So whether it’s your first time going through it or you’re a seasoned veteran, you won’t have to wonder whether or not it’s started. There’s always:

- A never ending barrage of commercials.

- Full-page newspaper ads.

- Hour-long infomercials throughout the day.

You won’t be able to watch the news, go online, open the newspaper, or check Facebook without a not-so-gentle reminder:

Medicare’s Annual Open Enrollment Period is upon us.

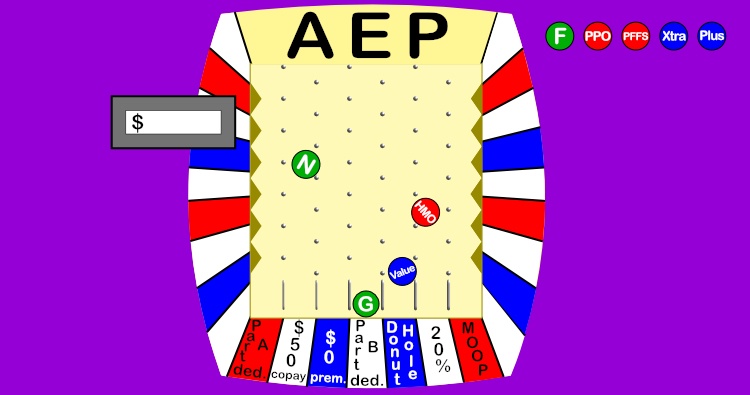

For the rest of this post, I’ll refer to this time as “AEP”. That’s what it’s lovingly called in the insurance community. I say ‘lovingly’ with a little bit of a smirk as I write this since as an insurance agent, this is a 10 week sprint.

Now I know how an accountant feels in the weeks leading up to tax day on April 15th.

Many of you have questions about your plan. You wonder if it’s the best one for you for next year. Maybe you want to switch your plan. Or, you simply aren’t sure what you’re supposed to do during this time.

Every year when I talk to my clients or help new clients, they always tell me things they’ve heard about Medicare or their plans that aren’t true. There’s a lot of misinformation out there. Some insurance agents and companies will use this time to take advantage of your uncertainty.

This guide will give you a complete roadmap on everything you should know about AEP. What you can do, should do or shouldn’t do. Let’s start with defining exactly what AEP is...

More...

The Medicare Annual Open Enrollment Period - Defined

AEP lasts each year from October 15th til December 7th.

During this time you can enroll or disenroll from any Medicare secondary insurance like:

- Medicare Advantage plans

- Standalone Prescription plans, and

- Medigap plans

This isn’t the only time of year that you can make these changes. Some of these plans allow you to change during other times of the year too.

Also, even though you can make changes to all of these plans, it doesn’t mean you’ll qualify to do so. For some of these plans, there is an approval process and you can be turned down.

We’ll get into this in more detail later in this article as we look at each of these types of plans one at a time.

However this is the only time of the year when you can make changes to any of these plans at the same time.

Even though you can make changes from only October 15th thru December 7th, there are a lot of things that can happen leading up to and following AEP. Let’s take a look at the full timeline now…

The Medicare Annual Open Enrollment Period - Timeline

There’s a lot that happens leading up to this period, and occurs after this period is over. Medicare, insurance companies, insurance agents, and many other folks involved with Medicare insurance are usually busy from the middle of August through early February.

But, let’s break down the timeline on what matters to you:

The Annual Notice of Change: late September

For anyone who’s enrolled in a standalone Prescription Drug Plan (PDP) or Medicare Advantage (MA) plan, you’ll receive this Annual Notice of Change (ANOC) around late September.

The reason the ANOC is sent to you is because PDPs and MA plans are calendar year plans. This means the plan benefits are for a specific calendar year only.

For example: 2017 Company ABC Select PDP, 2018 Company XYZ PPO Plus.

The ANOC lets you know any changes made to your plan from one year to the next.

Don’t let the name deceive you. It’s not so much a “notice” but rather a book. Depending on your plan it could have 100 pages or more.

If your plan has Part D (drug) coverage, your ANOC could give you such information like next year’s:

- Complete list of covered drugs, also called a formulary

- Pharmacies that are considered preferred and give the best prices for prescription drugs

- Pharmacies that are considered standard and have higher prescription costs

- Plan deductible, if any

- Copay dollar or percentage amounts for formulary drugs in the various tiers (for example, Tier 1 drugs could be Preferred Generic, Tier 3 drugs could be Preferred Brand Name)

If you have an MA plan, your ANOC could tell you next year’s:

- List of in-network doctors, hospitals, and other healthcare facilities

- Copay dollar or percentage amounts for various tests, treatments, visits, etc.

The ANOC will usually point out changes made to in any of these various categories from one year to the next so you can see how your plan is changing. This can help you decide if your plan may or may not be a good fit for the next year, or if you might want to shop around during AEP.

But how many of you actually look through your ANOCs each year? Does it go straight in the trash? Or maybe you put it in the folder with the rest of your Medicare stuff and don’t even look through it.

Trying to find the information in the ANOC that you actually care about can be like finding a needle in a needle stack.

It would really help if you had the help of a professional to help you dig out the info that matters to you. But more on this later.

This brings us to…

Pre-AEP: October 1st – 14th

Ahh, so this is when the fun starts.

You turn on the TV and are bombarded with commercials, programs, and news stories about Medicare and Medicare plans.

Your phone starts ringing with people wanting to talk to you about Medicare. This stuff starts to show up in your mailbox too. It’s almost like you’re turning 65 all over again.

During pre-AEP the insurance companies will release their plans’ details for next year. You can find this info starting October 1st on Medicare.gov and on each insurance company’s website.

Keep in mind though that you can’t actually apply for a new or different plan until AEP actually starts on the 15th. You can speak with insurance agents and companies about the various plan details and benefits but they can’t take your application just yet.

This is another period where you can do a bit more homework to decide on your AEP game plan.

Annual Open Enrollment Period: October 15th – December 7th

This is the time when you can make your changes. I’ll go into a lot more detail about this nearly 8-week period later.

Post-AEP: December 8th – 31st

During this time, the insurance companies are scrambling to get everything updated.

Whenever someone changes their MA or PDP plan during AEP, the new plan always goes into effect on January 1st. This gives the insurance companies and Medicare about 3 and ½ weeks to:

- Process all the new applications

- Get welcome kits, summaries of benefits, new cards, and other new member materials in the mail to all of their new subscribers

- Notify Medicare of all their new enrollees and their information

- Process January premium payments or send out bills for premiums due

- Make decisions of whether or not a new applicant is approved (only for Medigap plans)

It seems like most of the time these things won’t be done by the 1st.

The later you make your plan change during AEP, the less likely it is that you’ll be processed in time for your plan to start. This does not mean your plan won’t start and be in effect January 1st. But, it just means you’ll get your stuff in the mail or have your bill processed till sometime later in January or even into February.

Ok, so what all can you do during AEP? That brings us to...

The Medicare Annual Open Enrollment Period - Options

So what exactly can you do during AEP? What makes it so special?

Well here’s a list:

- Switch from a Medicare Advantage (MA) plan to a Medigap plan

- Switch from a Medigap plan to a MA plan

- Switch MA plans

- Switch standalone Prescription Drug Plans

- Disenroll from either a MA or PDP plan

Do you notice the one option that’s missing?

6. Switch from a Medigap plan to a Medigap plan.

You can switch your Medigap plan during AEP. However, you can switch Medigap plans any time throughout the year. You don’t have to wait til AEP!

AEP only applies to MA and PDP plans. You can enroll or disenroll in these plans only during this time (except for when you first get on Medicare or an occasional special enrollment period).

That’s why if you wanted to drop your MA plan to get a Medigap plan, this is the time to do it.

Let’s look at the process involved in making each of these 6 types of changes:

1. Switch From a Medicare Advantage Plan to a Medigap Plan

Applying for Medigap Coverage

The first and most important thing to know is that you’ll likely have to be approved for your Medigap plan.

When you first get on Medicare Part B and are 65 and older, you can get any Medigap plan you want to “no questions asked”. However, this Medigap Open Enrollment window is a one-time period that lasts for only 6 months in your life.

Once it’s over, you have to answer health questions if you want to get a Medigap plan. Now, you don’t have to get a physical. No one is going to come out to your house and draw blood or get a urine sample like they do with some life insurance.

But you will have to answer some basic health questions. And if you’re managing certain chronic health conditions, then it may be tough to find a plan that will accept you.

One very important thing to remember is that every Medigap insurance company asks different health questions. So, you could very likely be declined coverage by one company but accepted with another one.

For example:

- Company ABC may accept you if you’re diabetic and take 20 units of insulin each day.

- Company DEF may not accept you if you take insulin but they will accept you if you have certain diabetic complications like neuropathy in your feet.

- Company XYZ may be fine with insulin and complications, but only if your height and weight is within certain limits.

Also, Medigap plans with the same letter from company to company are identical in coverage. You can see the different Medigap plans available in the chart below (insert chart):

But each company charges different monthly premiums, sometimes extremely different (give examples)

Since each company is different, the best thing for you to do is to use an independent insurance agent that’s licensed with many different companies. We can shop the different companies for you and find the one that has the best rate who will still accept you based on your health.

Process of Applying

Here is the step-by-step process you should take when switching from an MA plan to a Medigap plan:

- 1. Work with an independent agent to find the most cost-efficient plan who will likely accept you

- 2. Fill out an application for that Medigap plan with a January 1st start date

- 3a. If you’re approved, fill out an application for a standalone drug plan (PDP) since Medigap plans don’t cover prescriptions

- 3b. If you’re declined, fill out an application for the 2nd most cost-efficient Medigap plan

If you’re declined more than once, keep trying to get accepted with the next best plan as long as it’s still in your budget.

A word of caution: Applying for a PDP will automatically disenroll you from most MA plans effective January 1st. So don’t apply for your PDP until you know you’re accepted into your Medigap plan.

Also, insurance companies that offer Medigap policies are extremely busy during AEP. They may not make a decision about your acceptance for several weeks. Apply as early as you can in AEP (or even before) so you can have enough time to apply again if you’re declined.

If you’re looking for help during this overwhelming and complicated time, I’d love to help steer you in the right direction. I don’t charge any fees for my services and get paid a small commission from the insurance companies if I’m able to help you sign up for a plan…Remember, AEP is over on December 7th. You might not get a decision from the Medigap company until after this date. If this is the case, don’t worry you can then take advantage of…

The Medicare Open Enrollment Period (OEP)

This OEP is new for 2019. It lasts from January 1st – March 31st.

During this time you can do a one-way move from an MA plan back to Original Medicare (Parts A & B). As part of this move, you can also pick up a Medigap policy and PDP if you wish.

So why does this matter?

We’re talking about AEP here, right?

Yep, so let’s say you want to switch from a MA plan to a Medigap plan. But you waited until right around Thanksgiving to apply. You might not know whether or not you’re approved by the end of AEP.

But, you need drug coverage too. And as I mentioned above, as soon as you apply for a PDP that will automatically cancel your MA plan at the end of the year.

If you apply for a PDP and find out after December 7th that you’re turned down for the Medigap plan, you will have no supplemental coverage as of January 1st!

That’s why you should wait to apply for your PDP until this special OEP.

If you don’t get an answer from the Medigap company by December 7th, no worries! If you do find out you’re approved later in December, January, or even February, then you can apply for your PDP.

Your PDP would start (and your MA plan would end) the 1st of the next month after you apply for your PDP. Just make sure your new Medigap policy will start on the same date as your new PDP too.

This advanced technique is critical to ensure you never risk losing coverage until you know for sure you have a new policy to replace it. Also, this gives you more time to make the change over to a Medigap plan in case you get declined with the first plan you apply with.

2. Switch From a Medigap Plan to a Medicare Advantage Plan

If you want to leave your Medigap plan and get an MA plan instead, AEP is the time to switch.

Here are some of the reasons you might want to do this:

- Your Medigap premium might have gotten too expensive

- There’s a highly rated MA plan in your area with a large network of quality doctors and medical facilities to choose from

- You want to take advantage of some of the extras an MA plan in your area has like basic dental, vision, and hearing coverage or free transportation to the doctor

Whatever the reason, switching from a Medigap to an MA plan is a much simpler process than the other way around.

Just fill out an application for the MA plan and it will start on January 1st. If you have a PDP, applying for an MA plan will automatically cancel the PDP as of the end of the year. This way you don’t need to call them and cancel.

But, you will need to cancel your Medigap plan. Just give your Medigap company a call and let them know you want your plan cancelled as of the end of the year. They may require you to send something in writing.

Before you switch to any MA plan you should always do 2 things:

- Check and make sure your doctors are in-network and will accept this new plan, and

- Check to make sure the plan covers all your prescriptions and that the costs are reasonable

If the MA plan you’re considering doesn’t cover your doctors or drugs, you may want to shop for a different MA plan. Or, maybe you should reconsider changing at all.

Check Your Doctors

There are 4 ways to check and see if your doctors will accept the new MA plan you’re thinking about:

- Simply call the doctor’s office and ask them

- Check the doctor’s office website

- Call the new MA plan, or

- Check the new MA plan’s website (video)

I’ve always been taught that the insurance company websites are the most up-to-date places to look to find which doctors are in network. But, it’s probably not a bad idea to check with both the plan and the doctor’s office.

Check your drugs

You should see if the new MA plan will not only cover your drugs, but what the new cost will be. The MA plan you’re considering might have copays that are a lot higher than the Part D plan you have now.

It’s best to do a side-by-side comparison to see how your drug costs will change. (video)

3. Switch From One Medicare Advantage Plan to Another

So maybe the quality of care in your MA plan has really gone downhill over the last few years.

Maybe your favorite doctor is leaving your network.

Or possibly, your sister keeps raving about her plan and wants you to try it out.

Well, AEP is also the time to switch from one MA plan to another.

You simply fill out an application for the new MA plan any time during AEP. Your new plan will start on January 1st and your old plan will be canceled.

Put in info about MA plans that are not automatically cancelled.

Also remember to look up your doctors and drugs to make sure the new plan will cover them.

4. Switch Standalone Prescription Plans (PDPs)

If you know you want to stay on a Medigap plan, you should at least review your drug plan. You might not need or want to make a change. But, reviewing your plan during AEP will let you see any potential problems with your plan for the next year.

For example:

- Your drug plan may not cover one or more of your drugs next year

- Your drug plan may increase the tier and cost of one or more of your drugs next year

- Your current pharmacy might switch from preferred pricing to standard pricing, meaning your costs go up

- Your drug plan might be discontinued and you’re automatically going to be put in another drug plan with the same insurance company that might not be right for you

If any of these situations happen to you, you’re not going to realize them until early next year when it’s too late to do anything about it. You often find out when you go to the pharmacy to fill your meds and get hit with a big bill.

There are 3 ways to do a Part D review, all of which don’t cost you anything:

- Call Medicare at 800-633-4227 and simply ask them to do it for you

- Do it yourself using the Medicare Plan Finder. I put together a detailed tutorial of how to use this wonderful tool.

- Ask an insurance agent to do it for you. If you’d like to have me review your drug plan for you, just book a phone appointment with me.(link)

All 3 of these methods will use the Medicare Plan Finder to find the recommended standalone PDP for you. You can then compare the recommended plan to the plan you’re currently in to see how different next year’s costs will be.

Quite often I’ve seen this difference in costs be several hundred dollars per year. So, just switching PDPs could easily save you hundreds of dollars each and every year if you’re willing to switch.

Changing PDPs is mostly painless too. There’s no approval process so you can get whatever plan you want. Also, when you apply for a new plan the old one automatically gets cancelled as of January 1st. So, there’s no need to have to get a hold of your current plan to cancel it.

There can be a bit of a hassle of getting your new payment methods set up with the new drug plan. Also, most plans use their own mail order service for drug delivery to your home. So, if you use mail order then you’ll have to get this set up with the new company.

The best thing to do though is to have your PDP reviewed, see how much the savings would be, then decide if it’s worth it to switch.

6. Switch Medigap Plans

Remember you’re not limited to AEP to switch Medigap plans. You can switch them anytime throughout the year.

The best time to review your Medigap plan is right before your anniversary date. Not the date you got married, but the anniversary of the date your Medigap policy started. This is the time when your Medigap plan is most likely to increase.

Whenever you do look to switch plans, you’re likely going to have to answer health questions to qualify for another plan. And like I mentioned earlier, each company has their own set of questions they ask. This is a good thing for you. If you have certain health conditions, it gives you a chance to find a company that will accept you, instead of everyone refusing you for that condition.

Declinable and Acceptable Health Conditions

There are some health conditions and situations that would likely prevent you from switching to any new plan, or at least one that would be any cheaper. Some of these are:

- Any type of cancer in the last 2+ years

- Stroke or mini-stroke (TIA) in the last 2+ years

- Heart attack or heart surgery in the last 2+ years

- Chronic kidney disease

- Alzheimer’s Disease or dementia

- Cirrhosis

- Congestive heart failure

- AIDS or HIV positive

- Any hospitalizations, treatments, or surgeries that have been recommended but not done yet, including joint replacements or an organ transplant

- Chronic lung conditions with oxygen use

Most other health conditions by themselves won’t necessarily prevent you from changing plans. Here are some other health conditions that can be considered by one or more Medigap companies:

- Atrial fibrillation

- Diabetes with insulin use

- Diabetes with complications like neuropathy or retinopathy

- Rheumatoid arthritis

- COPD

- Macular degeneration

- Osteoporosis

- Unoperated aneurysm

- Hepatitis

- Systemic lupus

- Pacemaker

- Hypertension (high blood pressure)

- Spinal Stenosis

This list just scratches the surface and is in no way complete. It just gives you an idea of some of the chronic health conditions you can have and still be approved with a new Medigap plan.

The point to take away is that you shouldn’t just assume you can’t qualify and are stuck in your plan until you talk to an independent insurance agent.

The health conditions by themselves aren’t the only things that Medigap companies look at. Here are several other things they consider when making their decision:

Timeframes

The timeframe where you last were diagnosed, treated, given advice, or tested for certain conditions matters a lot.

Some chronic health conditions are permanent.

However, many other ones you can recover from. Or you may simply experience an isolated “episode”.

Here are some examples of how some timeframes can come into play:

- You’ve been cancer-free for 3 years now

- It’s now been 2 years since you last had an episode of atrial fibrillation

- You had a stroke 5 years ago

- You’ve been in the hospital 3 times in the last 2 years

Once it’s been a certain number of years since you experience that particular health condition, it’s no longer an issue with that particular company.

Also, each company could have a different timeframe. Take cancer, for example. Some companies require you to be cancer-free for either 2 years, 3 years, or 5 years.

Height & Weight

This is another area of your health that Medigap companies treat very differently.

Companies will either:

- Not consider height/weight at all

- Accept you within certain height/weight ranges, and decline you if you’re outside of them, or

- Accept you, but charge you more if you’re within certain height/weight ranges

And yes, they can turn you down if you don’t weigh enough!

Prescription History

Medigap companies also treat your prescription history and use very differently.

Most companies ask for a list of any drugs you’ve been prescribed in the last year or two. But, at least one company doesn’t ask for a list of your meds at all.

Some companies will dig into a list of your medical history and ask you about drugs that you took 4 years ago, for example. They’ll even ask you to prove to them that you don’t have that particular health condition that that drug is usually prescribed for too!

Companies can automatically decline you if you take drugs on their “declinable drugs” list. Others will only decline you if you’re taking a drug on that list for a certain health condition. And each company has a slightly different list.

For example, there’s at least one company that will decline you if you’re taking any narcotic pain medications at all for pain management.

One last thing to consider when it comes to drugs is the amount you take (dosage) of the drug as well as how many drugs you take for a certain health condition. If you take more than 2 or 3 drugs for high blood pressure or COPD, that will cause many companies to decline your application.

Combinations of Health Conditions

Certain combinations of conditions can cause you to be turned down, where one condition by itself would be acceptable. Here are some examples:

- Diabetes with any history of heart or artery blockage

- Diabetes with more than 2 medications for blood pressure

- COPD with current tobacco use

A lot of the health condition combinations involve diabetes. In general, having diabetes makes it a bit harder to get approved.

Stability

The concept of stability and timeframes overlap a little bit.

In general, Medicare supplement companies want to see that whatever health conditions that you’re managing are stable. To do this, many times they don’t want to see any changes in the medications you take for that condition or even the dosages.

When you change meds or dosages, that can often mean that condition isn’t well controlled. Your doctor can be trying to find a solution that will keep that issue in check.

Your First AEP

Is it your first AEP?

If it is, then you likely haven’t been on your supplemental plan (or plans) yet for a full year. You probably spent a lot of time and effort picking out the plan you started with so you might not want to switch.

So what should you do?

Well, if you don’t do anything else, at least make sure you review your drug coverage for the next year.

Why?

Well if you started your plan later in the year, it probably didn’t make much sense for you to get a drug plan with a deductible. Why pay full price for your meds just to try and meet the deductible for a few months, when you’ll have to meet a new deductible starting in January anyway?

But, when you’re looking at the best drug plan to be on for a full year, the most cost-efficient plan very well might have a deductible. It doesn’t cost anything to look, and it very well may save you several hundred dollars over the course of the next year.

Traps, Pitfalls, and Other Things to Watch Out for in AEP

AEP is a time when you can make smart decisions about your Medicare plans. But, it’s also a time when you can make mistakes. Sometimes the mistake is not doing anything.

Let’s take a look at the most common things to watch out for during this time:

Your Prescription Drug Plan Company Could Try to Convert You to an MAPD

Most of the insurance companies that offer standalone drug plans (PDPs) will also offer Medicare Advantage plans that include drug coverage too (MAPDs). And they’ll make a LOT more money if you sign up for their MAPD instead.

They may mail you something or even call you. The conversation could go something like this:

Insurance Company: Do you have a health plan to go along with our wonderful PDP?

You: Of course!

Insurance Company: How much are you paying for it each month?

You: About $130

Insurance Company: How would you like to get a health plan with us including the drug coverage you’ve been so happy with for only $29 per month?

You: Heck yeah! Sign me up!

However, they don’t really highlight the fact that now you’re confined to using their network. If you don’t you’ll pay higher amounts out of pocket, or worse, not be covered at all.

Oh yeah, and you’re on the hook for up to several thousand dollars per year in copays, deductibles, and other out-of-pocket costs.

You might not realize the drastic differences between this new MAPD and your old Medigap plan until the next year when it’s too late to switch back.

Beware the $0 Premium Plan

You might see it featured on one of those late night hour-long MAPD infomercials. Maybe you see a story about it on your local news. Or, your friend might tell you about how happy she is with this plan.

“Wait, you mean I can get a Medicare plan for $0!?!”

Yep, you probably can. These plans are available in most areas across the country.

However, they still carry the usual limitations of an MAPD like limiting networks and large possible out-of-pocket expenses.

Now these plans will differ depending on where you live. Some $0 premium plans have richer benefits than others.

Just understand the difference between this plan and the one you have now before making a change. Don’t be lured in by the promise of “free”.

Switching from an MAPD to a Medigap plan? Wait to Sign Up for Your PDP!

I mentioned this earlier in the article, but it bears repeating:

When you sign up for a PDP in AEP and you currently have a MAPD, that MAPD will automatically be cancelled (in most cases) effective January 1st!

If you apply for a Medigap plan, sign up for your PDP, and then are turned down by the Medigap company, you’ll be left without supplemental coverage as of the 1st of the year. Make sure you know you’re accepted before applying for your PDP.

Make Sure to Use the Medicare Plan Finder to Review Your Drug Coverage

Doing this helps solve more than one potential problem:

- It’ll show you if your plan doesn’t cover any of your drugs for the next year

- It’ll show you if there’s a cheaper pharmacy to use compared to the one you use now

- It’ll show you the overall most cost-efficient plan based on your list of meds

Sometimes the difference between your current plan and the most cost-efficient one for next year might be $10 or $20. Sometimes it could be over $1,000.

The higher the total retail cost of all your drugs is, the more critical it is for you to review your drug coverage.

You can use this Plan Finder yourself at Medicare.gov. Or, you can call 1-800-MEDICARE or call me at 866-240-8639 to do it for you.

Currently Have Medigap Plan F? Get Out While You Can

Plan F premiums increase faster than other plans like Plan G or Plan N. Also, it won’t be available for folks new to Medicare starting in 2020.

Because of this, over the next several years you’re going to see Plan F rates skyrocket. This is not a scare tactic or “fake news”. This is a fact. It’s not a matter of “If” but “When”.

If you’re healthy enough to leave Plan F, do it. You could easily save $30 - $100 per month if you can qualify for Plan G. And the most you have to pay in out-of-pocket expenses with Plan G is the Medicare Part B deductible of $183.

Is it worth saving $500 in premiums for the year as long as you’re willing to pay up to a $183 deductible?

If You Have a Medigap Plan, Make Sure You Shop Around for a Better Rate

Medigap plan premiums are always changing.

Sometimes they go up, but sometimes they actually go down.

The longer you’ve been on your plan, the more likely it is that you can save money by simply switching companies but keeping the same plan.

Remember, Medicare “standardizes” Medigap plans. That’s just a fancy way of saying a Plan G with one company is the exact same coverage as a Plan G with a different company. The only difference is price.

I like to use the analogy of filling up at the gas station…If you need gas, and there are 2 gas stations on the same side of the road right next to each other, and one has gas for 20 cents less per gallon, it makes no sense to fill up at the station with the higher price!

Don’t Give Up if You’re Declined for a New Medigap Plan

Every company has their own unique health questions on their Medigap application. They all have a different process for checking into your health record to see if they’ll accept you.

It’s best to start by applying with a company that has the best rate in your area who will likely accept you with your current health conditions. But if they decline you, it’s usually still best to try the company with the next best rate.

If you could save $30 per month with your first choice, maybe it’s only $20 per month with your next choice. So what. You don’t lose anything or risk anything if you’re declined by a company and you try again, as long as you don’t cancel your current coverage until you know for sure you’re approved.

Like the old saying goes: “if at first you don’t succeed, try, try again”.

Everyone is BUSY During AEP

Insurance companies, Medicare, insurance agents, telemarketers. Everyone that has anything to do with Medicare is extremely busy during AEP and the time leading up to it.

If you’re thinking about switching plans or using the services of someone who can help, do it sooner rather than later in AEP.

Outside of AEP it might take a Medigap company a few days to make their decision to approve you or not. During AEP, it could take a month or more.

The later you sign up for a new PDP or MAPD, the longer it’ll take for you to receive your new plan’s materials and membership cards. You might not get them in the mail for several weeks after your plan has already started.

It seems like every year there are always a handful of folks that I’m not able to get back with. I mostly handle requests for help from my clients and new folks looking for help on a first come-first served basis. The longer you wait to get a hold of me, you might risk waiting several days for me to get back with you or possibly not at all.

Just remember to be a little patient with the process of whatever you’re looking to do, and get started as early as you can.

Don’t Assume Your Doctors Won’t Leave Your Network

If you have an MAPD, you want to make sure you can see the providers you need to.

But do you still want to be in that plan if your doctors leave?

Although doctors can stop taking any particular insurance any time throughout the year, AEP is the best time to make sure they’ll still be in-network for the next year. That way you can change plans during this time if you learn one or more of your doctors won’t take your insurance in the following year.

Conclusion

This should give you a pretty good idea of what to expect during the end of the year extravaganza that is the Medicare Annual Open Enrollment Period.

You’ve learned:

- What you can, should, and shouldn’t do during AEP

- When you can do it, and

- What to watch out for each step of the way

I’m an independently licensed health insurance agent. I’ve specialized in the Medicare insurance industry for over 6 years. I’m able to offer plans for about 20 different insurance companies.