If you have only ONE chance to do a certain thing in your life, wouldn’t it be nice to at least know about it?

You have lots of opportunities to apply for a Medigap policy when you’re on Medicare, but you only have one Medigap Open Enrollment period. And for some of you, this will be the only time you’re eligible for a Medigap plan.

Let’s understand a little better when this enrollment window is, why it’s different than other Medicare enrollment periods, and what’s so special about it…

More...

Get a quote on Medigap plans in your area

What Exactly is the Medigap Open Enrollment (OE) Period?

The Medicare supplement (Medigap) OE period is a 6 month period that you can qualify for any Medigap policy you want “no questions asked”.

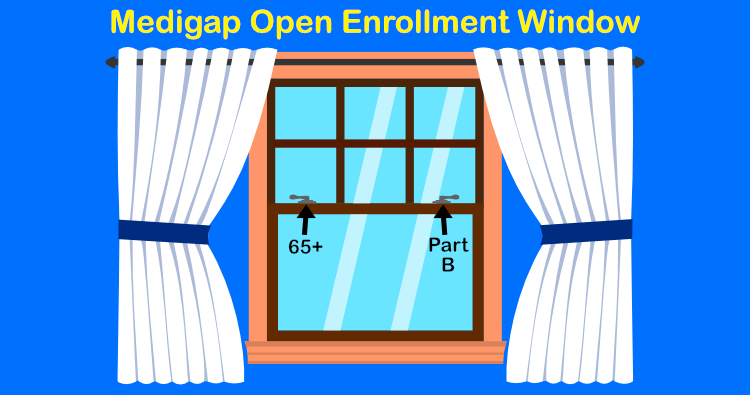

You only get this Medigap OE period once in your life. It starts when BOTH of 2 conditions are true:

- You’re 65 or older, and

- You’re enrolled in Medicare Part B

If either one of these conditions is not true, your OE window has not yet opened. Let’s look at a couple examples:

Example #1: John badly hurt his back at the machine shop where he worked a couple years ago. At this point, John qualified for Social Security Disability Income (SSDI), and now he is becoming eligible for Medicare Parts A and B for the first time. However, John is only 59. His Medigap Open Enrollment window will not open now, but will open when he turns 65.

When he does turn 65, he can get any Medigap policy he wants to with no health questions asked.

Example #2: Estella is turning 65 in a few months, but she likes her job and wants to keep working for at least a few more years. Her health insurance at work is very good. She talked to her benefits department about Medicare, and they told her that her coverage at work is considered “creditable coverage”, and they don’t require that she sign up for Medicare Part B.

When Estella retires and starts Part B, her Medigap Open Enrollment window would then open. It doesn’t matter what her age is, as long as she’s 65 or older.

Why is the Medigap Open Enrollment Period Different Than Other Medicare Enrollment Periods?

This is the only enrollment period that applies specifically to Medigap plans.

Other Medicare enrollment periods have to do with things like:

- When you can first enroll in Medicare

- When you can enroll in Medicare after you’re first eligible

- When you can enroll in, disenroll from, or switch Part D drug plans, or

- When you can enroll in, disenroll from, or switch Medicare Advantage (MA) plans

Don’t confuse the Medigap OE period with the Annual Medicare Open Enrollment Period (AEP), even though AEP does apply to Medigap plans too. During AEP, a couple things you can do are leave an MA plan and apply for a Medigap plan, or you can drop your Medigap plan and enroll in an MA plan. But if you want to apply for a Medigap plan during AEP, you have to answer health questions to qualify for it. This means you can be turned down if you don’t qualify.

Quick Tip: If you have a Medigap policy and want to switch to a different Medigap policy, you can do so anytime throughout the year. Keep in mind though, you’ll still have to answer health questions. You’re only restricted to AEP if you are leaving an MA plan, or want to enroll in an MA plan. I can’t tell you how many folks I talk to get this rule wrong about Medigap plans.

What’s So Special About the Medigap Open Enrollment Period?

This period is so important for you because it’s the one chance you have on Medicare to get a Medigap policy guaranteed. For some folks in bad health, it could be the only chance you have in your life to get a Medigap policy.

There are three things the Medigap insurance companies are NOT allowed to do during this OE period:

- Turn you down for whatever Medigap plan you want

- Charge you more if you have pre-existing health conditions (however, some companies in some states do charge tobacco users a higher premium)

- Make you wait for your coverage to start

However, even though a Medigap insurance company can’t make you wait for your coverage to start, they can refuse to cover claims for certain pre-existing conditions you might have when your coverage does start.

I’ve gone into a bit more detail about this topic in my article about pre-existing conditions. To summarize here though, ALL of the following conditions have to be true before a Medigap company would deny your claims:

- Been diagnosed or treated for that pre-existing condition in the previous 6 months before your Medigap plan starts

- Had a gap in “creditable coverage” for 63 days or more in the previous 6 months before your Medigap plan starts

- Be insured with a Medigap company who would actually choose to deny these claims (most of them won’t, even though they have the right to)

If all of these conditions are true, your claims for these pre-existing conditions can be denied in the first 6 months you have your policy.

Want to discuss your situation with a Medicare expert? Click the button to book a FREE personal 1-on-1 consultation.

So Which Medigap Plan Should You Pick in This OE Period?

Ahh, this is why this period is so important. It’s important to try and choose not only the best plan, but also the best insurance company you can too.

All Medigap policies are standardized. This means that for the same letter plan (Plan G, for example), it’s exactly the same coverage no matter which insurance company provides it. The only thing that’s different for the same plan among the different companies is the monthly premium amount. However, it’s important to look at the financial strength and history of the different Medigap companies too when you’re choosing which one to go with.

When you’re choosing your Medigap plan, my best piece of advice is this: pick the particular insurance company’s plan you’d be happiest with if you had it the rest of your life.

Although it usually makes sense to switch companies every so often in order to pay less for the same coverage, you want to make the best choice up front in case you get “stranded” in your plan. You never know when you could get hit with a critical illness that would prevent you from ever changing plans again.

I look at the following things along with the current monthly premium when helping a client decide which company to go with:

- Rating of the particular company

- How many years that company has been offering Medigap policies

- The loss ratio of that particular company

- The amount of Medicare folks insured by that company

These factors give some clues as to whether a particular company is likely to keep your rate fairly low for years to come, or whether it’s a low introductory rate only to go up a lot a year or two into the policy.

This shows you all the more reason you want to get professional help from an independent insurance agent (like me!), when choosing which particular plan to go with. If you decide to make this decision on your own and go direct with the insurance company, you’re just rolling the dice.

One more thing worth mentioning about Medigap OE periods is that…

Knowing your state's OE rules is one of my 31 tips to save money on Medicare. Interested in learning about 30 others? Get your copy of my FREE e-book "31 Ways To Save Money on Medicare"

Several States Have Their Own Additional Medigap OE Periods Available

So this section should be a big asterisk to everything you’ve read so far. Some states do have rules where they give you additional OE period(s) to enroll in Medigap plans. If you’re a resident of the following states, you can take advantage of these additional OE windows if you qualify:

- California: You have an OE period each year that lasts for 30 days following your birthday. During this window, you can switch Medigap plans of equal or lesser benefit. For example, you can switch from a Plan F to a Plan G, a Plan F to a Plan F, but not from a Plan G to a Plan F.

- Connecticut: Medigap plans are guarantee issue year round, which means no health questions.

- Maine: You have an OE period at any time to switch to a Medigap plan with equal or lesser benefits only if you have had any plan to supplement Medicare within the last 90 days.

- Missouri: You have an OE period starting 30 days before and ending 30 days after your Medigap policy anniversary date. During this window, you can only change to an equal policy with no health questions.

- New York: Medigap plans are guarantee issue year round, which means no health questions.

- Oregon: You have an OE period each year that lasts for 30 days following your birthday. During this window, you can switch Medigap plans of equal or lesser benefit.

- Washington: You have a year-round OE period to switch Medigap plans of equal or lesser benefit. The only exception is if you have Plan A, you can only switch to Plan A with no health questions.

I’ve purposely left out any OE periods for folks under 65, leaving other coverage like employer plans, and losing eligibility to Medicaid. Things start to get pretty tricky when you consider these other special circumstances since each Medigap insurance company tends to have their own OE rules for them. So these special circumstances are beyond the scope of this article.

Always check with your state’s Medigap rules, and check with an independent insurance agent (like me!) who can look into these various insurance companies to find one friendly toward your situation.

Conclusion

If you didn’t realize it before, now you know you only have one Medigap OE period to pick whatever plan you want. Make sure you do a little extra homework and pick the best plan to start your Medicare journey with. And as always, if I can help, give me a call at 866-240-8639.