Well, yes and no…

Like any important question, there’s a bit more to it than just a one-word answer.

Now lots of salespeople and telemarketers are trained to use scare tactics to get you to leave Plan F and sign up with the plan they’re offering. Their plan might even be better than Plan F, but they’re being dishonest in what they’re telling you.

In this article, I’ll give you a the whole picture of exactly what’s happening with Plan F, what your options are, and how to decide whether to keep Plan F or switch to a different plan that could fit your situation better.

So is it going away?...More...

Plan F Will Be Discontinued in 2020

If you enroll in Medicare Part B in 2020 or later, you will not be able to enroll in Plan F. Every so often Medicare discontinues certain Medigap plans to help save money for both the Medicare program and/or for folks enrolled in these plans.

In 2015, Congress passed the Medicare Access and CHIP Reauthorization Act (MACRA). As part of this Act, Congress decided to eliminate any Medigap plan that included “first-dollar coverage”. This just means that Congress didn’t want any Medigap plans to pay for expenses before the patient paid themselves.

Why?

Well, think about it. Let’s say you have a nagging cold that’s not going away. It’s been a week. You’re sick of being sick so you’re ready to head to urgent care to see a doctor and get a prescription for some antibiotics.

Now Plan F pays all of your out-of-pocket expenses for you. So if you have Plan F, you can go to urgent care, see the doctor, get your prescription, and be on your way.

But what if you had a Medigap plan with even a small deductible that you had to pay before the plan paid? You’d probably think twice about that visit.

So, Congress passed MACRA in order to save the Medicare program money. Any Medigap plan that provides this “first dollar coverage” will be discontinued. You can see in the chart below that this means Plans F and C will be going away because they’re the only two that pay the Medicare Part B deductible.

So that’s the “yes” part of the answer to the original question; the “no” part means…

Plan F Enrollees Can Keep Their Plan if They’re Already on Part B

So, even though Plan F will be discontinued in 2020, you can still keep your plan. You can keep it the rest of your life if you want since Medigap plans are guaranteed renewable. And not only can you keep your plan, you can even sign up for Plan F after 2020 if your Part B effective date is before 2020.

So, that’s good news, right? Well, yeah…for some people; those people who can’t switch plans because of pre-existing health conditions. This is because…Plan F Monthly Premiums Will Eventually Skyrocket

First of all, Plan F has problems. Even if it wasn’t going away, there are other Medigap plan alternatives to Plan F (like Plan G) that will save you money every year. But why will rates skyrocket? Let’s take a look at how Medigap plans are priced:

You see, Medigap companies charge monthly premiums based on the amount of claims they have to pay out. Your individual rates don’t go up if you get sick and have a lot of claims, like it would for car insurance. For Medigap plans, you’re placed in a “risk pool” with hundreds or even thousands of other folks that have the same plan in the same area that you do.

Now, if a plan stops accepting new, younger, 65-year old folks on Medicare, this “risk pool” is now closed. And what happens? Everybody in the “risk pool” continues to get older and file more health claims, on average. This then drives up the premiums to keep up with claims.

To make matters worse, those folks healthy enough to switch plans will do so in order to save money in premiums. This causes the average person left with the plan to file a higher amount in claims, which causes premiums to spiral out of control.Check out the image below for an illustration how risk pools work:

Pool A - Big pool of people, lots of new healthy people joining all the time

Pool B - Pool is closed, average person's health is getting worse, and premiums start to increase

Pool C - Healthy people start to leave the closed pool, the amount of health claims and premiums keep going up

Pool D - Almost all healthy people have left, the remaining folks are stuck, and premiums have increased dramatically

Plan F Has Other Alternatives

Plan G and Plan N are wonderful alternatives to Plan F. You’ll typically save hundreds of dollars each year with these other plans, even after you factor in your slight increase in possible out-of-pocket expenses. Why pay $400 more each year in premiums to have Plan F instead of Plan G, when all you’re responsible for with Plan G is a $183 total deductible for the year? This is usually the case.

If you’re new to Medicare between now and 2020, I would strongly recommend looking at these other plans. If you’re already on Plan F, you should definitely get a quote for Plan G to see how much money you could save starting now.

Remember, Medigap plans are allowed to ask you health questions once your Medigap Open Enrollment period is done (this period expires after you are on Part B for 6 months). They can turn you down or charge a higher rate if you have pre-existing conditions at the time you apply.

But, each insurance company that offers these plans asks different health questions. Company ABC might turn you down if you have COPD, but Company XYZ may accept you. The same can be said for lots of health conditions like rheumatoid arthritis, insulin-dependent diabetes, etc.

This is why it’s easiest to use an independent broker (like me!) who knows what companies are accepting for various health conditions. I can get an idea of what your health is like, shop the different companies’ rates for your area, and come up with the plan that will save you the most money. This will save you lots and time and money compared to you calling several different companies yourself.

If you have Plan F now, switching to a plan like Plan G could easily save you $500 per year or more for equivalent coverage! If you’re retired and on a fixed income this could make all the difference in the world for you.Want to discuss your situation with a Medicare expert? Click the button to book a FREE personal 1-on-1 consultation.

Conclusion

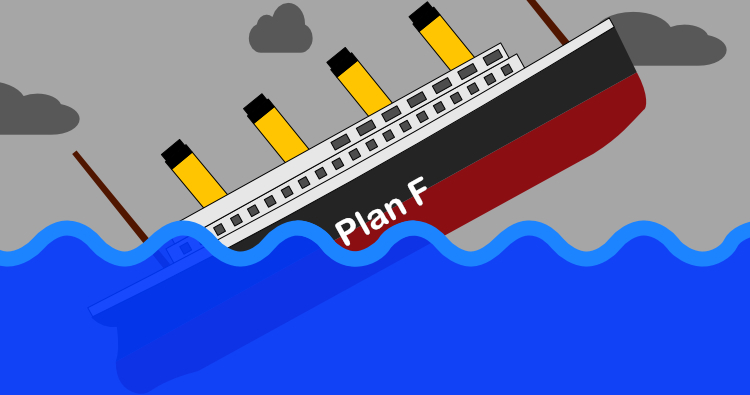

Do yourself a favor and get off the sinking ship that is Plan F, if you can. You can give me a call at 866-240-8639 to shop for a new plan for you. I’m an independent insurance agent, so I represent many different insurance companies. I don’t charge any fees, but get paid a small commission by the insurance company if I help you sign up for a plan with them. My interests are aligned with yours not theirs, so let me try and put a few hundred bucks back in your pocket this year.