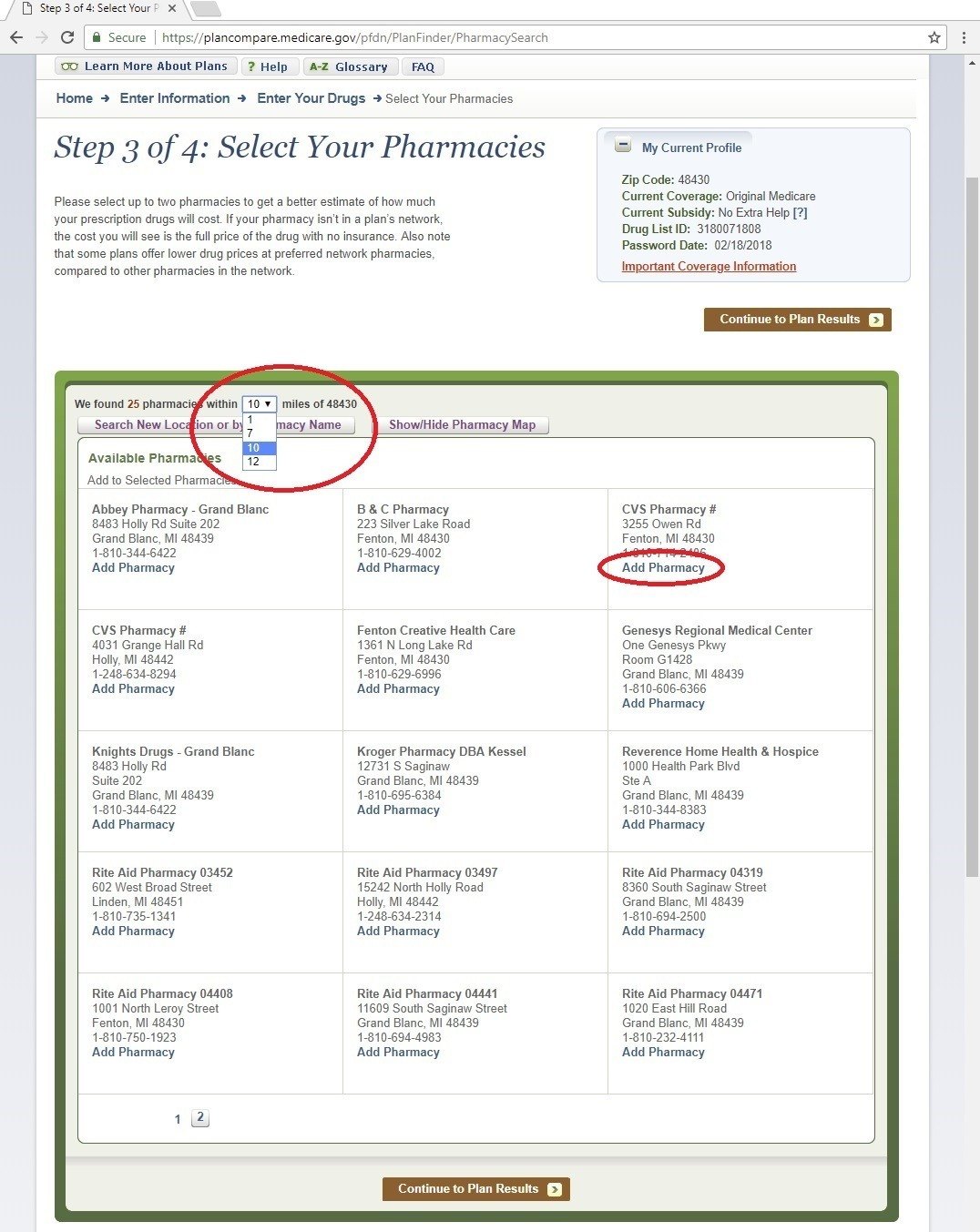

Step 3 of 4: Select Your Pharmacies

Here you can select up to two pharmacies. If you have a strong preference of a pharmacy where you will only consider going to that one, simply click “Add Pharmacy” underneath that choice. If you don’t care much which one to go to, or would like to consider a second option to possibly save money, just pick another one.

If you don’t see your pharmacy, or want to look at more choices, just click the drop down menu where it says “We found 9 pharmacies within” ___ “miles of your zip code” and select a larger number. If there is more than one page, click to go to the next page using the numbers at the bottom.

Once you’re done click the brown button that says “Continue to Plan Results”.

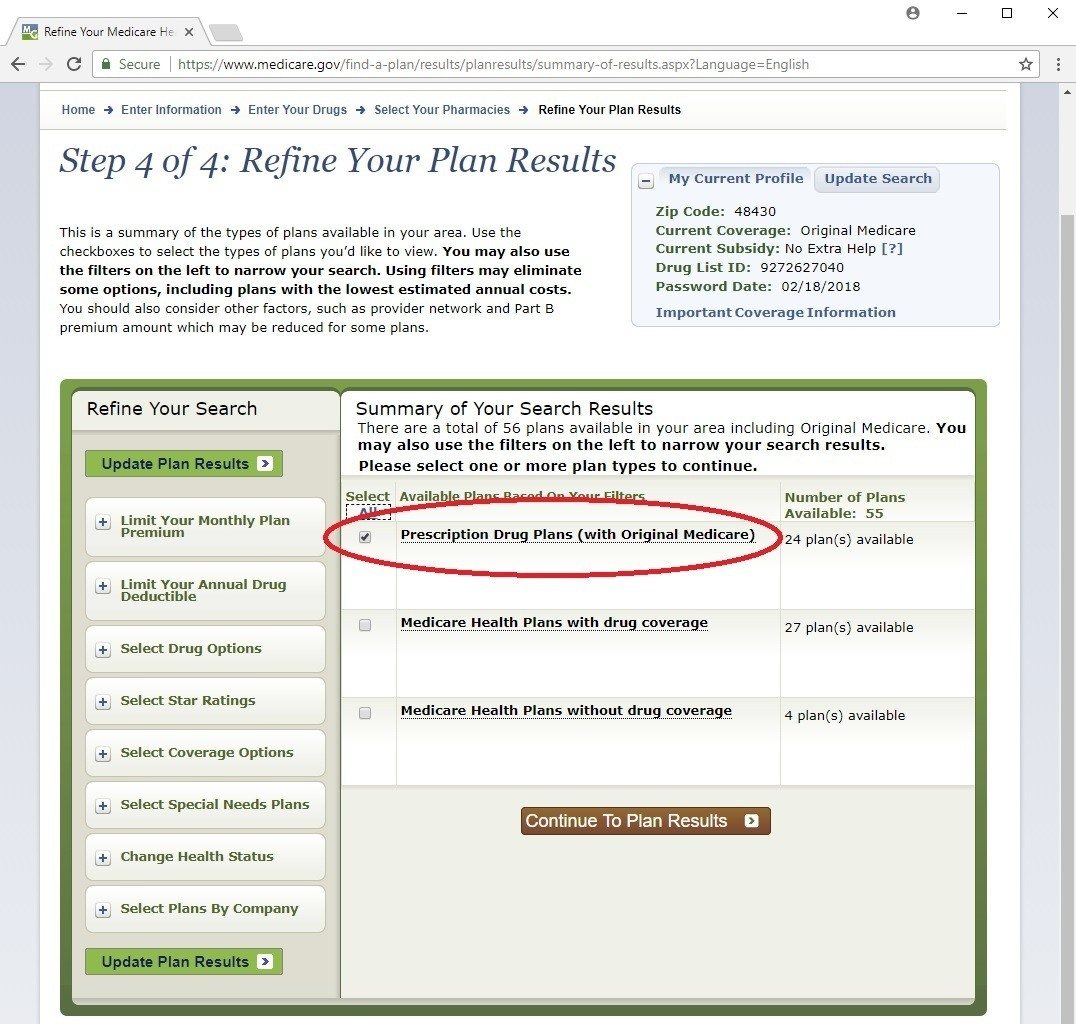

Step 4 of 4: Refine Your Plan Results

In this chapter we’re just going to focus on standalone drug plans. So we want to click the first check box only that says “Prescription Drug Plans”. We’ll look at the other boxes in the next chapter. Again you want to click the brown button: “Continue to Plan Results”

Alright, finally we’ve given this tool all the info it needs. Now time for the…

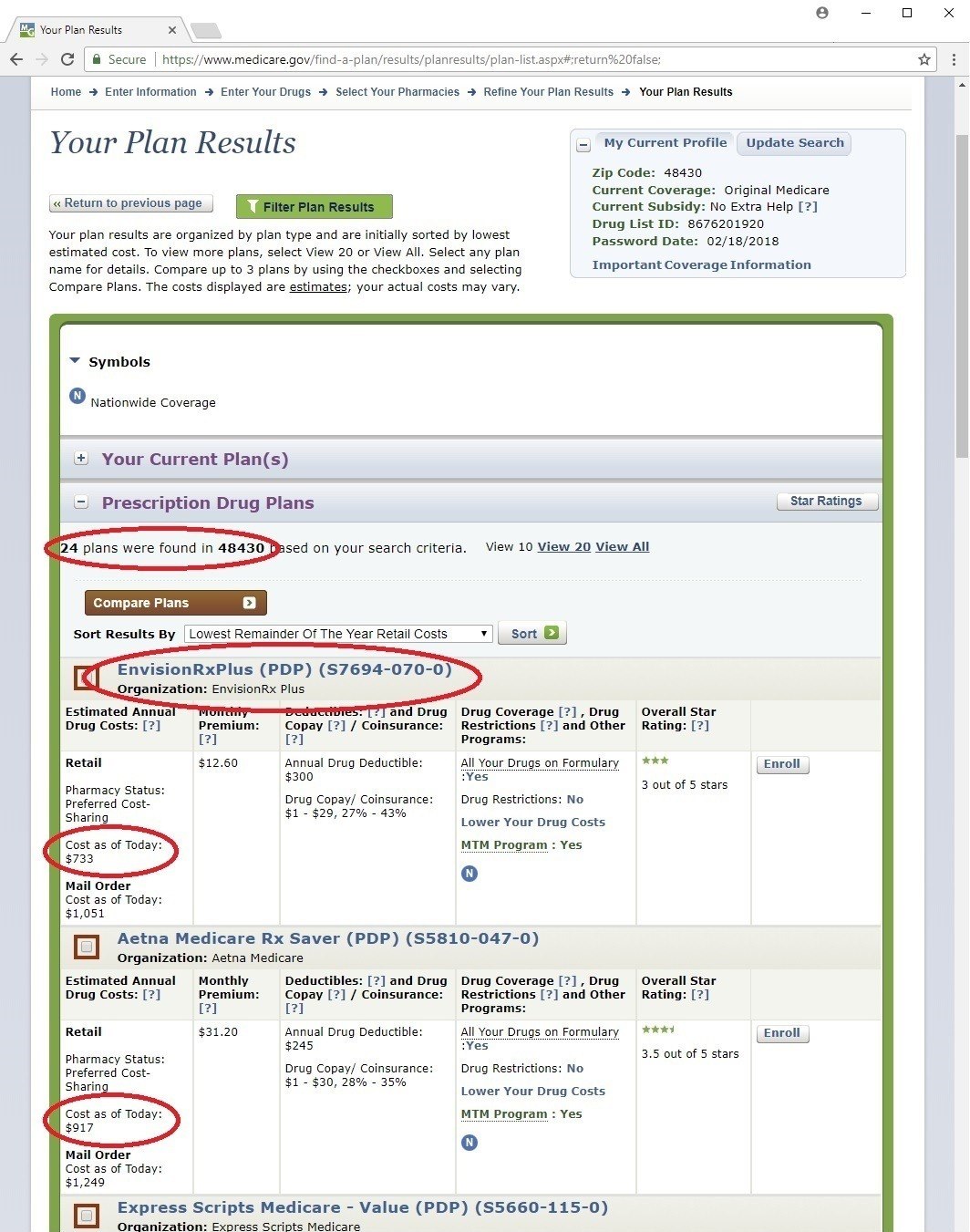

Your Plan Results

This page is probably a little overwhelming to look at, but like we’ve done things so far, let’s break it down piece-by-piece.

The first thing to point out is how many PDPs there are in your zip code. This tool has considered all of them and has put the plan that will result in you spending the least out of pocket for the rest of the year for prescription drug costs at the top.

Let’s look at the plan at the top. Now look at the number on the left after “Cost as of Today:”. The plan that has the lowest amount of all plans listed is at the top. This amount is a total for the rest of the year of each PDPs premium and copays for the drugs you’ve entered. We’ll look at this in more detail a bit later.

Now notice how this number increases for each plan further down the page. This means as you go down the page each plan gets more expensive for the year for the drugs you told the Plan Finder you’ll be taking and at which pharmacies you want to pick them up at.

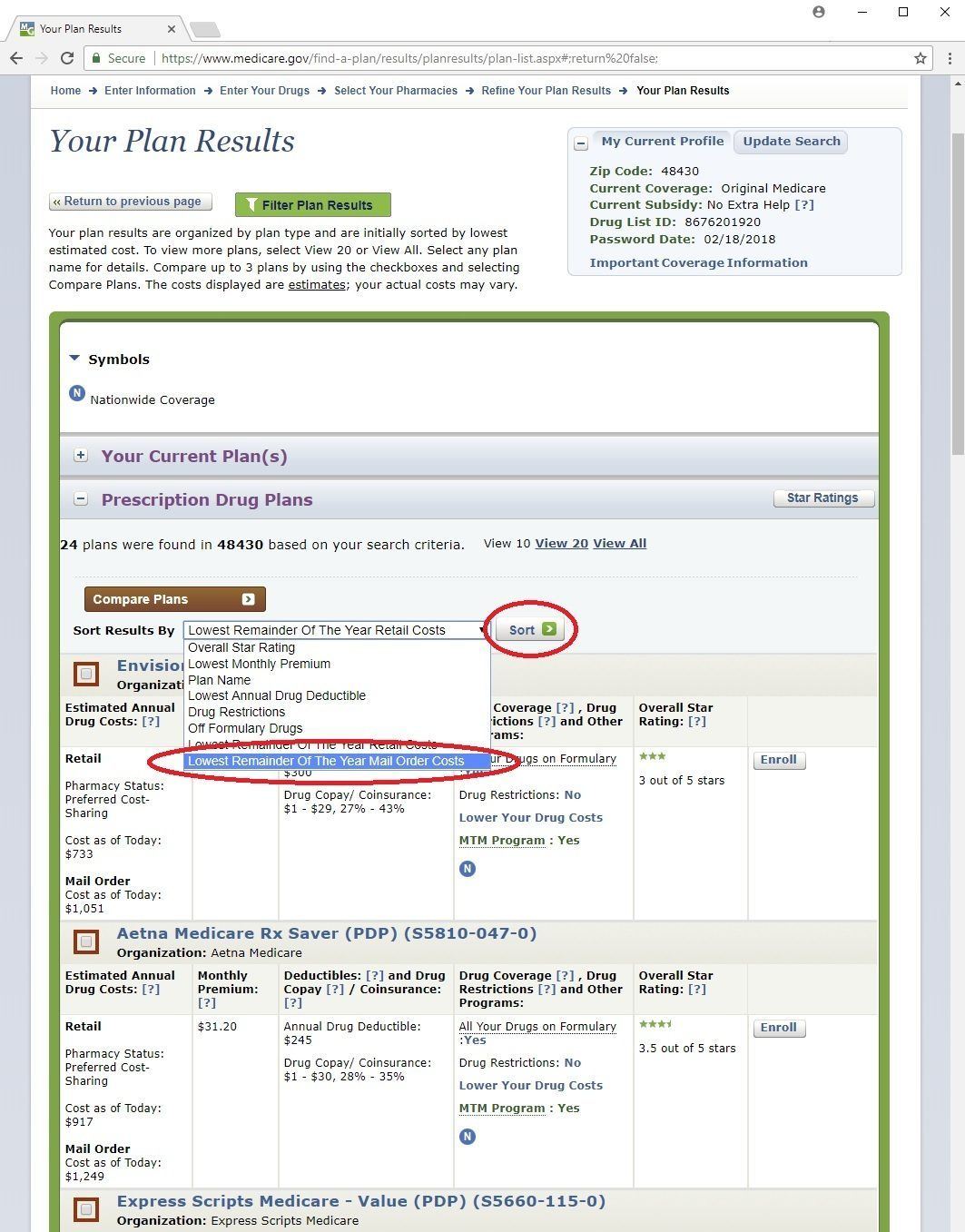

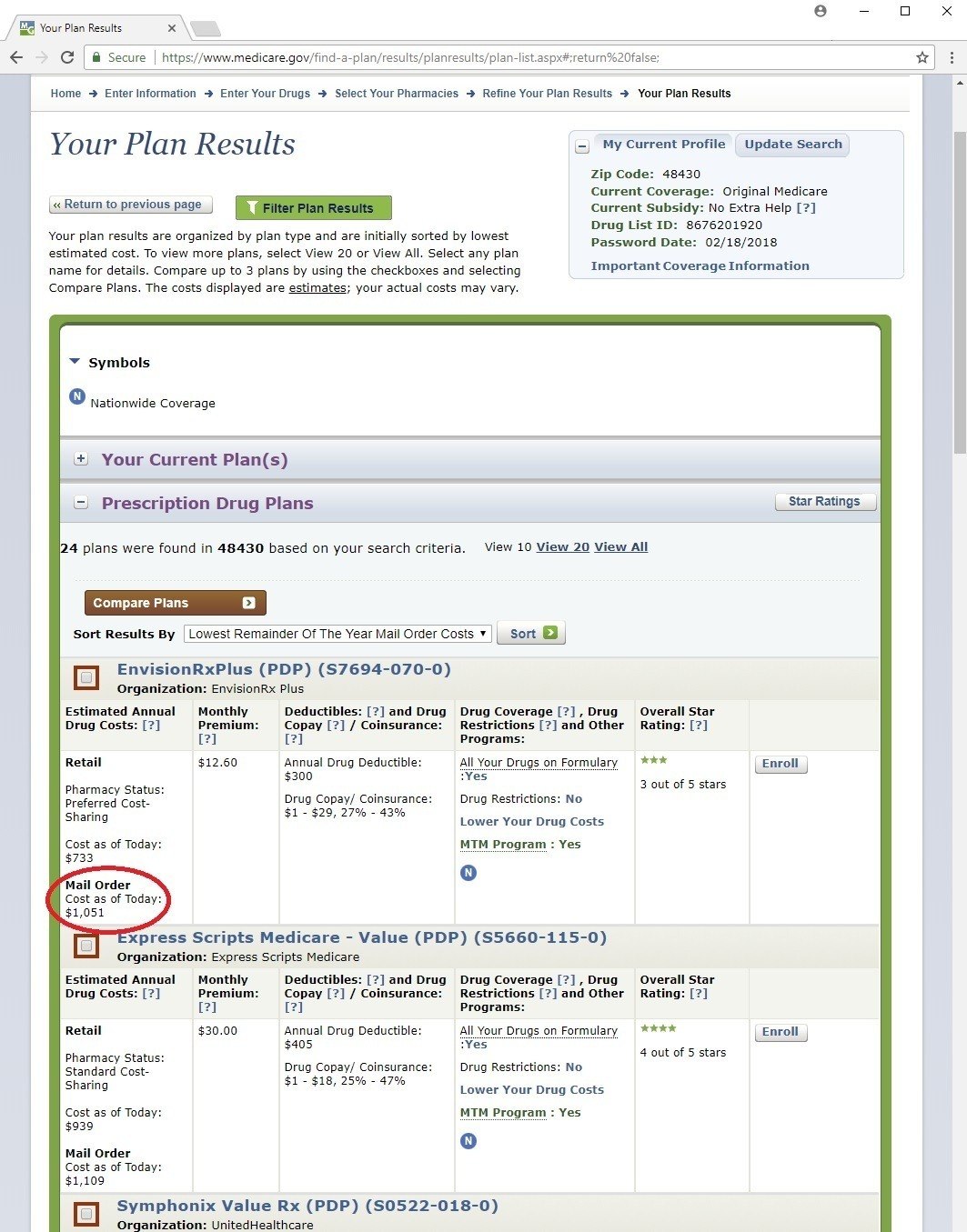

You can sort these results different ways too. See where it says “Sort Results By”? Let’s pick the choice of “Lowest Remainder Of The Year Mail Order Costs”, then click the Sort button.

This shows the same plans, but now puts the one at the top which would be most cost-efficient if you’re willing to use mail order to have your drugs delivered instead of picking them up at the pharmacy. Looking at the results this way puts the plan with the smallest “Cost as of Today:” under Mail Order at the top.

Either way we’ve sorted, click on the actual plan name at the top to see it in more detail…

Your Plan Details

Let’s look at several of the sections on this page one at a time:

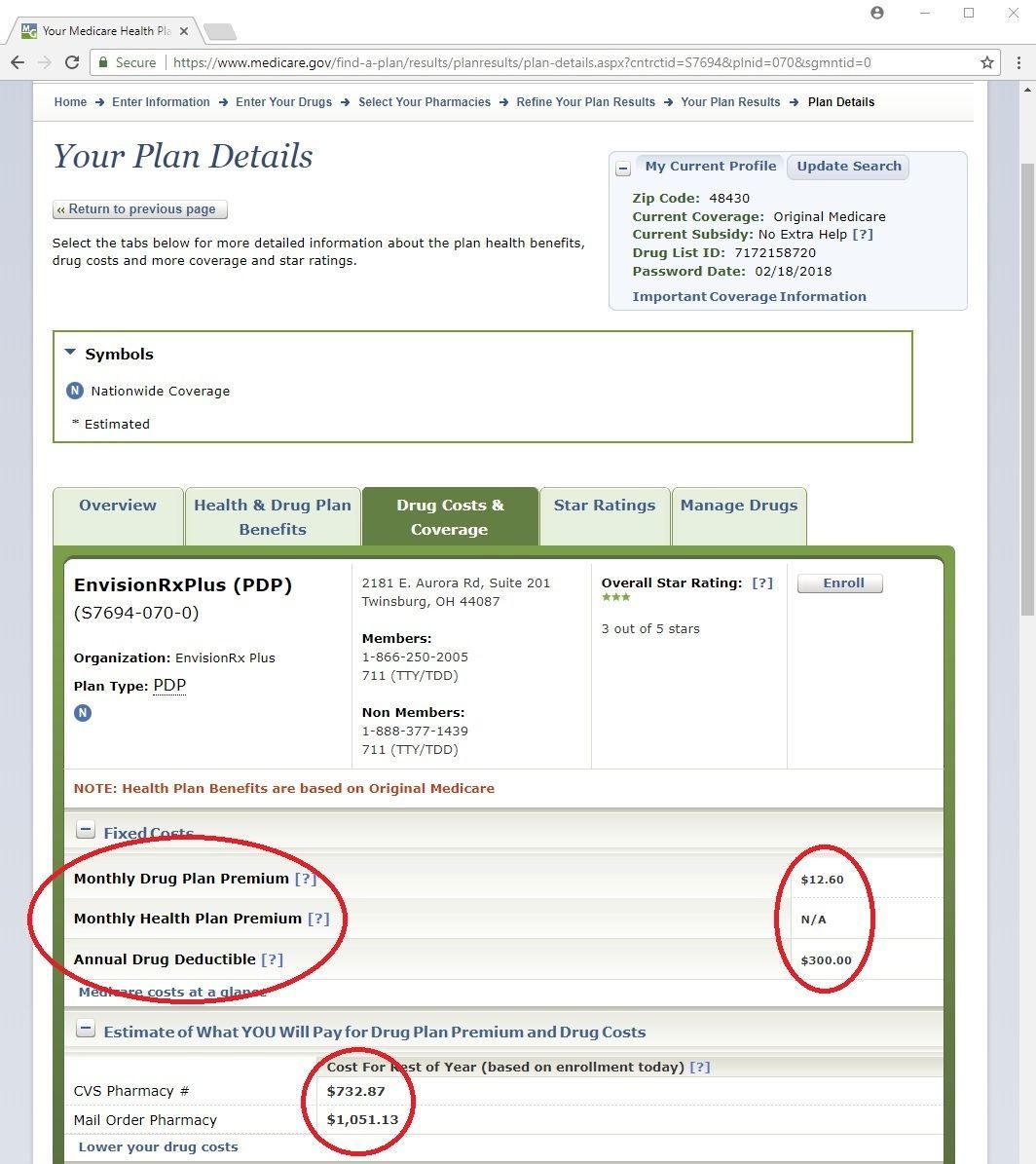

Fixed Costs - here we can see the monthly premium for the PDP, and any deductible it has. If the plan has a deductible, a lot of times it will only apply to brand name drugs, not to generic drugs. This means that if any drugs you’re taking are generic, the insurance will help pay for part of them right away. But if your drugs are brand names, you have to pay for them yourself up to the cost of the annual deductible before the insurance will pay its part. We can see how this works further down the page.

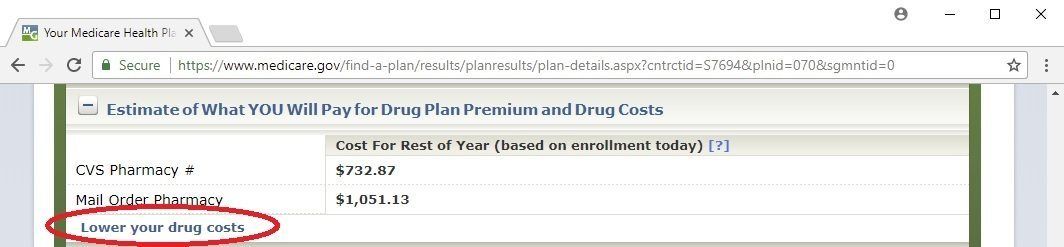

Estimate of What YOU Will Pay for Drug Plan Premium and Drug Costs – the amounts listed here are the amounts that the results were sorted by on the previous page.

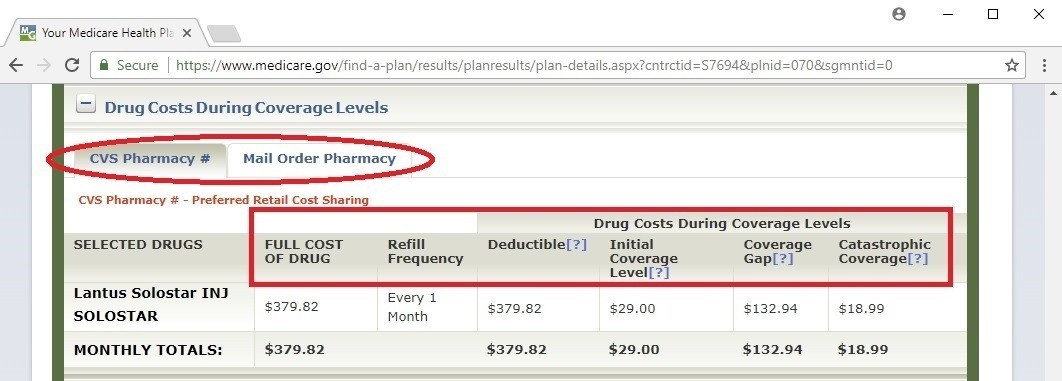

Drug Costs During Coverage Levels – this section shows your copays for your drugs in much more detail.

The first column with a dollar amount shows the FULL COST OF THE DRUG. This is the actual retail cost of the drug before the insurance pays anything. This amount is how much you would have to pay for the drug on your plan if you have not met the deductible yet.

If the amount in the Deductible column is less than the full cost, then this means the deductible doesn’t apply to this drug and you get coverage right away. If there is not a Deductible column, then this plan does not have a deductible. The largest a deductible can be is $445.

PDPs have 4 separate phases of coverage:

- The deductible is the 1st phase where you have to pay the full cost.

- Once you do, you enter the 2nd phase called the Initial Coverage Level. In this phase you pay either a fixed cost or a fixed percentage of the full cost depending on how that plan works.

- The 3rd phase is called the Coverage Gap, otherwise known as the Donut Hole. This is a term you may have heard of before. You get into the donut hole once the total full cost of your drugs for the year total $4,130. This amount is not the amount you’ve spent, but the total retail cost. In this phase your drugs will cost up to 35% of the full cost for brand name drugs, and 44% of the cost of generic drugs.

- The 4th phase is called Catastrophic Coverage. Not many people get to this phase but if you do, your cost will be either 5% of the full cost or $3.70 for generics or $9.20 for brand-name drugs, whichever is more. You get into this 4th phase when your true out-of-pocket (TrOOP) amount hits $6,550 for the year.

The following amounts are counted toward TrOOP:

- Your deductible

- Your copays in the Initial Coverage Level

- Your copays for brand name drugs in the Donut Hole + an additional 50% of the drug’s full cost; otherwise stated, 85% of the full cost of brand-name drugs

- Your copays for generic drugs in the Donut Hole

One more thing to notice about this section are the tabs that show your selected pharmacy, or pharmacies, and a tab for Mail Order. So if you click on the Mail Order Pharmacy tab, you can see how the full costs and costs in all 4 phases change, if at all. For Mail Order, it always shows results for refilling your meds 3 months at a time.

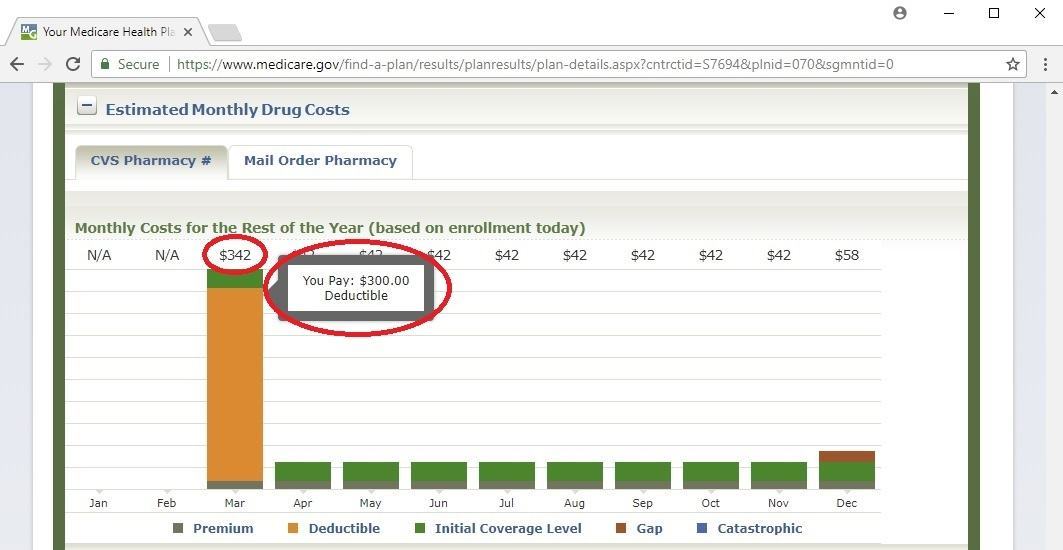

Estimated Monthly Drug Costs – this section has a very helpful budgeting tool, as well as helps you understand your costs throughout the year in a nice color coded graph.

Each bar represents your total costs for the month. The PDP monthly premium is a gray color at the bottom. Then on top of these gray bars, it shows you what your copays would be throughout the year as you go through each of the 4 phases, represented by a different color.

In some of the months there may be more than one color on top of the gray bar. This just means this is when you transition to the next phase. In that month, your drug copays are kind of a combination of what they are in each of the phases you’re in that month.

At the top of each bar, you can see what your total estimated cost is for that month. Also, if you’re looking at this on a computer you can hover over each part of each bar to see how the costs are broken down.

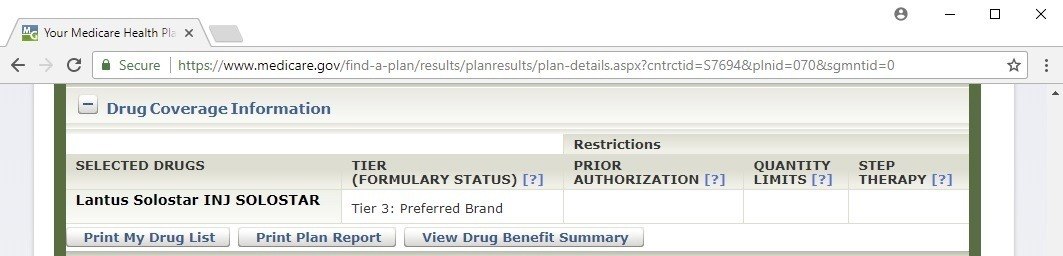

Drug Coverage Information – this section tells you what tier each of your drugs is classified at. There are usually either 4 or 5 tiers in a given drug plan. The higher number of the tier a drug is in, the higher the cost usually is.

In this section, you can also see if there are any restrictions on your drugs. There are three types of restrictions:

- Prior Authorization – this requires either you or your doctor who prescribed this drug to contact this drug plan and see if you qualify to take this drug. If not, they can let you what you may need to do before they fill this prescription.

- Quantity Limits – this lets you know the limit on the amount of this particular drug that the plan will cover in a certain time frame. For example, they may only let you have 60 tablets every 30 days. In my experience, the prescribed amounts of medication pretty much always fall under these amounts, and shouldn’t be a problem for you.

- Step Therapy – sometimes drug plans will require you try another medication to treat your medical condition before they will cover this drug. Only if that other drug doesn’t work well, will they cover this drug. Sometimes your doctor can work with the plan to get it covered without trying other meds first.

Saving Money

Sometimes even with these PDPs, they can save you a lot of money on your meds off the full cost, but still your copays make your drugs nearly impossible to afford.

The Medicare program was designed to put things in place that can help you afford all levels of healthcare, including getting your prescriptions. Here are just a few ways to make them more affordable:

Mail Order

So we’ve seen how far to find the plan that will result in you spending the least out-of-pocket for the year for total drug costs, both at a pharmacy or using mail order.

You’ll often find that on the results page when you sort the plans by lowest mail order cost, this number will be lower than the lowest number for retail costs. This is because using mail order to fill your prescriptions will almost always save you money, sometimes quite a bit in any given year.

Different pharmacies

Another thing you can try is being willing to switch pharmacies. You can go back to the top of the page and click the Select Your Pharmacies link. This will let you go back and try putting a few different pharmacies in to see if it lowers that annual retail costs number. Before you do this though, write that number down to see if you can lower it by picking a different pharmacy.

Pharmaceutical Assistance Programs (PAP)

Let’s go back to the page that has all the details of the best possible plan. If we look at the section “Estimate of What YOU Will Pay for Drug Plan Premium and Drug Costs” again, notice the link in there that says ‘Lower your drug costs’. Go ahead and click on it.

This page will show you if there are any Pharmaceutical Assistance Programs for any of your drugs. If there are, it will show “Yes” in that column. Click the “Yes” link.

This will show you one or more assistance programs for that drug. These will either be general drug assistance programs or those specifically offered by the company that makes that drug. Most of them are require you having your income under certain amounts in order to qualify. If you think you might qualify but look like you’re a little bit over the required income amounts, go ahead and apply anyway. The worst they can do is say no.

If you want to look up drugs in general without being in the Plan Finder, here is the direct link: https://www.medicare.gov/pharmaceutical-assistance-program/Index.aspx. Just click the first letter of the drug you want to look up. Then if it’s in that list, click the Details link for more info.

Extra Help

This program is also called Low Income Subsidy (LIS). If your income and financial resources are below certain amounts, then you may qualify as LIS. This could lower your PDP premium and set limits on how much each of your drug copays are.

It’s harder to qualify as LIS compared to a PAP because the income and resource amounts are lower. This is because it can usually give you bigger savings off your meds and you won’t have to apply with several programs to lower your costs on more than one of your drugs.

You can either qualify as full LIS or partial LIS. To qualify as partial LIS:

- Your annual income should be less than $19,560 for single folks, $26,370 as a household if you’re married, and

- Your financial resources (e.g. investments, retirement accounts, bank accounts, liquid assets) should be less than $14,790 for single folks, $29,520 as a household if you’re married

Partial LIS will get you the following benefits:

- It pays for part or all of your PDP premium

- It limits your annual deductible to $92, down from $445

- It limits your copay for each of your drugs to 15% of the full retail cost

Full LIS will give you even richer benefits. To qualify as full LIS:

- Your annual income should be less than $17,628 for single folks, $23,757 as a household if you’re married, and

- Your financial resources should be less than $9,470 for single folks, $14,960 as a household if you’re married

Full LIS will get you the following benefits:

- It pays for all of your PDP premium

- It eliminates your annual deductible

- It limits your copay for each of your drugs to $3.70 for generic drugs, and $9.20 for brand names

In the few months before you turn 65, you might receive an application for Extra Help in the mail. If you don’t, or don’t want to wait to apply, you can simply apply online using this link: https://www.ssa.gov/benefits/medicare/prescriptionhelp/

If you qualify, Social Security will automatically let you know what level of LIS you have. Also, if you qualify for LIS it will prevent you from getting the Late Enrollment Penalty we talked about earlier in the chapter.

The Things Part D Doesn’t Cover

Excluded Drug Classes

Since Part D covers drugs you fill at the pharmacy, it generally will cover all of your prescriptions. But just like Part B doesn’t cover certain things that aren’t considered “medically necessary”, Part D works the same way.

Some of the types of drugs Part D doesn’t cover are:

- Used for anorexia, weight loss, or weight gain

- Used to promote fertility

- Used to regrow hair or for other purely cosmetic purposes (but drugs used for certain skin conditions are NOT considered cosmetic and are covered)

- Used specifically for sexual or erectile dysfunction

- Over the counter vitamins and supplements

No Annual OOP Limit

Another thing worth pointing out is that there is no limit on how much you could spend out of your own pocket for prescriptions. If your drugs are expensive enough to drive you into the 4th phase of your drug plan, you’ll still have to pay 5% of the full cost of that drug the rest of the year.

Drugs Covered by Other Parts of Medicare

Part D pretty much covers drugs you pick up at the pharmacy or receive from a mail order pharmacy. Drugs that are administered at a doctor’s office or other medical facility are almost always covered under Part A or B.

Some examples of these types of drugs are infusions or intravenous (IV) drugs like chemo for cancer treatment, or Remicade for rheumatoid arthritis.

Conclusion

Hopefully this chapter has helped show you why it’s really important to sign up for a Medicare drug plan when you’re first eligible. We’ve also gone over how to use the extremely helpful Medicare Plan Finder to find the best PDP for your unique situation. Lastly, we looked at a few ideas and programs available to help you with the cost of your meds.

In the next chapter, we’ll take a look at a different way to get Part D along with a different way to help with the gaps in Parts A & B.