Enroll in Your Medicare Plan

If you’ve been reading this guide up to this point, you should have a pretty good idea of what plan you want to get, right?

Well, hopefully things are a lot clearer for you now compared to where they were before you started Chapter 1. Or, you just may be a just getting a couple questions answered away from making your decision.

Once you’ve made your decision, you’ve just got to get enrolled in your plan, or plans. Let’s first learn the best times to sign up for each part.

Medicare Enrollment Timeline

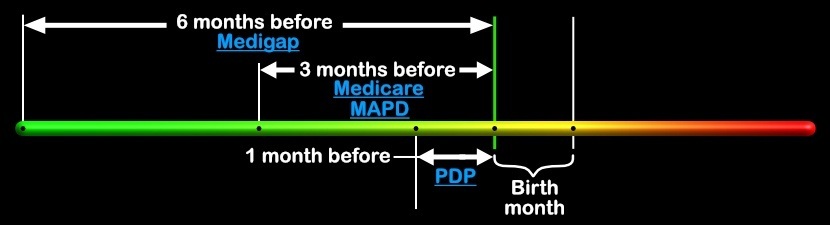

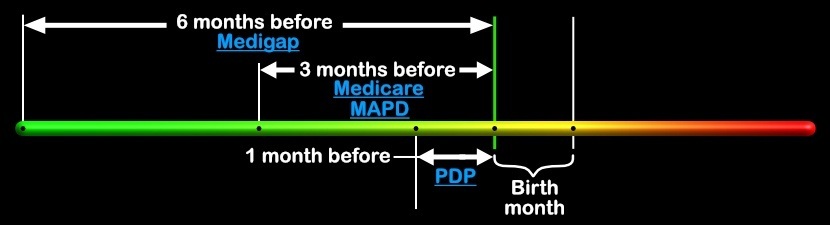

Below you can see a graphic that breaks down your Medicare decision and shows you the best times to sign up for the different parts:

Everything is based on what month you turn 65. We went over this in Chapter 3 how Medicare starts for you the 1st day of the month in which you turn 65 (unless you’re already on it due to disability). The exception to this is if your birthday is on the 1st day of the month, Medicare starts the 1st day of the month before this.

Also, to simplify this discussion a bit, I’m assuming Part A and Part B are both starting on this day.

Let’s look at each plan type starting from the furthest away from your 65th birthday:

Medigap Plan

You can enroll in a Medigap plan up to 6 months before your Part B effective date.

If you know you want to get a Medigap plan paired with a prescription drug plan (PDP), it’s best to sign up for it earlier rather than later. If you enroll several months before your birthday, then you can usually lock in your rate. So if the plan you pick has a rate increase effective sometime between the date you apply and the date it starts, you’ve already filled out the paperwork and lock in your rate for anywhere up to 12 months.

Original Medicare

Your Medicare Initial Enrollment Period (IEP) starts 3 months before your Medicare start date. This period lasts for seven months.

If you’re not automatically enrolled in Medicare because you’re drawing Social Security income, then I recommend signing up for Medicare as early as possible in your IEP. Sometimes it takes several weeks Social Security to process your application. Make sure you give yourself enough time here.

Medicare Advantage Plan (MAPD)

If you decide to get a Medicare Advantage plan (MAPD), then you can also sign up for it any time during your Medicare IEP.

If you sign up anytime in your IEP before your Medicare start date, your MAPD will start on your Medicare start date. For MAPDs, I don’t think it matters much when you sign up during these first 3 months before your birth month.

If you weren’t automatically enrolled into Medicare and had to sign up, I’d wait a week or two after this before signing up for your MAPD. And in general, don’t wait til the last minute to sign up. It’s better to do it earlier rather than later so you can have all of your paperwork, outline of coverage, insurance cards, etc. in your hands by the time your plan starts.

If you do miss this three month window and sign up anytime during the rest of your IEP after your Medicare start date, your MAPD will start the 1st of the following month.

Prescription Drug Plan (PDP)

The best time to enroll in a PDP is the month before you want it to start. So, it’s best to enroll early in the month before your Medicare start date, even though you can enroll anytime during the IEP.

There are a couple reasons for this:

- When you use the Medicare Plan Finder (discussed in Chapter 5) to find your drug plan, it will give you results based on your plan starting the next month. In other words, this tool assumes you’re starting your plan the 1st of the next month. There’s no option to select when your start date is. So by waiting to use this tool until the month before you want your plan to start, it will give you the most accurate results.

- You can call Medicare to do this exact same analysis for you and then have them enroll you in the best plan. But, many times they won’t enroll you unless you are within a month of your start date.

Now we should know the ‘what’ and ‘when’ parts of signing up, let’s look at the ‘how’…

Enrollment Methods

Medigap Plan

In the last chapter, I mentioned three different ways you can find Medigap premiums for plans in your area. These are basically the three different ways you can enroll in your Medigap plan:

When a company reaches out to you

This method works if they contact you at just the right time.

Maybe you’re online researching how Medicare works, and a Medigap company just happens to call right then.

Or, you’re going through that pile of Medicare mail that’s been getting higher and higher on your kitchen counter over the last couple months and find a plan that looks good. You just tear out the application that’s included, mail it back, and you’re done.

On your own

If you’re someone who simply wants to take on this challenge by yourself, you can always contact the Medigap company directly to enroll.

Once you’ve done your homework, researched the plan you want, called around or filled out online forms to get the quotes you need, you’re ready to take the last step and fill out an application. Maybe you haven’t even done any research but you’re just going with the plan your brother, sister, or friend has because it works for them.

Pretty much any company can enroll you right over the phone when you call them. Some of them will even let you enroll on their website without ever needing to talk to anyone.

Through an independent insurance agent

This is by far your best option. A good independent agent will represent a dozen or more Medigap companies and be able to show you who have got the best rates available for you in your area and get you enrolled in that plan too.

Most agents don’t charge a fee for their services, so you’re benefitting from their years of experience, service of doing the legwork for you to find the best rates, and ease of helping you get signed up too. It doesn’t make much sense why you wouldn’t want to have an expert help you that will save you the time and headache of having to try and understand how the parts of Medicare and all the plans work, let alone help you sign up with Medicare and your plan.

PDP or MAPD

Through the Medicare Plan Finder

If you follow the instructions we went through in Chapter 5 showing you how to use the Plan Finder, it’s easy to enroll once you decide on the plan you want.

There will be a button to “Enroll” both on the Your Plan Results page, and on the Your Plan Details page.

By calling 1-800-MEDICARE

If you call Medicare, they’ll actually do this analysis for you. They’ll ask you for your zip code, list of medications, and preferred pharmacy, and find the most cost-efficient plan for you. They can even enroll you there right on the spot, either for your PDP or MAPD

Like I mentioned earlier though, they may not enroll you unless you call the month before you want your plan to start.

Through an independent agent

Any good agent out there can help you find the best drug plan for you. Keep in mind though most agents don’t represent every PDP that’s available. So if the most cost-efficient plan they can offer you is quite a bit more expensive than the most cost-efficient one for you overall, I’d recommend enrolling a different way.

If you decide that you’d rather get an MAPD instead, an independent agent can go over several different plan options with you. They can help find one that your doctors will accept, one with a premium you can afford, and one with OOP expenses that you can manage.

Directly with the company

No one is allowed to enroll you in a PDP or MAPD if they cold-call you, so the only way you can enroll directly with the company is if you apply through the mail, or contact them directly.

Conclusion

Now that you’re enrolled, what’s next?

Well, you’ve just taken the first step on your Medicare journey. The first step is one of the most important. But it shouldn’t be a “set it and forget it” decision.

You need to be able to make changes at some point as the Medicare program changes, your plan changes, and/or your needs change.

We’ll take a look at some frequently asked questions in the next chapter, and then finish this guide off by looking down the road a bit.