Choosing the Best Medicare Plan for You

So now that you’ve learned about your work options in Chapter 2 and your Medicare insurance options in Chapter 4, Chapter 5, and Chapter 6, you know exactly what you’re going to do right?

Well, maybe some of you do. The rest of you are still trying to figure it out.

Don’t worry, we’re not done. Like I did in Chapter 2, I’m going to go over lots of examples where each type of plan makes sense for that situation.

What I won’t do in this Chapter is bring employer coverage as an option back into the conversation. If you’re reading this chapter to decide whether to get a Medicare Advantage plan (MAPD) or a Medigap plan paired with a standalone prescription plan (PDP), then you’ve already decided against any employer plan options.

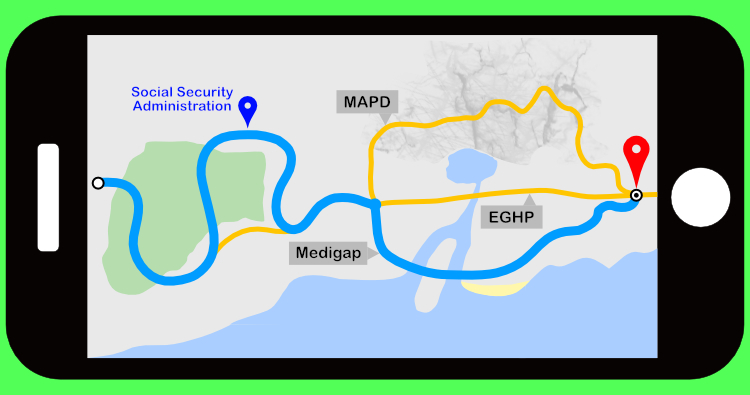

Let’s start with a very high-level look at the pros and cons to each path you can take at the Medicare “fork in the road” shown below:

Path on the Left (Medigap + PDP)

The pros of this option are:

- Much lower potential out-of-pocket (OOP) expenses

- Freedom to see any doctor in the country who accepts Original Medicare

- No referrals required to see a specialist

The cons of this option are:

- Higher premiums

- No routine dental, vision, or hearing coverage

Path on the Right (MAPD)

The pros of this option are:

- Lower average monthly premiums

- Additional non “medically necessary” benefits like gym memberships and free or discounted dental, vision, and hearing services and expenses

The cons of this option are:

- Much higher potential OOP amounts

- Network restrictions

- Possible referrals required to see a specialist

Medigap & PDP | Medicare Advantage | ||

|---|---|---|---|

Pros | Cons | Pros | Cons |

Little-to-no OOP | Higher average premiums | Lower average premiums | Much higher possible OOP |

See any Medicare doctor | No dental, vision, or hearing | Some preventative dental, vision, and hearing | Network restrictions |

No referrals required | Some additional freebies | Referrals sometimes required | |

Knowing the pros and cons of each type of insurance isn’t enough. Having the actual premium of the plan choices is a pretty big piece of the puzzle too. Let’s figure out the best way to get those…

Getting Quotes for Plan Premiums

Let’s start with the path on the left:

Medigap Premiums

These premiums are not easy to find. At all.

Now you might have received brochures from one or two Medigap companies in the mail that show their rates, but that’s usually more of the exception that the rule.

Wouldn’t it be nice if there was a one-stop shop where you could get rates for everybody out there, all at the same time? Guess what, there is! But more on that in a second.

One way to get Medigap premiums is to…

Have the insurance company contact you

Many Medigap companies will try to cold call you and attempt to enroll you on the spot over the phone. Others will mail you brochures and hope you fill out their application and send it back. Either way, by waiting for the company to contact you, you’re only going to be able to compare costs with a small handful of companies. It’s probably very unlikely that one who reaches out to you will have the best rates. Or, you can...

Do your own legwork

Medigap companies don’t make it very easy to find out their rates. So, if you’re looking to be thorough and try to find the best rate in your area, you’re likely going to have to call a dozen different companies or more.

Depending on what state you live in, there may be some premium information on a handful of Medigap plans available in your state. If you’re fine dealing with the headache and hassle of gathering rates this way, that’s up to you.

But the best way to get quotes is to use...

An independent insurance agent

An independent agent, like I am, can pull up his or her handy-dandy quoting tool to show you what premiums are for different plans in your area. Some plans will give discounts if you’re married or even living with someone in your house age 18 or older. Some plans charge more if you’ve used tobacco in the last 3 years.

They’re all different.

I can show you which companies have the best rates in your area for your specific situation. Here’s a screenshot of my quoting tool to give you an example of what I can look up:

There are two very important things to point out here:

- Most insurance agents, including myself, don’t charge a fee for these services. Instead, if we help you pick out and enroll in a plan, we’ll get a small commission from that insurance company.

- Rates are exactly the same no matter how you sign up. So whether you have an agent help you shop and enroll, or you do the legwork yourself and sign up with the insurance company directly, you’re going to pay the exact same rate for that company’s plan.

PDP Premiums

We covered these in-depth in Chapter 5.

MAPD Premiums

For this path on the right, I touched on how to find the details of the MAPDs available in your area at the end of last chapter. Just use that Medicare Plan Finder tool again like you would to find your best drug plan, but select the box in Step 4 to look at health plans. This will bring up a list of plans in your zip code including their details like monthly premiums.

Now that we know the pros and cons of the plan types, and we know what some of the different plan rates are, let’s look at some examples where different plans might fit better than others in different situations…

Examples

All these examples are for folks who are turning 65 soon:

Example #1: Bad experience with OOP expenses – Sally is generally pretty healthy and only takes one generic drug for cholesterol. She’s a widow and currently is on her late husband’s retiree plan. But this plan goes away when she turns 65 and gets on Medicare. He passed a few years back because of a heart attack, and for the last year he was in and out of the hospital with complications. They had several thousand dollars to pay in OOP under his plan his last couple years.

Conclusion: Sally saw how expensive OOP costs can get and doesn’t want any part of them, which is why she doesn’t want an MAPD. Because she’s only on one inexpensive drug, the most cost-efficient PDP for her would run about $20/mo. Plan G sounds good to her because it only has a small deductible and no copays for any office visits. In her area, she can get a Plan G for about $100/mo.

Example #2: Country living – Jeff & Donna live pretty far from any major city. They own a few dozen acres, have some cattle, and grow a few crops. They’re both retired and haven’t had any health insurance the last couple years because they didn’t want to pay the huge premiums. They both turn 65 a few months apart this year and have been waiting for Medicare to start so they can start using healthcare services if they need too. Jeff has been limping a bit the last year or so and his primary doctor told him he should see an orthopedist soon because he might need a knee replacement.

Conclusion: They are both a perfect candidate for a Medigap plan for several reasons. First, they live out in the country so there aren’t a lot of doctors available in their area compared to someone who lives closer to the city. If they signed up for an MAPD, this would restrict their choices even further to doctors that would accept their insurance. Also, Jeff is anticipating possible surgery soon, with likely physical therapy to follow, and getting a Medigap plan would cover all (or almost all) of these expenses.

Example #3: Snowbirds – Jose & Patricia leave Illinois right before Christmas to spend time near their family in Texas until Easter every year. They have a primary doctor and specialists established in both states. Jose is diabetic and needs to have his blood sugar checked every three months. Patricia has a history of blood clots, is on a blood thinner, and also needs frequent blood work.

Conclusion – Jose & Patricia should get a Medigap plan to go along with Original Medicare. This would give them the freedom to see any doctor they want and to get anything medically necessary done as long as that provider accepts Medicare. If they chose an MAPD instead, they would have to make sure the doctors they wanted to see in Texas would even take that plan. Even if they did, they would likely pay out of network OOP amounts for any non-emergency services. And since they both have some health issues, if their blood work results ever suggest the need for more tests or even some treatment, this could really drive up their OOP expenses with an MAPD.

Example #4: Good health, large HSA - Dave is divorced, retired, and lives in the suburbs of a fairly large city. He’s fairly healthy and active and enjoys golf and jogging when the weather’s warm, and visiting his local YMCA to swim when the weather isn’t as nice. He works in upper management at a Fortune 500 company, but plans to retire at 65. He has maxed out contributions the last 10 years or so in his health savings account (HSA).

Conclusion – This is a case where the decision is closer. A Medigap plan and a PDP would still be a great choice for Dave. He could choose a plan like Plan G, Plan N, or high-deductible Plan F. These plans would still give him the option to see any doctor that takes Medicare. He can’t use the funds in his HSA to pay for his Medigap premiums, but can use them for things like his Part B premium, Medicare deductibles and coinsurance not paid for by a Medigap plan. He also could get a MAPD. He lives in the suburbs of a large city, so he likely has a decent selection of providers that would accept his plan. Since he’s healthy and lives a healthy lifestyle, he’s not as likely to have as many OOP healthcare expenses. But if he does, he’s got a large HSA to use for these. Also, he retired from a good job likely with good benefits and can afford a bit better than your average person on Medicare to self-insure if something unexpected does come up.

Example #5: Fixed income - Willie & Sarah live in an urban area of a mid-sized city in North Carolina. They both are on his union retiree plan that becomes very expensive for him when he turns 65. She’s only 63 and will be dropped from his coverage at that time. They live on a pretty fixed income made up of his pension and both of their Social Security checks. They don’t want to risk any large bills if they have health problems, even though they’re both pretty healthy. Neither one of them takes any prescriptions, although Willie’s doctor told him that he’s pre-diabetic.

Conclusion – Willie should get a Medigap plan with a PDP. He might pay a little bit more each month for his coverage compared to getting a MAPD. But he’s not risking having to come up with several thousand dollars for OOP if he happens to have a bad health year, and then is unable to get a Medigap plan at this time.

Example #6: Pre-existing condition – Judy was diagnosed with Parkinson’s disease a few years ago and is still in its early stages. She’s taking a couple medications for it. Her OOP expenses for it on her work plan aren’t too bad right now, but she knows that will likely change at some point down the road as the disease gets more advanced. A Plan G Medigap plan would cost her about $125/mo., but she could also get a $0 premium HMO that has a $2,500 max OOP.

Conclusion – Judy decides to get a Medigap plan with a PDP. She knows this is likely the one chance the rest of her life to get a Medigap plan because she’s in her Medigap Open Enrollment (OE) Period. Otherwise, if she starts with a MAPD and tries to get a Medigap plan down the road, she’d likely be declined because of her chronic condition. The $0 premium with a low max OOP sounds tempting, but she also wants the ability to see just about any doctor she wants to and not settle for whoever is in her HMO network.

Example #7: Very low income - Sue has been a widow for about 10 years. She lost her job when she was 60 and had to start taking her widow’s Social Security income based on her late husband’s work record. She was a stay-at-home mom most of her life and didn’t make enough to get much Social Security based on her own record. She lives in the suburbs in major metropolitan area, qualifies for Extra Help (see Chapter 4), and often struggles to make ends meet. She’s planning on not getting any secondary insurance to Medicare because she doesn’t think she can afford it, and she makes too much to qualify for Medicaid. But, there is a $0 premium MAPD available to her in her county.

Conclusion – Sue knows that if she spends money to get a Medigap plan, she feels she’d have to take money out of her food budget to afford it. She should at least consider the $0 premium MAPD, instead of just Original Medicare. Since every MAPD does cap your spending each year with a max OOP amount, that would at least give her some protection against unlimited medical expenses with Parts A & B only. Also, since she lives in a densely populated area she can likely find a good provider that should meet various different medical needs she might have. She should really take advantage of her monthly savings of a $0 premium plan and lower prescription copays because of Extra Help and put away as much money as possible. This will help her when she inevitably does have to come up with some money to pay OOP amounts under her plan.

Example 8: High deductible - Rick has been on a high deductible plan at work for the last several years. His health is ok as he does have a mild case of COPD that he uses a daily inhaler for. Other than that, he takes pills for high blood pressure and anxiety as needed to calm down when he has bad days with his breathing. He’s planning on retiring right around when he turns 65 and won’t have the option for retiree coverage. He’s been on a high deductible plan long enough that he doesn’t mind having a large deductible if it can keep his monthly costs down.

Conclusion – Rick should strongly consider a high deductible Plan F Medigap plan, or even a Plan N. Both plans have some OOP expenses you’re on the hook for, but are usually not nearly as high as most MAPDs. Also, this gives him the freedom to choose his own doctors and not worry whether or not they’re in network. His COPD will severely restrict his options to get a Medigap plan later as that’s a condition that most Medigap insurance companies will turn him down for having. He’d be better off using his OE period and getting whatever plan he wants to now.

Conclusion

Well there you have it. I hope these “real-life” examples have given some good insight into what plan might work best for your situation. I’m sure there was probably more than just one example you could identify with.

Once you’ve figured out what plan will probably work best for you, now you need to actually get signed up. You have a few different options by which you can enroll. Next chapter will show you these options along with a detailed timeline of when is the best time to enroll in each piece.